Title loans for seniors offer quick cash access using vehicle titles as collateral, bypassing strict credit checks. While convenient, they carry risks like losing the vehicle and higher fees, requiring thorough understanding of terms to make informed decisions. Key requirements include valid ID, proof of ownership, and income verification. Borrowing responsibly involves reading fine print, managing interest rates, and avoiding unnecessary debt.

“Exploring Title Loans for Seniors: Unlocking Financial Solutions in Later Years. Many elderly individuals turn to title loans as a source of quick funding, but understanding the process and associated terms is crucial. This article navigates the intricate world of senior title loans, offering insights into their functionality and the benefits and challenges they present. By decoding key terms, we empower seniors to make informed decisions, ensuring financial literacy in their golden years.”

- What Are Title Loans and How Do They Work?

- Benefits and Challenges for Seniors Seeking Title Loans

- Key Terms: Decoding the Language of Senior Title Loans

What Are Title Loans and How Do They Work?

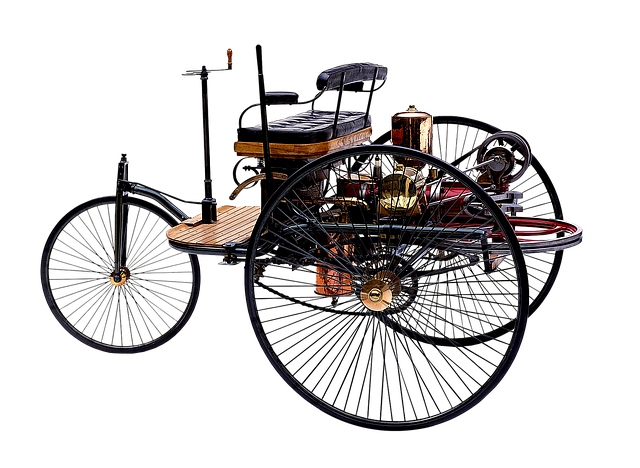

Title loans for seniors are a form of secured lending where an individual uses their vehicle’s title as collateral to borrow money. This alternative financing option is designed for those who may need emergency funding and don’t have the best credit history or traditional banking relationships. The process works by evaluating the vehicle’s valuation, which sets the loan amount available. Once approved, lenders disburse funds, often on the same day, directly into the borrower’s account.

Unlike traditional loans that require extensive documentation and strict credit checks, title loans offer a simpler approach. Lenders consider the value of the vehicle as the primary factor in determining the loan terms and repayment conditions. This convenience makes it an attractive solution for seniors facing unexpected expenses or cash flow issues, allowing them to access emergency funding quickly without needing perfect credit.

Benefits and Challenges for Seniors Seeking Title Loans

For seniors looking for financial support, title loans can offer a unique advantage due to their straightforward nature and potential for quick funding. This type of loan uses the senior’s vehicle as collateral, which allows them to access cash with minimal hassle and often faster than traditional bank loans. The benefits are significant, especially for those needing emergency funds or facing unforeseen expenses. A title loan can provide seniors with the financial flexibility they require, enabling them to manage immediate financial obligations without extensive waiting periods.

However, there are challenges associated with this option. One notable concern is the potential loss of a valuable asset—the vehicle. If the senior fails to make payments as per the agreed-upon payment plans, they risk forfeiting ownership. Additionally, while title loans may seem like a quick solution, the interest rates and fees can be higher than those of conventional loans, which might prove burdensome for seniors on fixed incomes. Moreover, the lack of a thorough credit check before approval could lead to unfair lending practices, emphasizing the need for cautious consideration and understanding of the terms involved in title loans for seniors.

Key Terms: Decoding the Language of Senior Title Loans

When considering a title loan for seniors, it’s essential to understand the key terms involved to make an informed decision. This type of loan uses your vehicle’s title as collateral, providing access to quick cash. Lenders will assess your vehicle’s value and offer a loan amount based on its equity. The process aims to be straightforward, often with no credit check, making it appealing for those with limited financial history or credit issues.

In San Antonio Loans, understanding these terms is crucial. “Loan requirements” can vary, but generally, you’ll need a valid government ID, proof of vehicle ownership, and a clear title. Lenders may also consider your income to ensure repayment capability. It’s vital to read the fine print, understand interest rates, and borrow only what you need to avoid falling into a cycle of debt. Familiarizing yourself with these terms empowers seniors to navigate the process confidently.

Title loans for seniors can provide a quick financial solution, but it’s crucial to understand the terms and conditions before borrowing. By decoding key concepts like interest rates, repayment plans, and collateral requirements, seniors can make informed decisions and navigate this type of lending with confidence. While title loans offer benefits such as access to cash and flexible terms, recognizing the potential challenges—including high-interest rates and the risk of default—is essential for a responsible borrowing experience.