In Texas, understanding that Texas title loans require an asset like a vehicle title as collateral is key when comparing options. This security can lead to better loan terms but default may result in asset loss. Lenders vary in their use of collateral, impacting loan conditions and experiences during the Texas title loan comparison process.

In the competitive landscape of Texas finance, understanding the intricacies of a Texas title loan is crucial. This article provides an in-depth Texas title loan comparison, focusing specifically on collateral requirements. We explore what assets can serve as collateral and how lenders use these guarantees. By comparing different lender policies, borrowers can make informed decisions, ensuring they secure the best terms for their unique financial needs. Key aspects include types of accepted collateral and the flexible usage policies that set various lenders apart.

- Collateral Requirements in Texas Title Loans

- Types of Collateral Accepted in Texas

- Comparing Lender Policies on Collateral Usage

Collateral Requirements in Texas Title Loans

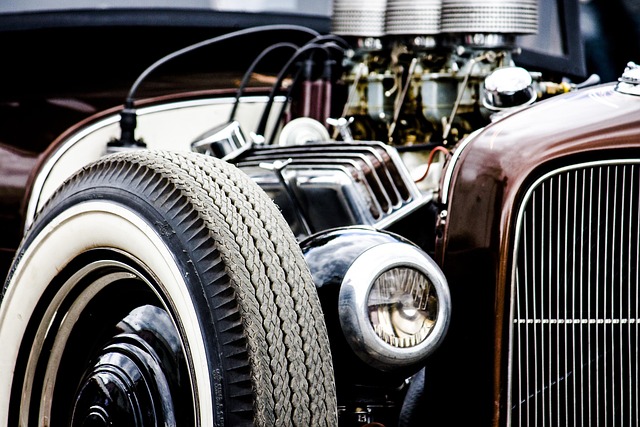

In Texas, when considering a Texas title loan comparison, one of the key aspects to understand is the collateral requirements. These loans, often sought for their fast cash availability, require borrowers to put up an asset as security. The most common form of collateral in these transactions is a vehicle title. This means that if you default on the loan, the lender has the right to initiate a title transfer and sell your vehicle to recover their losses.

The collateral process serves as a safety net for lenders, offering them a clear avenue for recovery in case of non-repayment. Additionally, it can lead to more favorable terms for borrowers, such as lower interest rates or extended loan periods (though this may not always be the case). When considering these loans, understanding both the benefits and potential consequences related to collateral is crucial before making any decisions regarding a loan extension.

Types of Collateral Accepted in Texas

In Texas, when considering a Texas title loan comparison, understanding what collateral is required can significantly impact your decision. Lenders in this state typically accept various forms of collateral to secure the loans. Common types include vehicles, such as cars, trucks, and motorcycles. If you’re opting for a Houston Title Loan, keep in mind that lenders will use your vehicle’s title as security until the loan is repaid. This means you get to keep your vehicle while accessing fast cash.

Beyond vehicles, some lenders may also accept other assets as collateral, such as real estate or personal property. The acceptable forms of collateral can vary between lenders, so it’s crucial to compare options when looking for a Texas title loan. Remember, keeping your vehicle while accessing immediate financial support is a significant advantage in the fast-cash market, especially during times of need.

Comparing Lender Policies on Collateral Usage

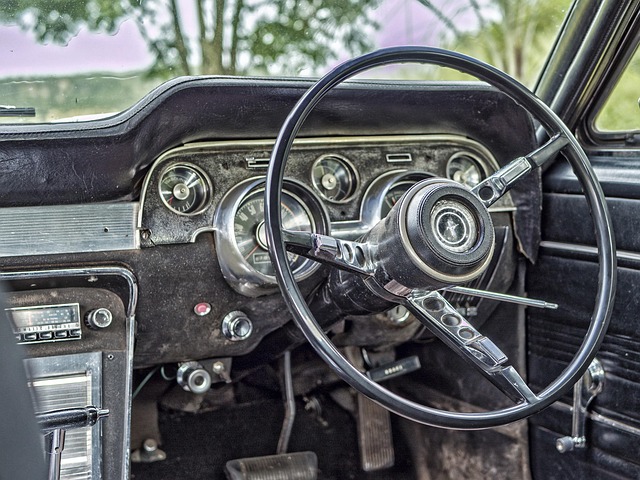

When comparing Texas title loans, a crucial aspect to consider is how lenders utilize collateral. Each lender has its own policy regarding what they do with the secured asset, which can significantly impact borrowers. Some institutions might allow for flexible collateral usage, enabling customers to use their vehicles or other assets for various purposes, including debt consolidation. This freedom can be advantageous, especially for those seeking to manage multiple debts in a single loan.

In contrast, other lenders may have stricter guidelines. For example, some might mandate that the collateral remains operational and in good condition, which could be ideal for borrowers looking for funds specific to their semi-truck loans or other specialized vehicles. Understanding these variations is essential when deciding on a lender, as it directly affects both the terms of the loan and the overall borrowing experience.

When comparing Texas title loans, understanding collateral requirements is key. Different lenders may accept various types of assets as collateral, such as vehicles or real estate. Each lender has its own policy on how these collateral items can be used, which could impact the terms and conditions of your loan. By thoroughly reviewing these policies, you can make an informed decision when selecting a lender for your Texas title loan needs, ensuring a transparent and beneficial borrowing experience.