Missouri City car title loans offer quick cash using your vehicle's title as collateral. Lenders assess your car's value for loan amounts, focusing on market trends, make, model, condition, and history, ensuring fair agreements accessible to diverse borrowers through competitive rates and online applications.

In the vibrant landscape of Missouri City, car title loans have emerged as a popular financial solution for many. But how exactly does the collateral valuation process work? This comprehensive guide demystifies the evaluation of your vehicle for a Missouri City car title loan. By understanding the factors influencing loan value, you can make informed decisions and navigate this alternative financing option with confidence. Whether you’re a first-time borrower or looking to refinance, this article provides invaluable insights into Missouri City car title loans.

- Understanding Missouri City Car Title Loans

- Collateral Valuation Process Explained

- Factors Influencing Your Loan Value

Understanding Missouri City Car Title Loans

Missouri City car title loans are a type of secured lending that offers quick access to cash using your vehicle’s title as collateral. This alternative financing option is designed for individuals who need immediate financial assistance and may not qualify for traditional bank loans or credit lines. It’s an excellent solution for emergencies, providing much-needed funds when you’re facing unexpected expenses or financial constraints.

With a car title loan, lenders assess the value of your vehicle to determine the maximum loan amount you can borrow. This process involves evaluating factors like the make and model of your car, its age, overall condition, and current market value. Unlike conventional loans that rely heavily on credit scores, Missouri City car title loans focus more on the collateral’s worth, making it accessible to a broader range of borrowers, including those with less-than-perfect credit histories. An added benefit is the flexibility offered by online applications, allowing you to apply from the comfort of your home and potentially secure funds faster through competitive interest rates.

Collateral Valuation Process Explained

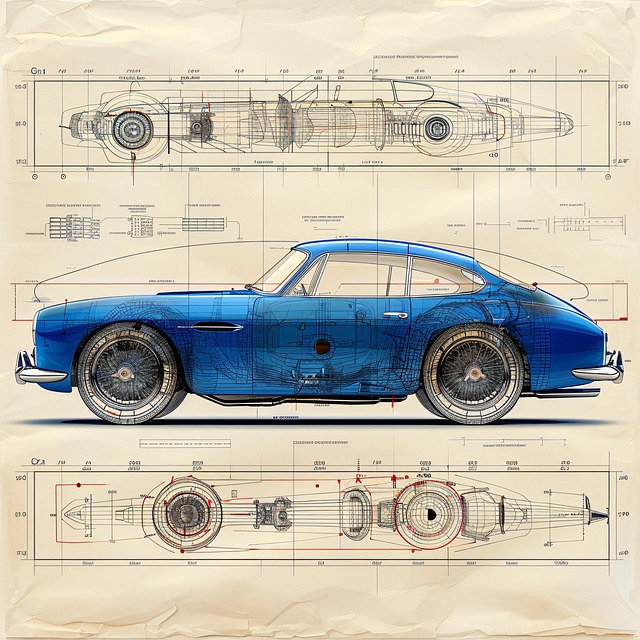

The Missouri City car title loan process involves a crucial step: collateral valuation. This stage is essential to determine the value of your vehicle, which serves as security for the loan. Lenders will assess several factors during this evaluation to ensure they are offering a fair and accurate loan amount. The first step in the process is a thorough vehicle inspection. During this inspection, a qualified appraiser examines various components of your car, including its make, model, year, condition, mileage, and any unique features or modifications. They also consider market trends and recent sales data for similar vehicles to arrive at an accurate value.

Once the initial assessment is complete, lenders will perform a Houston Title Loans collateral evaluation to confirm the vehicle’s worth. This step includes a detailed look at the car’s title history and any existing liens or encumbrances. The lender wants to ensure they are dealing with a clear title and that the loan amount aligns with the vehicle’s actual market value, facilitating a smooth and secure loan payoff process for both parties involved.

Factors Influencing Your Loan Value

When applying for a Missouri City car title loan, several factors play a crucial role in determining your loan value. Lenders assess your vehicle’s collateral valuation to ensure they offer a fair and secure lending option. The primary influences include the make, model, year, overall condition, and current market trends for your specific vehicle type. For instance, newer models with low mileage typically command higher values due to their residual demand in the automotive market.

Additionally, San Antonio loans providers consider the overall market demand for your vehicle’s make and model. Rare or classic vehicles may have a higher valuation due to collector interest, while more common models are valued based on average supply and demand. Other factors like any existing damage, past maintenance records, and odometer reading also contribute to the final evaluation, ensuring that both parties in the loan agreement understand the vehicle’s true worth.

Missouri City car title loans offer a unique opportunity for individuals seeking quick funding. The collateral valuation process, while seemingly complex, is designed to ensure fairness and accuracy. By understanding how factors like vehicle condition, age, and market trends influence loan values, borrowers can make informed decisions. Armed with this knowledge, folks in Missouri City can navigate the process with confidence, knowing they’re getting a fair deal that meets their financial needs.