Texans are increasingly opting for flexible and accessible Texas title loan alternatives like secured loans backed by vehicle ownership. These options provide quick cash with less stringent requirements, same-day funding, convenient repayment plans, lower interest rates, and the use of collateral, making them safer choices for managing unexpected costs or debt consolidation compared to traditional Texas title loans.

In the dynamic financial landscape of Texas, the growing popularity of non-traditional loan options is reshaping how residents access credit. As an alternative to conventional methods, such as Texas title loans, innovative lending solutions are gaining traction. This shift reflects a conscious move towards more flexible and safer borrowing options. This article delves into exploring these alternatives, highlighting their benefits, and providing guidance on navigating the realm of reliable credit, empowering Texans with informed financial choices.

- Exploring Non-Traditional Loan Options in Texas

- Benefits of Alternative Lending: A Growing Trend

- Navigating Safe and Reliable Credit Alternatives

Exploring Non-Traditional Loan Options in Texas

In Texas, the landscape of loan options is evolving beyond traditional banking models. As more Texans explore non-traditional loan sources, they’re uncovering innovative solutions for their short-term financial needs. This shift towards alternatives to Texas title loans reflects a growing awareness and desire for flexible financing options that cater to unique circumstances.

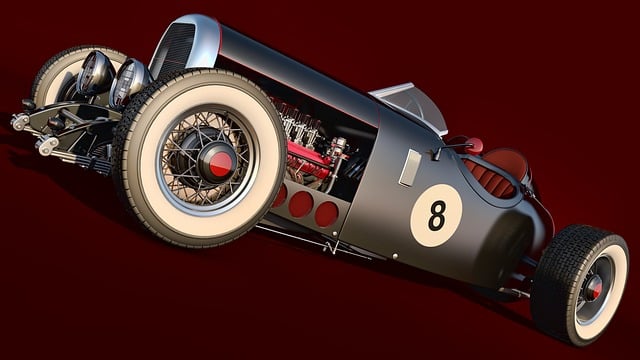

One prominent avenue gaining traction are secured loans backed by vehicle ownership, such as motorcycle title loans and truck title loans. These alternatives offer Texans the chance to leverage their assets—in this case, their vehicles—to secure smaller, short-term funds without the stringent requirements often associated with traditional loans. With these options, individuals can maintain vehicle use while repaying the loan, making them an attractive solution for those needing quick cash access and preserving their means of transportation.

Benefits of Alternative Lending: A Growing Trend

In recent years, the concept of Texas title loan alternatives has gained significant traction as consumers seek more flexible and accessible financial solutions. This growing trend reflects a shift in preferences away from traditional lending methods, particularly for short-term or immediate cash needs. One of the primary advantages of exploring these alternatives is the convenience they offer. Unlike the lengthy processes and stringent requirements associated with bank loans or Dallas title loans, alternative lending options often provide same-day funding, enabling borrowers to access their funds promptly. This rapid availability of capital can be a lifesaver during emergencies or unexpected financial constraints.

Additionally, Texas title loan alternatives cater to a diverse range of borrower profiles and needs. Many traditional lenders adhere to strict criteria, making it challenging for individuals with less-than-perfect credit history to secure loans. However, alternative lending platforms are more inclusive, offering options like installment loans or lines of credit that allow borrowers to build their creditworthiness over time. Furthermore, loan extensions might be available, providing flexibility and the potential to spread out repayments, which can alleviate the pressure on borrowers’ finances.

Navigating Safe and Reliable Credit Alternatives

In today’s digital era, Texans are exploring safer and more reliable credit alternatives to traditional Texas title loans. This shift is largely driven by the desire for flexible repayment options and lower interest rates, which can often be found in secured loans. These loan extensions provide a fresh approach, allowing borrowers to leverage assets like vehicles without the risk of losing them if they fail to repay.

Secured loans, unlike Houston title loans, offer a more sustainable borrowing experience. They are backed by collateral, ensuring lenders mitigate risks while offering competitive rates and terms. This stability is particularly appealing to those seeking a long-term solution for managing unexpected expenses or consolidating debt, without the burden of high-interest rates often associated with short-term, secured credit options.

Texas title loan alternatives are gaining popularity due to their benefits, such as flexible terms and easier access. As consumers increasingly seek safer and more reliable credit options, exploring these non-traditional loans offers a promising path forward. By carefully navigating the available alternatives, Texans can make informed decisions that best suit their financial needs.