Round Rock car title loans have gained popularity as a fast cash solution for residents with limited banking options or poor credit. These loans use vehicle titles as collateral, offering quick funds but with higher interest rates and shorter repayment periods. State agencies play a vital role in regulating this industry, ensuring consumer protection, fair lending practices, and transparent agreements through rigorous inspections, audits, and vehicle appraisals, thus safeguarding residents from predatory schemes and promoting responsible auto lending in Round Rock.

In the dynamic financial landscape of Round Rock, Texas, state agencies play a pivotal role in monitoring and ensuring compliance within the unique sphere of car title loans. This article delves into the intricate details of Round Rock car title loans, exploring their operational dynamics and the stringent oversight mechanisms implemented by state watchdogs. By examining these processes, we uncover how regulatory bodies foster fairness and transparency in auto lending, safeguarding consumers while fostering a robust local financial ecosystem.

- Round Rock Car Title Loans: An Overview

- State Agencies' Role in Compliance Monitoring

- Ensuring Fair Practices in Auto Lending

Round Rock Car Title Loans: An Overview

Round Rock car title loans have gained significant popularity as a short-term financing solution for residents in need of quick cash. This type of loan involves using an individual’s vehicle, typically their car, as collateral to secure the funding. Unlike traditional bank loans or credit cards, car title loans offer a simpler and faster application process, making them attractive to those with less-than-perfect credit or limited banking history. The concept is straightforward: borrowers provide their vehicle’s title to the lender, who holds onto it until the loan is repaid, usually within a specified period.

These loans are particularly appealing for folks seeking a cash advance without the usual stringent requirements of bank loans. While they may come with higher interest rates and shorter repayment terms, many people in Round Rock opt for car title loans as a convenient way to meet immediate financial obligations or cover unexpected expenses. Once the loan is repaid, including any associated fees, the borrower regains ownership of their vehicle’s title. Understanding these loan requirements can help residents make informed decisions when considering a Round Rock car title loan as a temporary financial assistance option.

State Agencies' Role in Compliance Monitoring

State agencies play a pivotal role in ensuring the compliance and fairness of Round Rock car title loans. These regulatory bodies are tasked with monitoring lending practices to safeguard consumers, especially those seeking Bad Credit Loans, from predatory or misleading transactions. They scrutinize various aspects of the Title Loan Process, including interest rates, repayment terms, and the overall transparency of loan agreements.

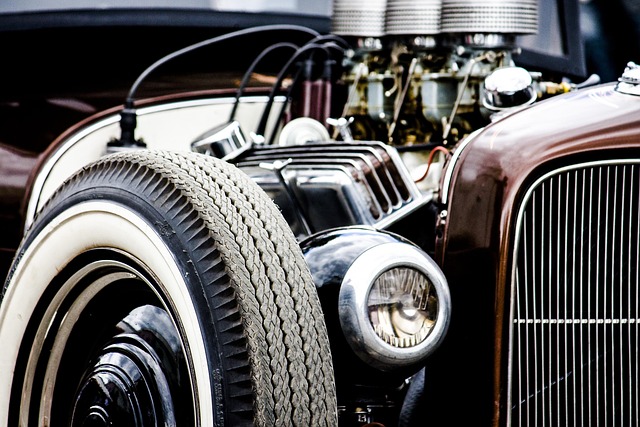

Through regular inspections and audits, they verify that lenders adhere to state laws and regulations. This includes conducting thorough Vehicle Inspections to assess the condition and value of collateralized vehicles, ensuring the process is accurate and doesn’t exploit borrowers. Their oversight helps maintain a balanced market, enabling responsible lending while preventing abusive financial practices.

Ensuring Fair Practices in Auto Lending

State agencies play a pivotal role in ensuring fair practices within the Round Rock car title loan industry. Their oversight helps protect consumers from predatory lending by scrutinizing loan agreements, interest rates, and repayment terms. This includes verifying that lenders comply with state and federal regulations, specifically regarding loan requirements and transparency. By holding these institutions accountable, agencies promote responsible auto lending, enabling residents to access fast cash without falling into debt traps.

The process involves regular audits of financial records, checking if lenders are utilizing vehicle equity fairly and accurately. This is crucial in preventing abusive lending schemes that take advantage of borrowers’ desperate situations. Round Rock car title loans should offer a safe and viable option for individuals seeking quick financial support, and state agencies’ vigilance ensures this by maintaining standards that safeguard consumers’ interests.

State agencies play a crucial role in monitoring Round Rock car title loans compliance, ensuring fair practices in auto lending. By regularly assessing lenders and enforcing regulations, these agencies safeguard consumers from predatory lending habits. This proactive approach fosters trust and transparency within the industry, providing peace of mind for borrowers seeking financial support through Round Rock car title loans.