Car title loans without a bank account offer swift financial aid to Houston residents lacking traditional banking access. Verifying vehicle ownership, a quick credit check, and application are steps to secure funds based on car value. This alternative is suitable for unbanked or underbanked individuals but carries risks of repossession and varying interest rates; refinancing options should be strategically considered.

Looking for a quick cash solution with no bank account? Explore the world of car title loans as an alternative financing option. This comprehensive guide delves into how you can access funds using your vehicle’s title, even without a traditional bank account. We break down the hassle-free process in simple steps and highlight the benefits and considerations of this unique lending route.

- Exploring Car Title Loans Without Bank Account

- Understanding The Process: Hassle-Free Steps

- Benefits and Considerations of This Alternative Financing

Exploring Car Title Loans Without Bank Account

For individuals lacking a traditional bank account, exploring car title loans as a financial solution can be an attractive option. This alternative lending method allows borrowers to access quick cash by using their vehicle’s title as collateral. Unlike bank loans that require robust credit history and a banking relationship, car title loans offer flexibility for those with limited or no bank account access.

In Houston, where the concept of Houston Title Loans has gained popularity, borrowers can keep their vehicle while securing a loan against its title. This is particularly beneficial for those relying on their vehicles for daily transportation or income, such as truck drivers and entrepreneurs. Even in the case of semi truck loans, where traditional financing may be scarce, car title loans provide a viable path to accessing emergency funds without closing the door on future financial opportunities.

Understanding The Process: Hassle-Free Steps

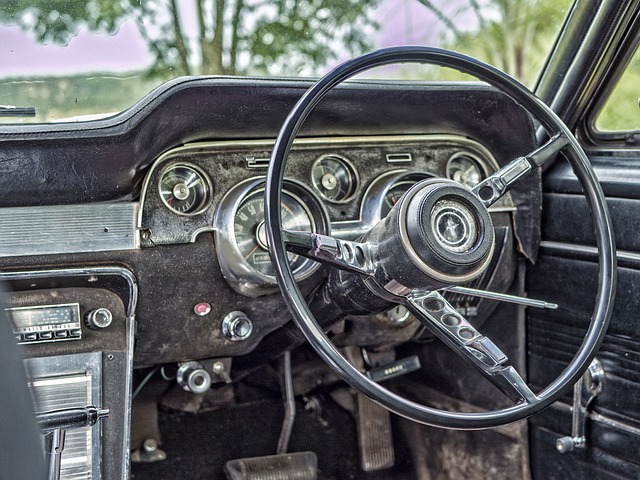

Obtaining a car title loan without a bank account is surprisingly straightforward, offering a swift solution for those needing emergency funding. The process involves just a few simple steps to ensure quick approval and access to your much-needed cash. First, you’ll need to provide proof of vehicle ownership; this can be done by presenting your vehicle’s registration documents. Once verified, lenders will conduct a quick credit check, not a rigorous one that affects your credit score, to assess your loan eligibility.

The next step is to fill out an application form, which requires basic personal information and details about your car. After submission, you’ll receive an offer based on the value of your vehicle and your loan requirements. Accepting the offer leads to a quick funding process, often within the same day, providing much-needed relief for unexpected expenses or urgent financial needs. This hassle-free method is especially appealing for those without a traditional bank account, offering a convenient alternative for emergency funding.

Benefits and Considerations of This Alternative Financing

For individuals lacking a traditional banking setup or struggling with poor credit, a car title loan without bank account offers a viable alternative financing option. This type of secured loan allows borrowers to leverage their vehicle’s equity, providing quick access to cash without stringent requirements often associated with bank loans. One significant advantage is its accessibility; it bypasses the need for a bank account, making it ideal for those unbanked or underbanked. Moreover, while traditional loans may be out of reach due to bad credit, car title loans can be more accommodating, as they primarily rely on the vehicle’s value rather than strict credit checks.

However, considerations are essential. The primary downside is that if you fail to repay, the lender could repossess your vehicle. This risk emphasizes the need for careful planning and budget management. Additionally, interest rates and fees can vary widely among lenders, so thorough research and comparison are crucial to securing a favorable deal. Loan refinancing options might be available, allowing borrowers to adjust terms, but these should be explored strategically to avoid further financial strain.

A car title loan without a bank account offers a viable alternative financing option for individuals facing financial constraints. By leveraging their vehicle’s equity, borrowers can access much-needed cash quickly and easily. This method eliminates the need for traditional banking requirements, making it an attractive solution for those with limited or no access to conventional loans. However, it’s essential to weigh the benefits against potential drawbacks, such as interest rates and repayment terms, to make an informed decision that best suits your financial situation.