Car title loans Texas for seniors often misunderstood but offer flexible options with simplified applications, no credit checks, competitive rates, and customizable repayment plans. Available through digital processes, these loans use vehicle equity as collateral, catering to short-term financial needs without overwhelming terms. Seniors should carefully review loan terms before signing.

“Unraveling the mysteries surrounding car title loans in Texas for seniors is essential, especially with prevalent misconceptions. This article aims to guide you through the process, separating fact from fiction. We’ll explore the reality of ‘Car Title Loans Texas for Seniors,’ dispelling common myths and providing insights into a potential financial solution. By the end, you’ll have a clearer understanding of how these loans work and whether they might be a suitable choice for your needs.”

- Car Title Loans Texas for Seniors: Fact vs Fiction

- Debunking Common Misconceptions About Senior Loans

- Navigating Car Title Loans: A Guide for Seniors

Car Title Loans Texas for Seniors: Fact vs Fiction

Car Title Loans Texas for Seniors: Fact vs Fiction

One common myth about Car Title Loans Texas for seniors is that they are inaccessible due to strict eligibility criteria. However, this isn’t true; these loans are designed to cater to a wide range of individuals, including the elderly. Lenders in Texas often offer flexible options tailored to senior needs, such as simplified application processes and no credit check requirements. This makes Car Title Loans an attractive solution for seniors facing financial emergencies or looking to access equity from their vehicles.

Another misconception is that these loans come with exorbitant interest rates and difficult repayment terms. While it’s true that interest rates can vary, many lenders in Texas provide competitive rates and customizable payment plans. The option for Bad Credit Loans is also available, ensuring that seniors with less-than-perfect credit histories can still access much-needed funds. Repayment plans can be structured to fit monthly budgets, making these loans a viable short-term solution or a means to rebuild financial stability.

Debunking Common Misconceptions About Senior Loans

Many seniors hold misconceptions about car title loans in Texas, often due to a lack of understanding or exposure to modern lending practices. One common myth is that these loans are exclusively targeted at younger individuals, ignoring the needs of the elderly. However, car title loans Texas for seniors are just as accessible and beneficial as any other demographic. Lenders offering Dallas Title Loans understand that financial emergencies can affect anyone, regardless of age, and thus provide quick funding options to help bridge the gap during difficult times.

Another misconception is that loan approval processes are lengthy and complicated. With modern digital platforms, the application and approval process for car title loans has become remarkably streamlined. Many reputable lenders now offer online applications, ensuring a swift and efficient way to secure funds. This efficiency doesn’t compromise security or legitimacy; instead, it reflects the evolving nature of financial services, catering to today’s fast-paced demands, including those of Texas seniors looking for emergency funding.

Navigating Car Title Loans: A Guide for Seniors

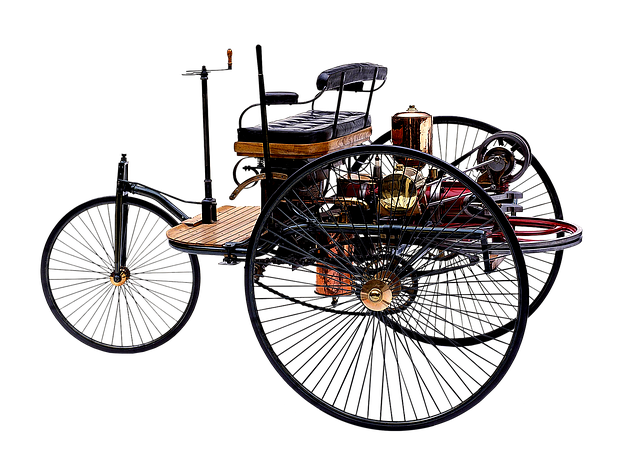

Navigating Car Title Loans can seem daunting for anyone, especially seniors unfamiliar with this type of financing. However, understanding the process is key to making an informed decision. In Texas, car title loans are designed to offer short-term financial relief by using your vehicle’s equity as collateral. This means you can access a loan despite having less-than-perfect credit or limited income. The application process typically involves providing identification, proof of vehicle ownership, and verifying your income.

Once approved, lenders provide a clear breakdown of loan requirements, including interest rates, repayment options, and the expected loan payoff period. Seniors should opt for terms that align with their financial comfort zone to avoid burdening themselves unnecessarily. Repayment options range from weekly to monthly installments, allowing flexibility based on individual income and cash flow patterns. Remember, transparency is vital; always read the fine print and understand the full terms before signing any agreements.

Car title loans Texas for seniors are a viable option when managed responsibly. By debunking common myths and understanding the process, older adults can navigate these loans effectively. This guide has shed light on the fact vs fiction, offering valuable insights into car title loans as a potential solution for financial needs. Remember, informed decisions lead to positive outcomes, ensuring peace of mind for Texas seniors considering this alternative financing method.