In financial crises, Texans turn to Texas title loans without proof of income for quick cash access using vehicle equity, appealing to freelancers and irregular earners. This alternative offers swift funding, bypassing traditional employment verification. Reputable lenders can be found online or in-person, with responsible borrowing ensuring efficient emergency relief until next paycheck.

In times of financial crisis, access to emergency cash is paramount. For those in Texas, a Texas title loan without proof of income offers a potential solution. This article delves into the world of Texas title loans, exploring their mechanics and providing alternative financing options when traditional routes are inaccessible. We offer a step-by-step guide on navigating these loans, empowering you to make informed decisions during financial emergencies.

- Understanding Texas Title Loans: An Overview

- Alternative Financing Options Without Income Proof

- Navigating Emergency Cash: A Step-by-Step Guide

Understanding Texas Title Loans: An Overview

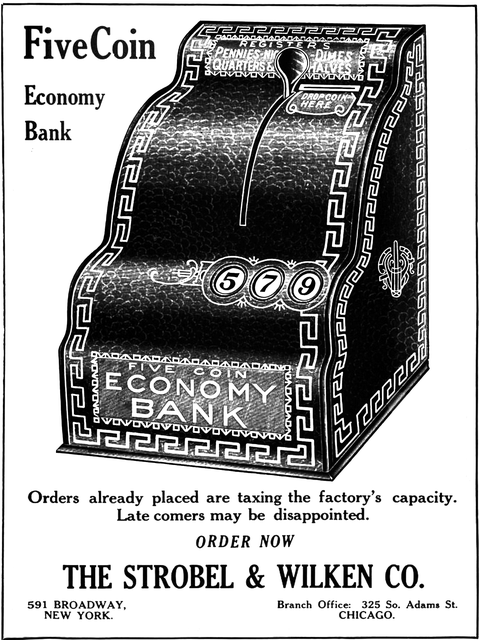

In the event of financial emergencies, individuals often seek quick and accessible solutions for obtaining emergency cash. One option gaining popularity in Texas is a Texas title loan without proof of income. This type of loan utilizes a person’s vehicle as collateral, allowing them to borrow funds based on the value of their car rather than relying on traditional employment verification or detailed financial documentation.

A car title loan in Texas offers several advantages for borrowers who may be unable to meet traditional lending requirements. Unlike Fort Worth loans or Dallas title loans that often demand extensive proof and strict credit checks, this alternative provides a more flexible approach. It caters to those with irregular income streams, freelancers, or individuals lacking a stable employment history. By leveraging their vehicle’s equity, borrowers can access funds quickly, making it an attractive solution for urgent financial needs without the usual stringent verification processes.

Alternative Financing Options Without Income Proof

When facing a financial emergency and you’re unable to provide proof of income, it might seem like your options are limited. However, there are alternative financing solutions available in Texas that don’t necessarily require traditional employment verification. One such option is a Texas title loan, which uses the equity in your vehicle as collateral. This allows individuals with no steady income or poor credit history to access much-needed funds quickly and easily. The title loan process is straightforward; you simply fill out an application, provide your vehicle’s registration, and drive away with cash in hand within the same day of funding.

Compared to other financial solutions, this method offers a faster and more convenient way to secure emergency cash without the hassle of extensive paperwork or lengthy waiting periods. It provides a sense of security for those facing unexpected expenses, offering a quick financial solution until their next paycheck arrives. Whether it’s an unexpected medical bill or a sudden home repair, a title loan can bridge the gap between paychecks, ensuring you have access to funds when you need them most.

Navigating Emergency Cash: A Step-by-Step Guide

Navigating Emergency Cash Needs: A Step-by-Step Guide for Texans

In times of financial crisis, having a reliable source of emergency cash is vital. For those in Texas considering a Texas title loan without proof of income, this quick guide can help demystify the process. First, identify reputable lenders who offer such loans, ensuring they adhere to state regulations and transparent interest rates. Compare repayment options available, choosing one tailored to your financial capacity without causing undue strain.

Apply online or in-person, providing necessary details like vehicle information and proof of identity. Upon approval, the lender may facilitate a direct deposit of funds into your account, enabling swift access to the emergency cash you need. Remember, while this can be a temporary solution, responsible borrowing and prompt repayment are key to avoiding long-term financial strain.

When facing financial emergencies, a Texas title loan can provide much-needed cash without the traditional requirement of proof of income. By leveraging the equity in your vehicle, you can access immediate funds, offering a swift solution for unexpected costs. However, it’s essential to explore all alternatives and understand the implications before choosing this route. With careful consideration and a well-informed decision, Texas residents can navigate emergency cash needs with flexibility and confidence.