Traditional banks slow loan approval processes contrast sharply with car title loans, online lenders, and credit unions that offer faster car title loan approval times due to streamlined paperwork, collateral security, digital platforms, smaller operations, and personalized approaches. Car title loans provide quicker access to funds, lower interest rates, and flexible terms, catering to borrowers needing urgent cash, while credit unions offer better rates and terms for individuals with less-than-perfect credit.

Car title loans have gained popularity as a quick source of cash, but understanding the approval process is crucial. This article delves into the average car title loan approval times by different lender types: traditional banks, online lenders, and credit unions. While banks often involve lengthy procedures, online lenders offer swift approvals, making them a preferred choice for urgent financial needs. Credit unions provide an alternative, sometimes with faster processing than banks but slower than their digital counterparts.

- Traditional Banks vs Car Title Loans: Approval Times Compared

- Online Lenders: Faster Approvals for Car Title Loans

- Credit Unions: Exploring Their Role in Car Title Loan Approvals

Traditional Banks vs Car Title Loans: Approval Times Compared

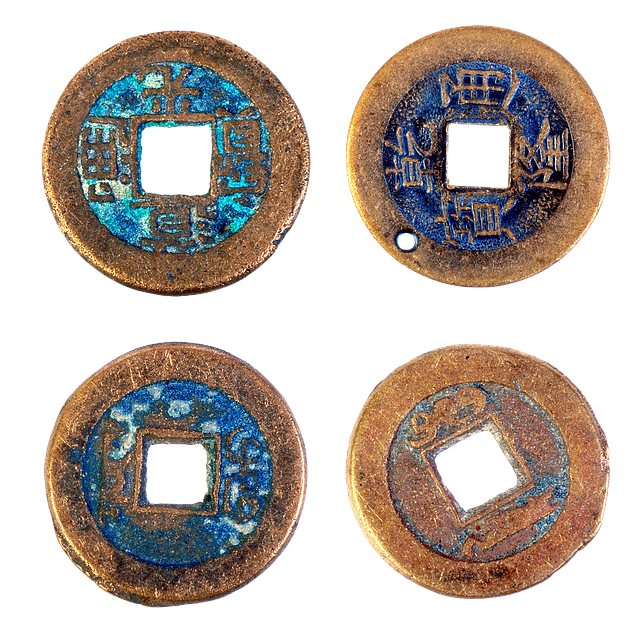

When it comes to securing a loan, traditional banks have long been the go-to option for many borrowers. However, in recent years, car title loans have emerged as a faster and more accessible alternative. The key difference lies in the approval process and time frame. While banks typically conduct extensive paperwork, credit checks, and underwriteings before approving a loan, car title loans streamline these steps significantly. This results in a notable contrast in car title loan approval times.

For instance, a Dallas Title Loan can often be approved within minutes to an hour, compared to the days or even weeks it might take for a traditional bank loan. This rapid approval is possible because car title loans are secured by the value of your vehicle, eliminating the need for extensive background checks. Additionally, interest rates on these loans tend to be lower than those offered by banks, making them an attractive option for borrowers seeking quick financial relief.

Online Lenders: Faster Approvals for Car Title Loans

Online lenders have streamlined the car title loan approval process, making it faster and more accessible for borrowers. With digital platforms and automated systems, these lenders can efficiently evaluate a borrower’s application, including their vehicle equity, in just a few minutes. This speed is a significant advantage over traditional lenders who often rely on manual paperwork and lengthy internal processes.

The convenience of online car title loan applications allows borrowers to get financial assistance without the hassle of visiting a physical branch. Secured loans with a customer’s vehicle as collateral ensure that online lenders can offer competitive interest rates and flexible repayment terms, making these loans an attractive option for those in need of quick cash.

Credit Unions: Exploring Their Role in Car Title Loan Approvals

Credit unions play a significant role in facilitating car title loan approvals, offering an alternative to traditional lenders. These financial cooperatives are member-owned institutions that prioritize serving their members’ needs, often including those with less-than-perfect credit. In the context of car title loans, credit unions may provide quicker approval times compared to banks or other large lenders. This is partly due to their smaller operation size and personalized approach, allowing for more flexible loan requirements.

Credit unions typically focus on community building and financial well-being, which can lead to better rates and terms for borrowers, especially those with limited credit history or poor credit scores. The quick approval process they offer is appealing to many individuals seeking emergency funding, as it provides a faster alternative to the longer waiting periods often associated with conventional loan providers, particularly when considering bad credit loans.

When it comes to securing a car title loan, understanding the average car title loan approval time is crucial for borrowers. The article has explored the disparities in approval speeds across different lender types, highlighting that online lenders often expedite the process, while traditional banks and credit unions may take longer due to their meticulous underwriting standards. By comparing these options, borrowers can make informed decisions, choosing the lender that best aligns with their needs and ensuring a smoother borrowing experience.