Texas online title loans provide quick funding for residents using vehicle titles as collateral, with minimal documentation and flexible repayment plans. Lower interest rates and convenient application process appeal to those with limited credit options, though high-interest rates and loss of vehicle upon default pose risks. Responsible management makes them a viable emergency financial aid option.

In the diverse landscape of lending, Texas online title loans stand out as a unique option. This article delves into the intricacies of these loans, offering a comprehensive comparison with traditional loan varieties. By understanding the key differences and exploring advantages and considerations, borrowers can make informed decisions. Discover how Texas online title loans provide access to quick funding, flexible terms, and potential benefits compared to other lending alternatives.

- Understanding Texas Online Title Loans

- Key Differences from Traditional Loans

- Advantages and Considerations Compared to Others

Understanding Texas Online Title Loans

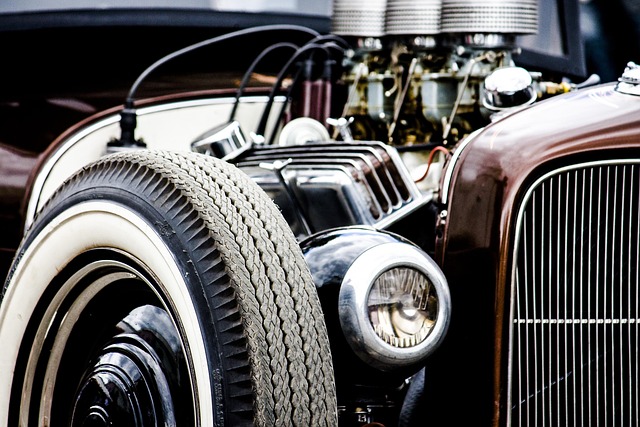

Texas online title loans have gained popularity as a quick and accessible lending option for residents of Texas. These loans are secured against a person’s vehicle, typically their car or truck, which serves as collateral. The process is entirely online, making it convenient for borrowers who prefer a digital experience. Lenders evaluate the value of the vehicle, offer a loan amount based on that assessment, and provide a straightforward borrowing option with potentially faster funding compared to traditional loans.

One significant advantage of Texas online title loans is their flexibility. Borrowers can expect customizable repayment plans, allowing for more manageable monthly payments. Unlike some other types of loans, including Semi Truck Loans, where interest rates might be higher, online title loans often come with competitive rates, especially when borrowers choose reputable lenders. This makes them an attractive option for those in need of rapid financial assistance without the hassle of extensive documentation and traditional credit checks.

Key Differences from Traditional Loans

When considering Texas online title loans, one of the key differences from traditional loans lies in their security requirements. Unlike conventional loans that often demand excellent credit and various forms of collateral, online title loans are secured by your vehicle’s title. This means if you fail to repay the loan, the lender has the right to repossess your vehicle. However, this also works in your favor, as it can result in lower interest rates and more flexible terms compared to other types of unsecured loans.

Another significant distinction is the application process. Online title loans streamline everything from initial inquiries to final approvals, often requiring just a few simple documents and a quick inspection of your vehicle. This digital approach saves time and effort, making it convenient for borrowers who need quick access to cash. Moreover, payment plans for these secured loans tend to be more tailored to individual financial capabilities, allowing for manageable installments over an extended period.

Advantages and Considerations Compared to Others

Texas online title loans offer several advantages when compared to traditional loan options. One key benefit is their accessibility; these loans are available to a wide range of borrowers, even those with less-than-perfect credit or limited banking history. This inclusivity is due to the fact that these loans are secured by vehicle equity, allowing lenders to mitigate risk. Additionally, San Antonio loans, like many online title loans, often provide same-day funding, giving borrowers quick access to emergency funds.

However, there are considerations to keep in mind. The primary one is the potential for high-interest rates and fees associated with Texas online title loans. These can make them more expensive than other loan types over time. Furthermore, the process involves pledging your vehicle as collateral, which means you risk losing it if you default on the loan. Despite these factors, for those in need of swift financial aid, online title loans can be a viable option when managed responsibly.

Texas online title loans offer a unique and convenient borrowing option, distinct from traditional loans. By leveraging the value of your vehicle, these loans provide swift access to cash with relatively simpler eligibility requirements. Compared to other loan types, they stand out for their faster approval times and flexible repayment terms, making them an attractive choice for those in need of immediate financial support. However, it’s crucial to weigh the benefits against potential drawbacks, such as interest rates and the risk of losing your vehicle if repayments fall through. Understanding these nuances is key to making an informed decision regarding Texas online title loans.