Title loans offer a unique financing option without a cosigner, secured against a vehicle's title. They provide access to funds based on the asset's value and remaining payoff balance, considering factors like make, model, condition, and outstanding debt. With same-day approval and potential loan extensions, they cater to urgent financial needs. Online applications simplify the process, eliminating the need for a third party, making it an accessible alternative to traditional loans with faster decision-making and fund disbursement.

Are you considering a title loan but hesitant to involve a co-signer? In today’s financial landscape, alternatives for secure lending are emerging. This article explores the option of obtaining a title loan without a cosigner, providing a comprehensive overview and dispel common myths. We’ll delve into the mechanics of title loans, understand the traditional role of co-signers, and discover innovative solutions for borrowers seeking autonomy in their financial decisions.

- Understanding Title Loans: A Comprehensive Overview

- The Role of Co-signers in Traditional Loans

- Exploring Alternatives: Secure Lending Options Without a Co-signer

Understanding Title Loans: A Comprehensive Overview

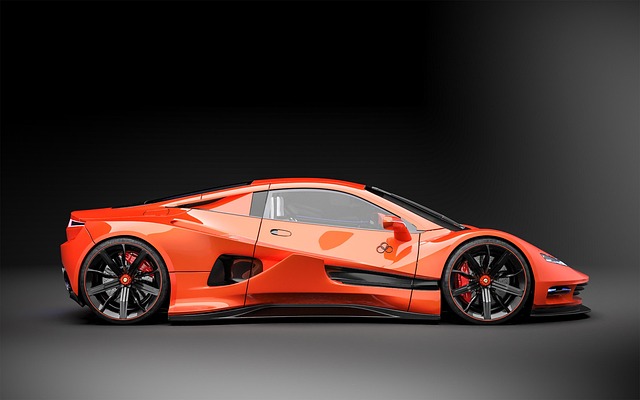

Title loans have emerged as a financial option for individuals seeking quick cash, especially those with limited or poor credit history. This type of loan is secured against an asset, typically a vehicle, giving lenders a measure of security. Unlike traditional loans that require a cosigner, a title loan allows borrowers to access funds without the need for a co-borrower, making it an attractive option for many. The process involves using your vehicle’s title as collateral, ensuring the lender has a clear legal claim in case of default. This alternative financing method has gained popularity due to its accessibility and potential for same-day loan approval, catering to urgent financial needs.

Understanding how title loans work is crucial when considering this option. Lenders will conduct a credit check to assess your ability to repay, but unlike a conventional loan, your credit score isn’t the sole determining factor. The primary focus is on the value of your asset (in this case, your vehicle) and its remaining payoff balance. Loan approval typically depends on factors such as the car’s make, model, year, overall condition, and how much you owe on it. Additionally, loan extensions might be available if unexpected financial challenges arise, providing some flexibility for borrowers.

The Role of Co-signers in Traditional Loans

In traditional loan scenarios, co-signers play a pivotal role in ensuring borrowers’ financial responsibility. When an individual applies for a loan, having a co-signer adds an extra layer of security for lenders. This is particularly true for personal loans and mortgages where the co-signer agrees to share the burden of repayment if the primary borrower defaults. The presence of a co-signer enhances the creditworthiness of the loan application, as it demonstrates a support system and potentially lowers the risk for the lender. This dynamic is especially relevant when considering the title loan without cosigner scenario, highlighting the evolving nature of lending practices.

With the advent of digital financing options, borrowers now have the convenience of applying for title loans through online applications, bypassing the traditional requirement of a co-signer. The title loan process streamlines the borrowing experience, allowing individuals to access funds securely without the need for a third party. This shift is driven by the efficiency and accessibility offered by digital platforms, catering to those who prefer a more straightforward and private borrowing option, especially when dealing with urgent financial needs.

Exploring Alternatives: Secure Lending Options Without a Co-signer

In today’s financial landscape, many individuals seek quick funding options without compromising their assets or creditworthiness. One alternative to traditional loans with a co-signer is exploring secure lending through title loans. This option allows borrowers to use their vehicle’s title as collateral, eliminating the need for a second party to vouch for the loan. By doing so, you can gain access to funds quickly and potentially avoid a rigorous credit check, making it an attractive solution for those in urgent need of capital.

Online applications have made this process even more convenient. Borrowers can complete the entire procedure from the comfort of their homes, providing essential details and documentation digitally. This streamlines the traditional loan application process, enabling faster decision-making and disbursement of funds. With these modern lending options, individuals now have greater flexibility to manage their finances without relying on a co-signer, thereby fostering financial independence.

In today’s financial landscape, understanding your lending options is crucial. While traditional title loans often require a co-signer, modern alternatives offer greater flexibility. Exploring secure lending options without a co-signer is now more accessible than ever, providing individuals with a viable solution to meet their immediate financial needs. By delving into these innovative choices, you can navigate the world of title loans confidently, ensuring a safer and more independent borrowing experience.