Texas motorcycle title loans have gained popularity as a quick and accessible financial option for riders using their bike's title as collateral, bypassing strict credit checks. With a simple process involving vehicle inspection and swift approval, residents can gain immediate cash access within short timeframes, ideal for unexpected expenses or bike upgrades. While traditional bank loans offer competitive interest rates and clear repayment structures, they have rigorous approval processes and strict collateral requirements, limiting access for those without substantial assets. Texas motorcycle title loans provide a more flexible alternative, allowing borrowers to keep their vehicles as collateral and gain faster access to funds, even with less-than-perfect credit.

In the vibrant landscape of Texas, understanding financing options is key for many riders. When considering a loan, Texas motorcycle title loans stand out as a unique alternative to traditional banking. This article delves into these two distinct borrowing methods, highlighting their advantages and disadvantages. By comparing key differences, from interest rates to collateral requirements, riders can make informed decisions, ensuring the best fit for their financial needs in the Lone Star State.

- Understanding Texas Motorcycle Title Loans

- Advantages and Disadvantages of Bank Loans in Texas

- Key Differences: Title Loans vs Traditional Banking

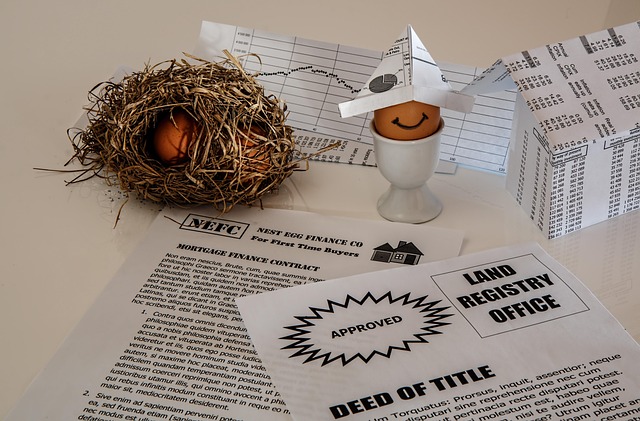

Understanding Texas Motorcycle Title Loans

In Texas, motorcycle title loans have emerged as a popular and accessible financial solution for riders seeking quick funding. This unique lending option allows individuals to use their motorcycle’s title as collateral, providing an alternative to traditional bank loans. The process is straightforward; lenders conduct a vehicle inspection to assess the bike’s value and then offer a loan based on its worth. This method ensures that Texas residents with good riding history can gain immediate access to cash without strict credit requirements.

Unlike bank loans, which often involve lengthy applications and rigorous credit checks, motorcycle title loans in Texas are known for their speed and convenience. Riders can complete the entire process within a short time, making it an attractive option for those needing rapid financial assistance. This type of loan is ideal for unexpected expenses or funding bike-related upgrades, offering a straightforward financial solution without the usual banking delays.

Advantages and Disadvantages of Bank Loans in Texas

Bank loans in Texas offer several advantages for borrowers looking to secure funding for various purposes. One significant benefit is the wide range of options available from different financial institutions, including traditional banks and credit unions. This competition often results in more favorable interest rates, especially when compared to alternative lenders. Additionally, bank loans typically provide a clear repayment structure with fixed monthly installments, making it easier for borrowers to budget and manage their finances effectively. This predictability can be a significant advantage for those seeking long-term financing solutions like Texas motorcycle title loans.

However, there are also disadvantages to consider. The approval process for bank loans can be lengthy and stringent, often requiring extensive documentation and credit checks. This might not be ideal for individuals with less-than-perfect credit or urgent financial needs. Furthermore, traditional banks may have strict collateral requirements, limiting options for those without substantial assets. In contrast, alternative forms of lending, such as boat title loans, offer more flexibility in terms of repayment and eligibility criteria but may come with higher interest rates and shorter term limits.

Key Differences: Title Loans vs Traditional Banking

When considering a loan option for your Texas motorcycle needs, understanding the key differences between Texas motorcycle title loans and traditional banking loans is essential. One distinct advantage of title loans is that they offer a more flexible approach to borrowing. With this type of loan, you can keep your vehicle as collateral, allowing for easier access to funds without the strict requirements often associated with bank loans. This is particularly beneficial for individuals with less-than-perfect credit or those seeking faster funding.

Traditional banking loans typically involve stricter criteria, including rigorous credit checks and a thorough review of your financial history. While they may offer longer repayment periods, the process can be time-consuming and might not suit everyone’s needs. In contrast, title loans provide a more straightforward path to acquiring capital, ensuring that you keep your vehicle as long as you meet the loan repayment terms. This flexibility has made motorcycle title loans an attractive option for many Texas residents in need of quick financial support.

When considering financial options in Texas, both Texas motorcycle title loans and bank loans have their merits. Title loans offer faster access to cash with fewer requirements, while banks provide a broader range of loan types with potentially better long-term rates. Ultimately, the best choice depends on individual needs, creditworthiness, and the desired terms for repayment. For swift funding, Texas motorcycle title loans could be a viable option, but for more traditional banking services, local institutions remain a reliable choice.