A title loan for classic cars offers short-term financing secured against a vehicle's title, appealing to enthusiasts needing funds for restoration or expenses. Accessible online with simpler eligibility criteria, these loans assess the car's value, age, condition, and market demand. Houston title loans allow owners to tap into their classic cars' equity without selling them. While providing immediate access to capital and flexible terms, they may have stricter requirements, higher interest rates, and less diverse repayment structures. To secure a title loan, consult experts, compare lenders, prepare documents, apply accurately, and review the agreement thoroughly.

Can you finance your passion project with a title loan? If you own a classic car, the answer might be yes. This guide explores the options of securing a title loan for classic cars, demystifying a process that can provide much-needed funds for restoration or upgrades. We’ll delve into how these loans work, their advantages and drawbacks, and the straightforward steps to borrow against your vehicle’s value. Discover if financing your dream car is within reach.

- Understanding Title Loans and Their Applicability to Classic Cars

- Benefits and Challenges of Obtaining a Title Loan for Your Classic Vehicle

- Steps to Secure a Title Loan for Your Beloved Classic Car

Understanding Title Loans and Their Applicability to Classic Cars

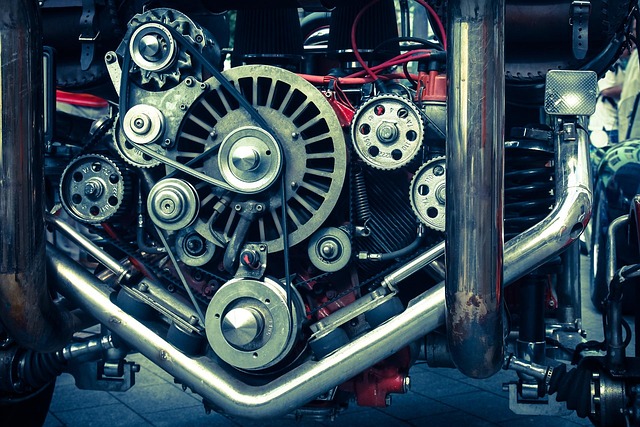

A title loan for classic cars involves securing a loan against the title of your vintage or retro vehicle. It’s a type of short-term financing where lenders offer cash to car owners, using the car’s title as collateral. This option is particularly appealing to classic car enthusiasts who may need funds for restoration projects, upgrades, or even daily driving expenses. The beauty of this process lies in its accessibility; not only are traditional banks less inclined to lend money for specialized vehicles like classics, but online platforms have made applying for these loans easier than ever. You can complete an online application from the comfort of your home, providing details about your vehicle and financial situation.

When considering a title loan for classic cars, it’s essential to understand the requirements and benefits. Lenders will assess the vehicle’s value, age, condition, and potential market demand before deciding on the loan amount. Unlike traditional car loans, these titles loans often have simpler eligibility criteria, making them accessible to a broader range of individuals. Moreover, having Houston title loans (or any other location-specific option) available allows owners to tap into the equity built up in their beloved classics without selling or sacrificing their prized possessions.

Benefits and Challenges of Obtaining a Title Loan for Your Classic Vehicle

Obtaining a title loan for classic cars can offer several advantages for enthusiasts looking to raise funds for their cherished vehicles. One significant benefit is access to immediate capital, allowing owners to cover unexpected expenses like repairs or maintenance without liquidating other assets. These loans are particularly appealing as they provide a secured financing option, often with more flexible repayment terms compared to traditional car loans, catering to the unique needs of classic car ownership. Additionally, since these vehicles tend to hold their value over time, owners may find themselves in a favorable position to repay and even profit from their investment.

However, there are challenges to consider. Lenders may have stricter loan requirements for classic cars due to their age and potential for fluctuating values. This could include demanding detailed documentation and proof of ownership, which can be more complex than with modern vehicles. Moreover, bad credit loans in this sector might come with higher-than-average interest rates and shorter repayment periods, posing financial constraints on borrowers. Another factor is the lack of readily available repayment options, as some lenders specializing in classic cars may offer less diverse repayment structures compared to mainstream lending institutions.

Steps to Secure a Title Loan for Your Beloved Classic Car

Securing a title loan for classic cars can be an exciting option for car enthusiasts looking to access funds while keeping their beloved vehicles. Here’s a breakdown of the steps involved in this process:

1. Assess Your Classic Car’s Value: Start by evaluating your classic car’s condition, make, model, and rarity. These factors significantly influence its worth. You can consult with experts or classic car communities to get an accurate estimate, which will help determine the loan amount you can secure.

2. Research Lenders Specializing in Classic Cars: Not all lenders offer title loans for classic cars, so it’s essential to find those who specialize in this niche. Look for lenders who understand the unique value proposition of these vehicles and can provide quick approval processes. They should also consider your car as collateral, ensuring a more accessible loan option. Check their terms, interest rates, and any additional requirements they may have, such as proof of insurance and maintenance records.

3. Prepare Required Documents: Gather essential documents like the car’s title (or a lien-free title), government-issued ID, proof of insurance, and any other documentation requested by the lender. These will be needed to establish your identity and loan eligibility.

4. Submit an Application: Fill out the loan application form provided by the chosen lender. Provide accurate information about your classic car, financial background, and intended use of the loan funds. Some lenders offer online applications for added convenience.

5. Review and Accept Loan Terms: Once approved, carefully review the loan agreement, ensuring you understand the repayment terms, interest rates, and any associated fees. If you’re seeking debt consolidation or quick approval, this is a crucial step to ensure the loan aligns with your financial goals.

Title loans for classic cars can be a viable option for enthusiasts who need quick access to cash while preserving their beloved vehicles. By understanding the process and weighing the benefits against potential challenges, car owners can make an informed decision. If you follow the outlined steps, securing a title loan on your classic vehicle could provide the financial support you require without sacrificing its value. Remember, responsible borrowing is key to ensuring this unique asset remains in your possession for years to come.