Car title loans for older vehicles offer a unique, accessible financing option for individuals with less-than-perfect credit, focusing on vehicle value and maintenance history. Lenders assess the car's condition, market demand, and creditworthiness to determine approval amounts and flexible repayment periods. Transparent communication about financial status and loan use is key to securing suitable terms, balancing potential benefits against interest rates and fees.

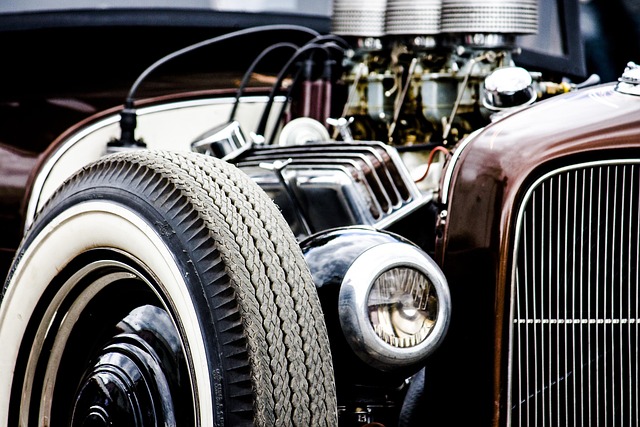

Looking to secure funding for your classic or vintage ride? Discover expert tips on navigating car title loans for older vehicles. This comprehensive guide breaks down the process, from understanding unique loan considerations to assessing your vehicle’s value. Learn how to assess your options and navigate lender requirements, ensuring a smooth journey towards securing the capital you need without compromising your beloved car’s integrity.

- Understanding Car Title Loans for Older Vehicles

- Assessing Your Vehicle's Value and Condition

- Navigating Lender Requirements and Terms

Understanding Car Title Loans for Older Vehicles

When considering car title loans for older vehicles, it’s essential to grasp the unique aspects that come into play. These types of loans are secured by the vehicle’s title, making them an attractive option for those with less-than-perfect credit or a lack of traditional loan qualifications. The process involves pledging your vehicle as collateral, which simplifies access to funds compared to unsecured loans. Lenders assess the car’s value and residual market demand to determine loan approval amounts.

Understanding the repayment options is another key factor. Car title loans typically offer flexible repayment periods, allowing borrowers to spread out payments over several months. This can be particularly beneficial for older vehicles that may have declining resale values. It’s important to weigh the potential benefits against the interest rates and fees associated with these loans, ensuring they align with your financial capabilities.

Assessing Your Vehicle's Value and Condition

When considering car title loans for older vehicles, assessing your vehicle’s value and condition is a crucial first step. While age can impact a car’s worth, don’t assume your older ride has no inherent value. Lenders will evaluate several factors, including make, model, year, overall condition, and market demand. A well-maintained classic or vintage vehicle might surprise you with its potential worth.

Regular maintenance records, repair receipts, and evidence of ownership history can all bolster your application. For those considering semi truck loans or car title loans for less common vehicles, showcasing detailed care and documentation is even more essential. This demonstrates responsible ownership, which is favorable when securing emergency funds through a title transfer process.

Navigating Lender Requirements and Terms

When applying for car title loans for older vehicles, understanding the lender’s requirements and terms is essential to a successful loan process. Lenders will assess your vehicle’s value, considering factors like its make, model, year, and overall condition. This appraisal determines the loan amount you can secure based on the car’s equity. Beyond the vehicle inspection, lenders often conduct thorough credit checks to evaluate your financial reliability. Demonstrating a good repayment history can improve your chances of securing favorable terms, including competitive interest rates and flexible repayment options.

In addition to assessing your creditworthiness, Fort Worth loans providers will present various repayment plans tailored to different borrower needs. Understanding these options is crucial as it allows you to choose a schedule that aligns with your financial capabilities. Transparent communication with the lender about your income, existing debts, and intended use of the loan can facilitate discussions on the most suitable repayment terms, ensuring a manageable debt experience for car title loans for older vehicles.

Securing car title loans for older vehicles can be a viable option for those in need of quick funding. By understanding the process, assessing your vehicle’s value honestly, and carefully reviewing lender terms, you can make an informed decision that best suits your financial situation. Remember, car title loans for older vehicles come with unique considerations, so it’s crucial to approach them strategically.