Dallas car title loans offer quick cash but come with high-interest rates and short repayment terms, risking vehicle repossession on default. Residents should understand these risks, consider safer alternatives like traditional bad credit loans from reputable institutions, and explore direct deposit loans to avoid predatory lending practices.

Dallas residents often turn to alternative financing options, like car title loans, for quick cash. However, these so-called Dallas car title loans can come with alarming risks and predatory practices. This article guides you through understanding these loans, identifying red flags, and exploring safer loan alternatives to help Dallas residents make informed decisions, avoiding financial pitfalls associated with predatory lending.

- Understanding Dallas Car Title Loans

- Spotting Predatory Lending Practices

- Protecting Yourself: Safe Loan Options

Understanding Dallas Car Title Loans

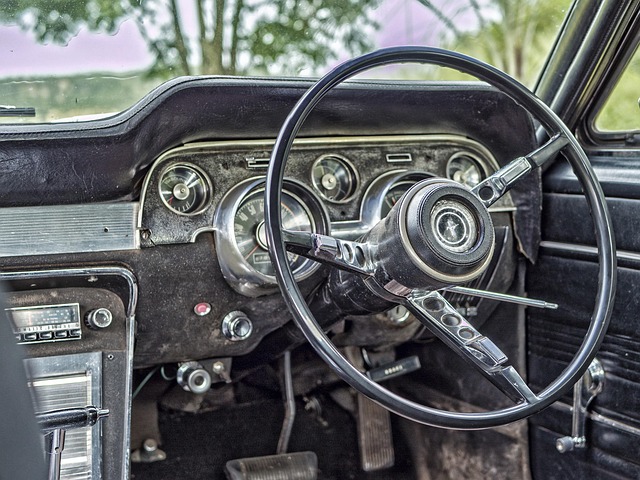

Dallas car title loans are a type of secured lending where borrowers use their vehicle’s title as collateral. This means that if the borrower defaults on repaying the loan, the lender has the legal right to repossess the vehicle. While this can be a quick way to access emergency funding or fast cash, it often comes with high-interest rates and harsh terms. In Dallas, as in many places, predatory lenders target individuals in desperate situations, offering seemingly attractive short-term solutions that can lead to long-term financial strain.

Understanding the mechanics of Dallas car title loans is crucial. Lenders typically assess a percentage of the vehicle’s value as a loan amount, often providing a fraction of its total worth. The interest rates on these loans are significantly higher than traditional bank loans or even semi truck loans, and repayment terms are usually shorter, leaving borrowers in a cycle of debt. It’s important for Dallas residents to be aware of these practices to avoid getting trapped in a predatory lending situation, especially when dealing with urgent financial needs.

Spotting Predatory Lending Practices

Dallas residents often turn to car title loans when facing financial emergencies, but it’s essential to be vigilant and recognize predatory lending practices. These unscrupulous lenders target individuals in desperate situations by offering quick cash with minimal requirements, often using high-pressure sales tactics. They may lure borrowers with promises of immediate funds, but the terms and conditions can be harsh, charging excessive interest rates and hidden fees.

One common tactic is the practice of forcing borrowers to surrender their vehicle titles as collateral, even for small amounts of fast cash. This gives lenders a powerful leverage point, and if the borrower defaults on repayment, they have the right to repossess the vehicle. It’s crucial for Dallas residents considering Dallas car title loans to understand these risks and explore alternative options like traditional bad credit loans from reputable financial institutions that offer fair terms and conditions.

Protecting Yourself: Safe Loan Options

When considering a loan in Dallas, it’s crucial to understand that not all lending options are created equal. While traditional banks offer various safe and secure loan types, some residents might turn to alternative lenders like Dallas car title loans or title pawn shops for quick cash. However, these high-risk loan options often come with stringent terms and hidden fees, making them a predatory trap.

To protect yourself from such situations, explore safer loan alternatives available in Dallas. Direct deposit loans from reputable lenders offer transparent terms, lower interest rates, and flexible repayment plans. These options ensure you keep your assets secure and provide a more stable financial solution in the long term.

Dallas residents can protect themselves from predatory lending practices by being informed and choosing safe loan options. When considering a Dallas car title loan, understanding the potential risks and knowing how to spot red flags is crucial. By exploring alternative, secure loan opportunities, individuals can avoid falling into cycles of debt created by high-interest rates and harsh terms often associated with these loans. Making informed decisions empowers residents to maintain financial stability and control over their assets.