Applying for a Texas title loan involves meeting minimum requirements, including proof of identity, residency, vehicle ownership, and details about the vehicle. These factors determine loan amounts and repayment terms. Ensuring all necessary documents are ready expedites the process, making it easier to access emergency funding or consolidate debt using your vehicle as collateral.

Looking to secure a Texas title loan but unsure where to start? This guide breaks down the process, focusing on meeting the state’s minimum requirements effortlessly. We’ll explore the fundamentals of Texas title loans, the identity and eligibility verification process, and the essential documents needed. By understanding these key steps, you’ll be well-prepared to navigate the application journey with confidence.

- Understanding Texas Title Loan Basics

- Verifying Your Identity and Eligibility

- Providing Necessary Documentation

Understanding Texas Title Loan Basics

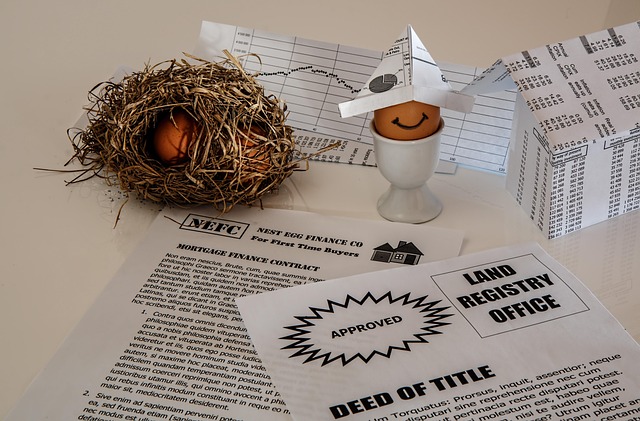

In Texas, a title loan is a type of short-term lending that uses a vehicle’s title as collateral. It’s designed to provide quick access to cash for borrowers who need emergency funding or a fast financial solution. Unlike traditional loans, these are often easier to qualify for, with less stringent requirements. The process involves borrowing against the value of your vehicle, typically with terms ranging from 30 days to a year. Lenders verify your ownership of the vehicle and assess its market value before approving the loan amount.

Understanding how Texas title loan minimum requirements work is crucial when considering this option for debt consolidation or other financial needs. Lenders will evaluate factors like your vehicle’s make, model, year, condition, and remaining mileage to determine the loan-to-value ratio. While there isn’t a universal minimum requirement, borrowers generally need to own their vehicle free and clear, have a valid driver’s license, proof of income, and a stable source of repayment to increase their chances of approval for an amount that aligns with their emergency funding needs.

Verifying Your Identity and Eligibility

When applying for a Texas title loan, verifying your identity and eligibility is a crucial step. Lenders will require specific documents to confirm your age, residential status, and creditworthiness. The process involves providing government-issued ID, such as a driver’s license or passport, to prove your identity. Additionally, lenders often ask for proof of income, employment details, and a valid vehicle registration to ensure you meet the Texas title loan minimum requirements. These documents are essential in establishing your eligibility for the loan, especially when considering debt consolidation options using your vehicle as collateral.

In San Antonio Loans, understanding these requirements is key to a smooth application process. Lenders assess factors like your ability to repay the loan and the value of your vehicle to determine the amount you can borrow. Proper documentation ensures that you don’t miss out on accessing funds for emergencies or other financial needs due to technicalities related to identity verification. Remember, meeting these minimum requirements is just the first step; lenders will also evaluate your credit history and overall debt-to-income ratio as part of their decision-making process.

Providing Necessary Documentation

When applying for a Texas title loan, one of the most important steps is to gather and provide all the necessary documentation. This process ensures that lenders can accurately assess your application and verify your eligibility based on the state’s minimum requirements. Key documents include proof of identity (such as a driver’s license or state ID), proof of residency, and verification of vehicle ownership. It’s crucial to have these ready before applying, as they streamline the approval process significantly.

Additionally, lenders will require details about your vehicle, including its make, model, year, and overall condition. This information contributes to what is known as a Vehicle Valuation, which plays a role in determining both the loan amount you may qualify for and the length of your repayment period. With quick funding often one of the main attractions of title pawn services, ensuring your application includes all necessary documentation can help expedite this process, getting you the funds you need promptly.

Meeting the Texas title loan minimum requirements is a straightforward process, offering a convenient solution for short-term financial needs. By understanding the basic principles of these loans, verifying your identity and eligibility, and providing the necessary documentation, you can access much-needed funds quickly. This approach ensures a smooth experience while adhering to the state’s regulations, making it an effective strategy for managing unexpected expenses.