Understanding Texas title loan fees explained, including origination charges, processing fees, late penalties, and higher interest rates due to bad credit, is crucial for making informed borrowing decisions. Houston Title Loans transparently reveals these costs, which should be carefully reviewed alongside loan terms before agreeing to any Texas title loan agreement.

In the competitive landscape of Texas finance, understanding title loan fees is paramount for borrowers. This article delves into the intricate breakdown of Texas title loan origination fees, providing clarity on costs that can significantly impact borrowing decisions. We explore different types of charges and their implications, equipping folks with knowledge to navigate this unique lending sector effectively. By dissecting these fees, we empower Texans to make informed choices tailored to their financial needs.

- Understanding Texas Title Loan Fees

- Types of Origination Charges Explained

- How These Fees Impact Borrowing Decisions

Understanding Texas Title Loan Fees

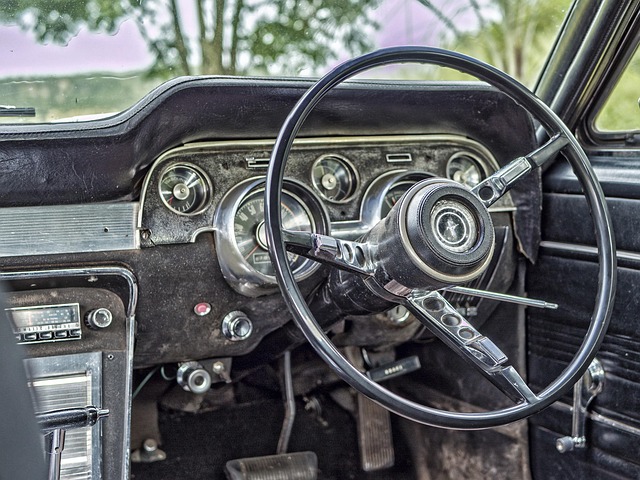

In the realm of Texas title loans, understanding the fee breakdown is crucial for borrowers seeking a quick financial solution. These loans, often referred to as car title loans, offer a unique approach to accessing cash by using your vehicle’s title as collateral. The process involves several charges, each serving a specific purpose, which can vary depending on lenders and loan terms. One of the primary concerns for borrowers is the origination fee, a one-time charge that covers administrative costs associated with setting up the loan. This fee varies among lenders but typically represents a small percentage of the overall loan amount.

Houston Title Loans, a popular option for those with bad credit or urgent financial needs, may include additional charges like processing fees and late payment penalties. Bad credit loans, by nature, often come with higher interest rates, which can impact the overall cost of borrowing. It’s important to consider these fees in relation to the loan terms and repayment schedule. Direct deposit, a convenient feature for many borrowers, might also incur small fees from the lender or third-party service providers. As with any loan, transparency is key; borrowers should thoroughly review all associated charges before finalizing a Texas title loan agreement.

Types of Origination Charges Explained

When considering a Texas title loan, understanding the various origination charges is paramount to making an informed decision. These fees encompass a range of services and costs associated with processing and securing your loan. Origination charges typically include application fees, credit check expenses, and documentation preparation costs. These fees vary across lenders but are designed to cover the administrative tasks involved in facilitating the loan process.

Different types of origination charges can be broken down further. For instance, some lenders may charge a one-time processing fee, which covers the initial assessment and paperwork. There might also be interest rates, expressed as a percentage of the loan amount, that contribute to the overall cost. Additionally, Texas title loan fees may include mandatory insurance costs, ensuring the protection of both the lender and the borrower’s asset. These charges are essential components of the loan agreement, offering financial assistance for immediate needs while ensuring the security of the transaction.

How These Fees Impact Borrowing Decisions

Understanding Texas title loan fees is crucial when considering short-term borrowing options. These fees can significantly impact a borrower’s decision, especially in challenging financial situations where emergency funding is needed. One common fee associated with San Antonio loans is the origination charge, which is typically a percentage of the loaned amount and serves as compensation for processing the title loan. This fee is often non-negotiable and is added to the overall cost of borrowing.

When facing financial emergencies, individuals may rely on title loans as a quick solution. However, it’s essential to be aware that these fees can accumulate, making the already high-interest rate even more burdensome. A thorough understanding of Texas title loan fees explained can empower borrowers to make informed choices, ensuring they receive the necessary emergency funding without being caught in a cycle of escalating costs.

In understanding Texas title loan fees, borrowers can make informed decisions about their borrowing options. By recognizing the various types of origination charges and their impact, individuals can navigate the market effectively. This knowledge empowers folks to choose loans that align with their financial needs while managing debt responsibilities responsibly. When considering a Texas title loan, it’s crucial to grasp these fee breakdowns to ensure a suitable and sustainable borrowing experience.