Car title loan default statistics vary by state, lender practices, and borrower demographics, with Dallas showcasing unique trends. Factors like income, credit history, and vehicle value assessments significantly impact eligibility and risk. High-risk borrowers face higher defaults due to lower incomes or poor credit. Secured/unsecured loans have distinct patterns, and emergency funding needs influence repayment. Lenders analyze product offerings and eligibility based on these insights. Nuances in loan features, such as inspection standards and refinancing options, further affect default rates, crucial for informed decisions.

Car title loans, a popular short-term financing option, have gained attention due to their high default rates. This article delves into the intricacies of car title loan default statistics, offering a comprehensive understanding of this concern. We explore how these rates are calculated and what factors significantly influence them. Furthermore, we provide an in-depth comparison of various car title loan products, helping borrowers make informed decisions by analyzing key differences in default probabilities.

- Understanding Default Rates in Car Title Loans

- Analyzing Factors Influencing Default Statistics

- Comparing Loan Products: A Detailed Breakdown

Understanding Default Rates in Car Title Loans

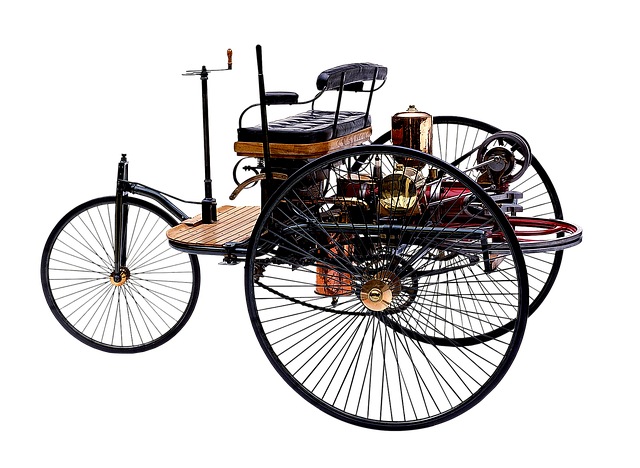

Default rates in car title loans represent the percentage of borrowers who fail to repay their loans according to the agreed-upon terms. These statistics are crucial for understanding the financial risks associated with this type of lending. When a borrower defaults, the lender has the legal right to seize and sell the secured asset—in this case, the borrower’s vehicle. Car title loan default statistics can vary significantly depending on various factors, including state regulations, lender practices, and borrower demographics.

In Dallas, for instance, where fast cash is often sought after, the default rates on Dallas title loans have sparked interest among both lenders and borrowers. Loan eligibility criteria play a significant role in determining default risks. Lenders assess factors such as income, credit history, and vehicle value to gauge a borrower’s ability to repay. However, these loans are known for their relatively lenient qualification standards, making them accessible to a broader range of individuals, but potentially increasing the likelihood of defaults. Understanding car title loan default statistics is essential for borrowers seeking fast cash solutions to make informed decisions regarding loan eligibility and repayment terms.

Analyzing Factors Influencing Default Statistics

Several factors significantly influence car title loan default statistics, making it essential to understand these dynamics for accurate comparisons. Lenders must consider borrower demographics and financial health since these play a crucial role in determining repayment abilities. For instance, higher-risk borrowers with lower incomes or poor credit scores are more likely to default, impacting overall default rates.

Additionally, the availability of various repayment options matters. Secured loans, backed by collateral like a vehicle, often have different default patterns compared to unsecured loans. Emergency funding needs can also drive default statistics; borrowers may struggle to meet obligations if unexpected circumstances arise, affecting their ability to repay on time. Understanding these factors allows for a nuanced analysis of car title loan default rates and aids in making informed decisions regarding product offerings and borrower eligibility.

Comparing Loan Products: A Detailed Breakdown

When comparing car title loan default statistics across different products, it’s crucial to look beyond initial interest rates and terms. While seemingly straightforward, a closer examination reveals intricate variations that can significantly impact borrower outcomes. Each loan product has its unique set of features and conditions, affecting the likelihood of default. For instance, while some lenders offer quick approval processes, these same loans might have stringent requirements for vehicle inspection, leading to higher default rates among borrowers whose vehicles don’t meet specifications.

A detailed breakdown would show that factors like flexibility in loan refinancing options can also play a pivotal role. Loans allowing for easy refinancing during unforeseen financial hardships tend to exhibit lower default statistics because they provide borrowers with a safety net. Conversely, rigid refinancing policies can push borrowers into default if they lack the means to repay on time. Ultimately, understanding these nuances is key to making informed decisions and mitigating risks associated with car title loans.

Car title loan default rates vary significantly based on product type, borrower demographics, and interest rates. By understanding these factors, borrowers can make informed decisions to mitigate risk and avoid costly defaults. Navigating car title loan options with a keen awareness of default statistics is crucial for both lenders and consumers alike, ensuring responsible borrowing and lending practices in the ever-evolving landscape of short-term financing.