A title loan on a paid-off car offers quick funding using vehicle equity, accessible to those with bad credit but carries repossession risk if payments are late. These loans have simplified terms, no interest charges, and streamlined applications, making them attractive for financial relief. Strategic planning, assessing financial health, understanding lender appraisals, avoiding high loan-to-value ratios, and ethical practices, plus open communication with lenders, are key to managing these loans responsibly.

A title loan using a paid-off car as collateral can be a strategic financial move, offering unique benefits for those seeking short-term funding. This article delves into the world of title loans, exploring how owning a vehicle free and clear can provide access to quick cash with minimal hassle. We’ll discuss the advantages, including fast approval processes, flexible terms, and the preservation of your vehicle. Additionally, we’ll guide you through repayment strategies to ensure a smooth experience while highlighting potential risks to avoid.

- Understanding Title Loans: An Overview

- Benefits of Using a Paid-Off Car for Collateral

- Strategies to Ensure Repayment and Avoid Risks

Understanding Title Loans: An Overview

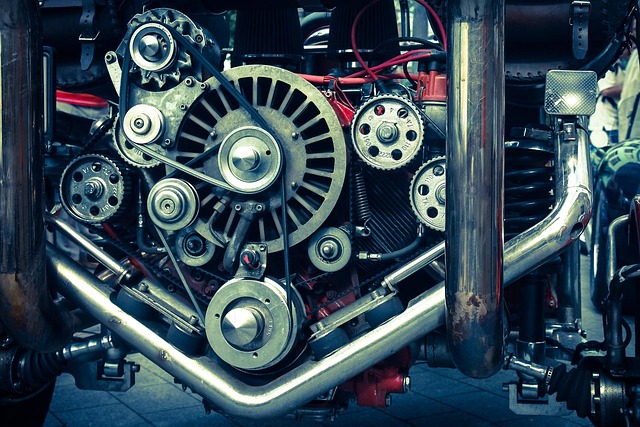

A Title loan on a paid-off car is a financial instrument that allows car owners to leverage their vehicle’s equity for short-term funding. This type of loan uses the car’s title as collateral, which means the lender has the right to seize the vehicle if the borrower defaults on payments. However, so long as the borrower makes timely Flexible Payments, they retain possession of their vehicle. The process typically involves a quick Vehicle Inspection to determine the car’s value and ensure it meets the lender’s standards. This makes Title loans an attractive option for those with Bad Credit Loans who need rapid access to cash without disrupting their primary mode of transportation.

Understanding how Title loans work is crucial when considering this financial strategy. Unlike traditional loans that require extensive documentation and a thorough credit check, Title loans focus primarily on the vehicle’s value rather than the borrower’s credit history. This makes them accessible to a broader range of individuals who may not qualify for other types of financing. However, it’s essential to approach Title loans cautiously, as late or missed payments can lead to repossession and significant financial consequences.

Benefits of Using a Paid-Off Car for Collateral

Using a paid-off car as collateral for a title loan can offer several advantages to borrowers. One of the primary benefits is the absence of interest charges, which can significantly reduce overall borrowing costs compared to traditional loans. Since the vehicle is already owned outright, there’s no need to worry about additional payments or fees related to ownership – just the structured repayment of the loan amount. This makes it an attractive option for individuals seeking financial relief without burdening themselves with extra expenses.

Additionally, a title loan secured by a paid-off car often comes with more flexible payment terms. Lenders may allow borrowers to spread out repayments over a longer period, easing the financial strain and making it easier to manage cash flow. The process of obtaining such a loan is also relatively straightforward, as there’s no need for a credit check – a common requirement in many other borrowing scenarios. This makes it an accessible option for those with less-than-perfect credit histories or who prefer alternative financing solutions. Furthermore, once the loan is repaid, the title transfer process can be swift and efficient, allowing borrowers to regain full ownership of their vehicle without any legal complications.

Strategies to Ensure Repayment and Avoid Risks

When considering a title loan on a paid-off car, it’s crucial to implement strategies that ensure timely repayment and mitigate associated risks. One key step is to accurately assess your financial situation before applying for a loan. This involves evaluating your income, ongoing expenses, and other debts to determine if the loan amount is feasible for you to repay without causing significant strain on your budget.

Additionally, understanding the vehicle valuation process is essential. Dallas title loans, for instance, involve assessing the market value of your car. You can protect yourself by obtaining a fair appraisal from reputable lenders who consider not just the make and model but also the vehicle’s condition and current market trends. Avoiding lending institutions with questionable practices or those that offer disproportionately high loan-to-value ratios is also wise to prevent falling into a cycle of debt. Regular communication with your lender about repayment progress, along with adhering to agreed-upon terms, can help ensure a smooth process and avoid the risks associated with title loans on paid-off cars.

A title loan using a paid-off car as collateral can be a strategic financial decision, offering benefits like access to quick funds without disrupting your vehicle’s ownership. By understanding title loans, leveraging the advantages of an already paid-off asset, and implementing repayment strategies, you can navigate this option with confidence. Remember, responsible borrowing and careful planning are key to ensuring a positive experience when considering a title loan on your paid-off car.