Immigrant workers facing financial challenges due to legal status and limited access to traditional banking services can turn to car title loans with ITIN as a viable solution. Using their vehicle equity, these loans offer competitive rates, flexible payment plans, and bad credit acceptance, while allowing immigrants to retain their vehicles. An Individual Taxpayer Identification Number (ITIN) enables them to participate in the U.S. tax system and access this alternative financing method. This option has gained popularity in cities with significant immigrant populations like Dallas and Fort Worth for its accessibility, swift funding, and reasonable interest rates.

“In a landscape where undocumented immigrants often face financial barriers, Car Title Loans with Individual Taxpayer Identification Number (ITIN) emerge as a game-changer. This article explores why these loans are increasingly appealing to immigrant workers. By circumventing the need for Social Security Numbers, ITIN car title loans offer faster approval, competitive interest rates, and flexible terms—addressing key challenges in accessing traditional financing. We’ll delve into how this option empowers workers, provides crucial financial support, and even helps build credit history.”

- Understanding ITIN and Its Significance for Immigrant Workers

- – Definition of Individual Taxpayer Identification Number (ITIN)

- – Challenges faced by undocumented immigrants in accessing traditional loans

Understanding ITIN and Its Significance for Immigrant Workers

Immigrant workers often face unique financial challenges due to their legal status and limited access to traditional banking services. This is where Individual Taxpayer Identification Number (ITIN) car title loans step in as a viable solution. ITIN, issued by the IRS for those not eligible for a Social Security number, allows immigrant individuals to access much-needed funds using their vehicle’s equity.

By utilizing an ITIN for a car title loan, these workers can secure competitive rates and flexible payment plans, even with bad credit. This alternative financing method enables them to keep their vehicles, a significant aspect of their daily lives and transportation, while accessing the financial support needed to cover emergencies, medical bills, or other essential expenses.

– Definition of Individual Taxpayer Identification Number (ITIN)

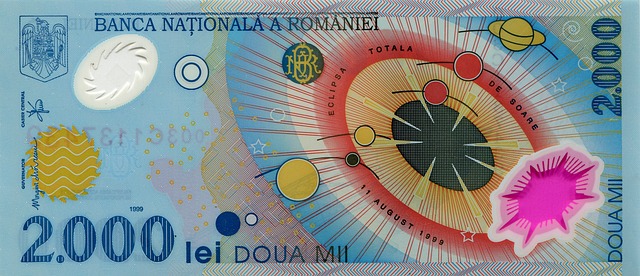

The Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service (IRS) to individuals who do not have, and are not eligible to obtain, a Social Security Number (SSN). This identifier is often used by non-citizen immigrants who are required to file U.S. taxes but don’t meet the SSN eligibility criteria. ITINs play a significant role in facilitating financial transactions for immigrant workers, particularly when it comes to securing loans.

For those seeking car title loans, an ITIN can open doors that might otherwise remain closed. In cities like Dallas, where a vibrant immigrant community thrives, ITIN-based car title loans offer accessible and quick funding options for individuals who need cash for various purposes, such as debt consolidation or direct deposit into their bank accounts. This alternative financing method has gained popularity due to its ease of access, especially when compared to traditional loan options that might require more extensive documentation and strict credit criteria.

– Challenges faced by undocumented immigrants in accessing traditional loans

Undocumented immigrants often face significant barriers when attempting to secure traditional loans from banks or financial institutions. One of the primary challenges is the lack of documentation required for verification, as they may not have legal identification or proof of income due to their immigration status. This exclusion from mainstream financing limits their access to capital for essential needs and opportunities. Many immigrants find themselves trapped in cycles of financial hardship, making it difficult to invest in education, start a business, or even purchase a home.

Car title loans with ITIN (Individual Taxpayer Identification Number) offer an alternative solution for these individuals. This type of loan allows borrowers to use their vehicle’s registration and title as collateral, eliminating the need for extensive documentation. In Fort Worth Loans, for example, where a significant population consists of undocumented immigrants, this option has gained popularity due to its accessibility and flexibility. Keep Your Vehicle during the loan period, and with reasonable interest rates compared to other short-term financing options, car title loans provide a viable way for immigrant workers to access much-needed funds without the usual hurdles.

For immigrant workers facing financial challenges, car title loans with ITIN offer a unique and appealing solution. By providing an alternative to conventional lending methods, these loans bridge the gap for those who may struggle to obtain traditional bank financing due to immigration status or inadequate credit history. With ITIN as a valid form of identification, immigrants can access much-needed capital quickly, making car title loans a reliable option for managing emergencies and securing better financial futures.