Understanding title loan maximum terms is vital for borrowers to avoid predatory lending and over-indebtedness. Factors like vehicle valuation determine these limits, influencing repayment options. Adhering to set terms, as seen in Houston and Fort Worth, ensures fair practices and prevents financial strain from extended loans.

Title loans, a quick source of cash secured by your vehicle, come with strict maximum term limits. This article delves into these limitations, breaking down key considerations that influence lender decisions. From creditworthiness to loan amount, we explore factors shaping title loan terms. Additionally, we offer best practices for borrowers, ensuring responsible financial decisions within these constraints. Understanding these maximum terms is vital for navigating this alternative financing option effectively.

- Understanding Title Loan Maximum Terms Limits

- Factors Influencing Title Loan Term Decisions

- Best Practices for Borrowing Within Maximum Terms

Understanding Title Loan Maximum Terms Limits

Understanding Title Loan Maximum Terms Limits plays a pivotal role in ensuring consumers make informed decisions. These limits are set by regulatory bodies to safeguard borrowers from predatory lending practices, focusing on reasonable loan amounts relative to the value of their vehicles, often used as collateral. The primary goal is to balance access to short-term funding with borrower protection, preventing over-indebtedness.

Key factors influencing these maximum terms include state laws and the overall health of the economy. For instance, in the case of Truck Title Loans, where commercial vehicles are used as collateral, lenders must consider the current market value of the truck. This ensures that the loan amount doesn’t exceed a certain percentage of the vehicle’s appraisal value, offering borrowers a fair deal and multiple repayment options. Understanding these limits is crucial when exploring various repayment options, allowing individuals to choose plans tailored to their financial capabilities without being burdened by excessive debt.

Factors Influencing Title Loan Term Decisions

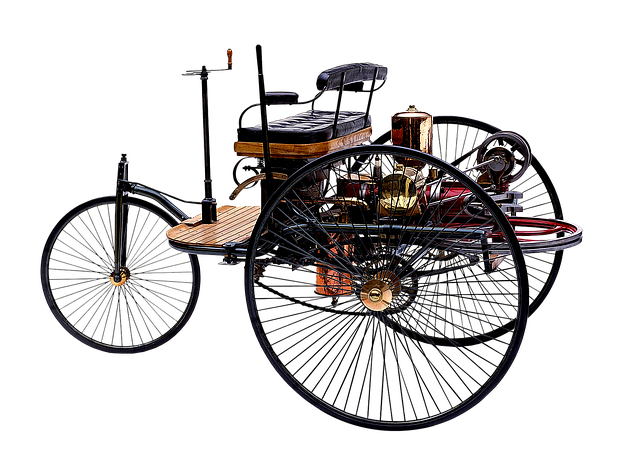

When it comes to determining the maximum term for a title loan, several factors come into play. Lenders carefully consider the value of the vehicle being used as collateral, often referred to as the vehicle valuation. This assessment is crucial in setting the borrowing limit and the overall repayment terms. A higher valued vehicle may allow for a longer loan term and potentially lower monthly installments, making it more feasible for borrowers.

Additionally, the quick approval process is another key aspect that influences term decisions. Boat title loans, for instance, can be approved swiftly due to their specialized nature, offering borrowers immediate access to funds. This speed does not compromise security; instead, it enables individuals in urgent need of cash to navigate financial challenges more efficiently. The lender will still conduct necessary checks and assess the vehicle’s worth, but the approval time is significantly shorter than traditional loan methods, thus impacting the overall term and repayment structure.

Best Practices for Borrowing Within Maximum Terms

When it comes to borrowing against your vehicle’s title, adhering to the established Houston Title Loans maximum terms is non-negotiable. These limits are designed to protect both lenders and borrowers by ensuring fair practices and preventing debt spirals. A best practice for borrowers is to borrow only what they absolutely need and can comfortably repay within the stipulated time frame. For instance, instead of opting for a large cash advance, consider taking out a smaller Fort Worth Loans amount that aligns with your immediate financial needs.

Extending loan terms beyond the maximum limit can lead to accumulating interest and fees, making it challenging to pay off the debt promptly. Borrowers should aim to settle their title loans within the set period to avoid these pitfalls. Regular budgeting and prioritizing repayment can help ensure timely debt liquidation, allowing you to regain control of your financial situation without facing any penalties for exceeding title loan maximum terms.

Experts agree that understanding and adhering to title loan maximum term limits is crucial for borrowers. By recognizing factors influencing these decisions, individuals can make informed choices and access short-term funding within safe and responsible parameters. Following best practices ensures a smooth borrowing experience while managing potential risks associated with extended loans. Remember, staying within the set limits fosters financial health and safeguards against overwhelming debt.