Sweetwater Title Loans offer quick and flexible funding options using your vehicle as collateral. To apply, individuals aged 18+ need valid ID, steady income proof, and detailed vehicle information. Essential documents for loan eligibility include identity, income verification, insurance, social security card, references, and existing loans. After submitting these, applicants can expect a swift review process with potential funding within days using their vehicle's equity. Sweetwater prioritises transparency, addressing any issues promptly.

“Uncovering the key requirements for securing Sweetwater title loans has never been easier. This comprehensive guide breaks down the essential documents needed, ensuring a seamless application process. From eligibility criteria to post-submission steps, we demystify every aspect. Whether you’re a first-time borrower or looking for a refresh, understanding what Sweetwater title loans demand is crucial. Equip yourself with knowledge and navigate the loan landscape confidently.”

- Eligibility Criteria for Sweetwater Title Loans

- Required Documentation for Loan Application

- What Happens After Submitting the Necessary Documents?

Eligibility Criteria for Sweetwater Title Loans

To be eligible for Sweetwater Title Loans, borrowers must meet certain criteria set by the lender. Firstly, applicants should be at least 18 years old and possess a valid government-issued ID to establish their age and identity. Additionally, a minimum steady income is required to ensure repayment capability. This can include employment records, salary stubs, or other proof of income sources.

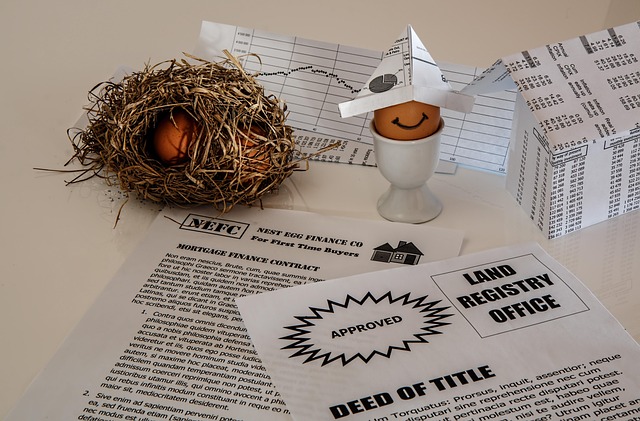

Sweetwater Title Loans offer a financial solution for individuals who need quick access to cash. The process involves using an asset, typically a vehicle, as collateral for the loan. Unlike traditional loans, these titles loans often have flexible requirements and faster approval times due to the direct security interest in the vehicle’s title. Borrowers should be prepared to provide details about their vehicle, including its make, model, year, and overall condition, as well as the current mileage. This information helps in assessing the vehicle’s value for loan purposes, and it also facilitates the title transfer process if a loan extension or early repayment is not possible.

Required Documentation for Loan Application

When applying for Sweetwater title loans, having the right documentation is key to a smooth and efficient process. Lenders will require specific documents to assess loan eligibility and ensure both parties are protected. Firstly, you’ll need proof of identity, such as a valid driver’s license or state-issued ID, to establish your personal information. Additionally, income verification is essential; this can be in the form of pay stubs, tax returns, or bank statements showing consistent employment and earnings.

For financial assistance, lenders often ask for vehicle registration documents and proof of insurance to keep your vehicle secure throughout the loan period. Other important papers may include a social security number (SSN) card, a list of references, and any existing loan agreements or debts you might have. Ensuring you have these documents ready demonstrates your commitment to the process and increases your loan eligibility chances.

What Happens After Submitting the Necessary Documents?

After submitting all the required documents for Sweetwater Title Loans, applicants can expect a swift review process. The team at Sweetwater will carefully assess every piece of information provided to ensure accuracy and eligibility. This step is crucial in determining the next course of action, especially when it comes to approval or any additional requirements.

Once the evaluation is complete, borrowers will be notified regarding their loan status. If approved, Fort Worth Loans can provide access to funds quickly, often within a short timeframe. The process involves using the vehicle equity as collateral, allowing for a streamlined and efficient way to secure emergency funding. Alternatively, if there are any discrepancies or further questions, Sweetwater may request additional documents or clarifications before making a decision, ensuring a transparent experience with minimal delays.

When applying for Sweetwater title loans, understanding what documents are required is essential for a smooth process. By providing all necessary paperwork, including identification, vehicle details, and proof of income, borrowers can navigate the application efficiently. Once submitted, lenders will assess the information, ensuring compliance with eligibility criteria, before moving forward with approval or denial. This streamlined approach allows folks seeking financial support to access the funds they need promptly.