Texas title loan verification process for self-employed individuals emphasizes robust income and employment verification through tax returns, bank statements, and business documents. Lenders assess repayment ability based on these records, offering flexible extensions and payment options tailored to freelance work's unpredictability. Properly organized financial documentation streamlines the process, ensuring faster approval and access to same-day funding.

In the competitive landscape of Texas, self-employed individuals often face unique challenges when applying for title loans. This article delves into the intricate details of the Texas title loan verification process specifically tailored for self-employed applicants. We explore critical aspects such as understanding state requirements, documenting income and employment, and the significant role bank statements play in ensuring a robust application. By navigating these factors, aspiring borrowers can enhance their chances of securing needed financial assistance.

- Understanding Texas Title Loan Requirements for Self-Employed

- Documenting Income and Employment for Verification

- The Role of Bank Statements in Title Loan Applications

Understanding Texas Title Loan Requirements for Self-Employed

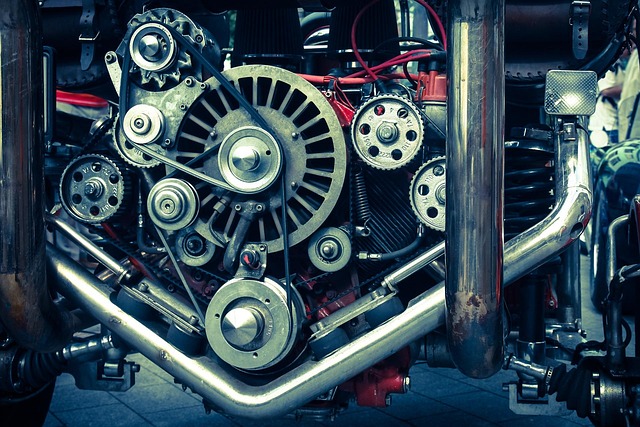

In Texas, the process for obtaining a title loan is well-regulated to protect both lenders and borrowers, especially when it comes to self-employed applicants. Understanding these requirements is crucial for those seeking financial assistance through Fort Worth loans. One of the key aspects is the need for robust verification of employment and income. For self-employed individuals, this may involve providing tax returns, business registration documents, and other proof of revenue streams. The state’s regulations ensure that lenders accurately assess an applicant’s ability to repay the loan, which is a vital part of the Texas title loan verification process.

Additionally, the flexibility offered by loan extensions and the option for flexible payments are significant advantages for self-employed borrowers. Given the unpredictable nature of freelance work, these options allow individuals to manage their repayments according to their income patterns. Whether it’s a sudden dip in business or seasonal fluctuations, Fort Worth loans with flexible terms can help self-employed Texans maintain financial stability during challenging periods.

Documenting Income and Employment for Verification

When applying for a Texas title loan as a self-employed individual, documenting income and employment is a crucial step in the verification process. Lenders require evidence to ensure borrowers can repay the loan, which often involves providing financial records and employment details. This may include tax returns, bank statements, pay stubs, or other official documents that showcase your earnings and job stability. As self-employed applicants, it’s essential to organize these documents meticulously, as they play a significant role in navigating the Texas title loan verification process.

During this stage, lenders might also request a vehicle inspection to assess the condition of the collateral (usually the applicant’s car). This step is part of the due diligence process, ensuring that the title transfer and subsequent cash advance are secure. By providing accurate and complete documentation, self-employed borrowers can increase their chances of a smoother loan verification and approval process.

The Role of Bank Statements in Title Loan Applications

In the Texas title loan verification process, bank statements play a pivotal role for self-employed applicants. These financial records provide a clear picture of an applicant’s income and cash flow patterns, which are essential considerations in assessing their ability to repay the loan. Lenders carefully review recent bank statements to ensure accuracy and stability, as this is one of the few tangible ways to verify self-employment income without traditional payroll records.

Unlike other loan types that often require a credit check, Texas title loans are known for offering “no credit check” options, making them accessible to a broader range of applicants. Bank statements fill this gap by serving as credible documentation of financial health. Moreover, the streamlined verification process allows for same-day funding, providing quick access to cash when immediate financial support is needed.

In navigating the Texas title loan verification process, especially for self-employed applicants, a thorough understanding of income documentation and employment verification is key. By compiling detailed bank statements as part of their application, borrowers can facilitate a smoother process. This ensures that lenders can accurately assess financial stability, making the Texas title loan verification more accessible and efficient.