This text explains the factors influencing Texas title loan costs, emphasizing interest rates, repayment terms, and lender fees. It offers strategies to optimize and reduce these fees by comparing offers, maintaining a good credit score, choosing shorter loan terms, and understanding early repayment penalties. Key focus: Texas title loan fees explained.

In the state of Texas, understanding the intricate web of title loan fees is paramount for borrowers seeking financial solutions. This comprehensive guide deciphers the complexities of Texas title loan fees, offering a transparent view of costs. We explore the factors influencing these fees and equip readers with strategies to optimize their loan terms. Get a clear picture of what you’ll pay and how to manage your expenses effectively with our insightful breakdown of Texas title loan fees explained.

- Understanding Texas Title Loan Fees: A Breakdown

- Factors Influencing Title Loan Cost in Texas

- Strategies to Optimize and Reduce Fees

Understanding Texas Title Loan Fees: A Breakdown

Understanding Texas Title Loan Fees: A Breakdown

In the state of Texas, title loans have emerged as a popular option for individuals seeking quick financial assistance. These loans are secured against the title of a vehicle, making them an attractive alternative to traditional banking options. The beauty of Texas title loans lies in their accessibility and speed—with many lenders offering quick approval processes, applicants can secure funds within hours. However, it’s essential to understand that these loans come with specific fee structures that can impact the overall cost.

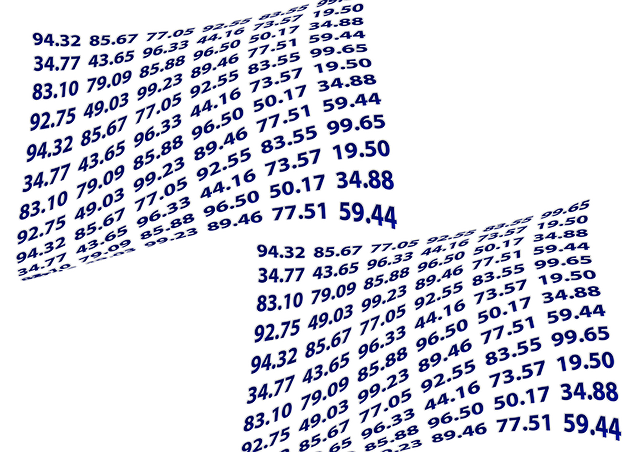

The fee structure for Texas title loan services typically includes an interest rate, a documentation fee, and various other administrative charges. Interest rates vary among lenders but are often calculated as a percentage of the loan amount. Documentation fees cover the costs associated with processing the loan application and securing the necessary paperwork. Additionally, some lenders may offer payment plans to make repayment more manageable, allowing borrowers to spread out their payments over several months. This flexibility can be beneficial for those needing immediate financial relief without being burdened by high-pressure repayment terms.

Factors Influencing Title Loan Cost in Texas

Several factors determine the cost of a Texas title loan, offering borrowers a clearer understanding of their financial obligations. These include the loan amount requested, which directly impacts the overall fee structure. Higher loan sums typically result in larger fees and interest charges. Interest rates play a pivotal role as well; they can vary among lenders and are often tied to the borrower’s creditworthiness. A good credit score usually secures lower rates, while less favorable scores might lead to higher-priced loans.

The term of repayment is another critical aspect. Texas title loans often come with flexible payment plans, allowing borrowers to distribute their payments over extended periods. However, longer terms mean paying more interest over time. Additionally, the lender’s fees and charges, such as application processing costs and administrative fees, contribute to the total cost. These fees can be influenced by the borrower’s ability to provide collateral, the type of vehicle used as security, and any additional services offered by the lending institution.

Strategies to Optimize and Reduce Fees

When it comes to Texas title loan fees, understanding how to optimize and reduce these costs is crucial for borrowers. One effective strategy is to shop around and compare offers from different lenders. Texas title loans are regulated, so borrowers have the right to access transparent fee structures. By comparing rates, terms, and conditions, you can identify the most affordable option that aligns with your needs. Additionally, maintaining a good credit score can lead to better interest rates and lower fees over time.

Another approach to keep Texas title loan fees in check is by opting for a shorter loan term. While Quick Approval processes may be enticing, borrowing for a longer period means paying more in interest and fees. Keep Your Vehicle during the repayment period, as this can help avoid unnecessary hidden costs. Additionally, being mindful of early repayment penalties (if any) can further reduce overall expenses.

Understanding the intricate details of Texas title loan fees is a powerful tool for borrowers. By recognizing how these fees are calculated and the factors that influence them, individuals can make informed decisions and optimize their financial strategies. The article has provided a comprehensive overview, allowing readers to navigate this process with confidence. Remember, when considering a Texas title loan, being fee-conscious can significantly impact your overall experience and savings.