Car title loans are a popular source of emergency funding in underserved markets where traditional finance is limited. However, these loans come with high interest rates and variable terms due to factors like risk assessments, competition, and borrowers' financial literacy. Borrowers should carefully compare offers, understand the loan process, and consider alternatives to avoid debt traps.

In many underserved communities, car title loans have emerged as a significant source of quick cash. However, these high-interest lending practices often come with varying interest rates that differ starkly from more affluent regions. This article delves into the complex dynamics behind car title loan rates in underserved markets, exploring the unique challenges and factors that influence pricing. We analyze how these loans work, their broader impact on vulnerable populations, and the factors driving rate variations within these communities.

- Understanding Underserved Markets: Challenges and Factors

- Car Title Loans: How They Work and Their Impact

- Exploring Rate Variations in These Communities

Understanding Underserved Markets: Challenges and Factors

Underserved markets are characterized by regions or demographics that often lack access to traditional financial services and products due to various challenges. These markets typically face higher rates of poverty, unemployment, or underemployment, making it difficult for residents to secure loans from banks or credit unions. In such environments, car title loans have emerged as a source of emergency funds for many individuals in need of quick cash. However, the interest rates and terms offered by lenders in underserved markets can vary significantly.

Several factors contribute to these differences. Lenders assess risk differently when entering underserved areas; higher default rates and limited borrower creditworthiness may lead to more stringent lending criteria and consequently, higher loan refinancing costs. Additionally, competition among lenders is often lower in these regions, allowing them to set less competitive rates without facing substantial market disruption. The lack of financial literacy and negotiating power among borrowers also plays a role, making it harder for them to secure flexible payments or negotiate better terms.

Car Title Loans: How They Work and Their Impact

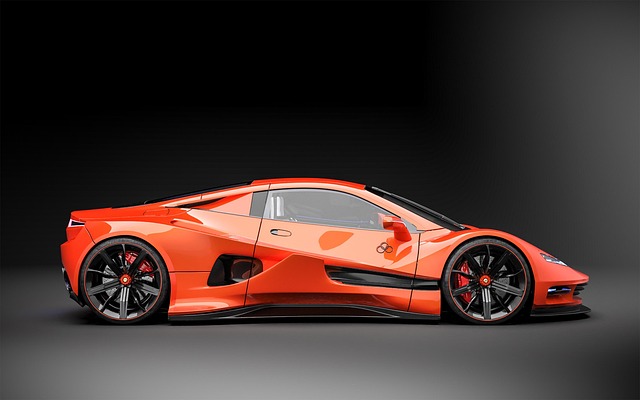

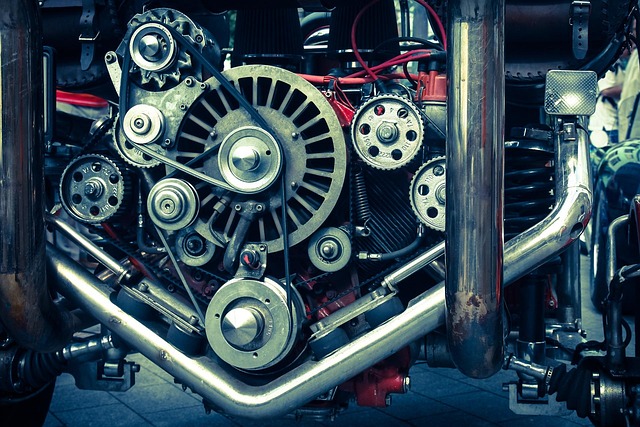

Car title loans are a unique financial tool designed to provide quick access to cash for individuals who own a vehicle. In underserved markets where traditional banking services might be limited, car title loans offer an alternative source of funding. Here’s how they work: borrowers use their vehicle’s title as collateral, allowing lenders to retain ownership until the loan is repaid. This type of loan is particularly attractive in underserved communities due to its accessibility and relatively simple approval process.

These loans can have a significant impact on individuals and families seeking financial relief or emergency funds. However, it’s crucial to understand that car title loans often come with higher interest rates compared to conventional loans, which can lead to a cycle of debt if not managed properly. The Online Application process makes it easier for borrowers in underserved markets to apply, but it’s essential to compare loan offers and ensure the terms align with their ability to repay, avoiding potential financial strain.

Exploring Rate Variations in These Communities

In underserved markets, exploring car title loan rates reveals a complex landscape. These communities often experience higher interest rates compared to more affluent areas due to various economic and social factors. Lenders in these regions may factor in higher risk levels, limited financial resources among potential borrowers, and the general lack of competitive lending options when setting their rates. For instance, in cities like Dallas, where access to traditional banking services can be limited, Dallas Title Loans step in to fill the gap, offering short-term financing with varying rates based on vehicle equity.

Understanding the title loan process is crucial for borrowers in underserved markets. This involves assessing the value of a borrower’s vehicle, verifying their identity and income, and agreeing upon repayment terms. While these loans can provide quick cash solutions, it’s essential to be mindful of the associated fees and rates, ensuring that the terms are fair and within one’s budget. Borrowers should also consider alternatives like building credit through traditional banking or exploring community-based financial support programs to avoid falling into a cycle of high-interest debt.

In exploring how car title loan rates differ in underserved markets, it’s evident that these communities often face unique financial challenges. By understanding the interplay of local economic factors and lending practices, consumers can make informed decisions about their short-term borrowing options. Further research and transparent policies are necessary to ensure equitable access to credit in these areas, fostering financial stability and opportunities for growth.