Title loan customer testimonials are vital in today's financial landscape, offering transparent insights into loan terms and processes. These real-life accounts build trust, inform borrowers, and help lenders improve services, fostering a culture of transparency in the competitive Dallas market for emergency funding. Testimonials showcase the accessibility and ethical practices of title loans, positively impacting businesses and customers alike.

Uncovering the genuine experiences of title loan customers offers a unique window into lending transparency. These testimonials provide an authentic perspective on loan processes, terms, and conditions, shedding light on both positive and negative interactions. By delving into these real-life stories, we can gain insights into how lenders foster trust or face scrutiny. This article explores the power of customer voices, examining their role in shaping perceptions and transparency within the title loan industry.

- Uncovering Truths: Testimonials as a Window to Transparency

- Customer Voices: The Power of Authentic Experiences

- Building Trust: How Testimonials Shape Loan Perceptions

Uncovering Truths: Testimonials as a Window to Transparency

In the fast-paced world of finance, building trust is paramount, especially when it comes to complex transactions like title loans. Title loan customer testimonials serve as a powerful tool to uncover truths and foster transparency between lenders and borrowers. These authentic accounts offer insights into the realities of taking out and repaying such loans, shedding light on various aspects from initial interactions with lenders to the overall loan payoff experience.

By reading through these testimonials, potential borrowers can gain a clearer understanding of the loan terms, the application process, and even unexpected challenges encountered during the repayment period. These firsthand experiences highlight both the positive and negative elements of title loans, enabling consumers to make more informed decisions. Moreover, lenders can address concerns raised in the testimonials, continually improving their services and ensuring customer satisfaction, thus fostering a culture of transparency.

Customer Voices: The Power of Authentic Experiences

Customer testimonials are a powerful tool for any industry, but they hold especially significant weight when it comes to financial services, particularly in the realm of title loans. When potential borrowers read authentic experiences shared by their peers, it humanizes the loan process and fosters trust. These personal narratives provide a glimpse into the real-life impact of taking out a title loan, offering insights that numbers and statistics cannot match.

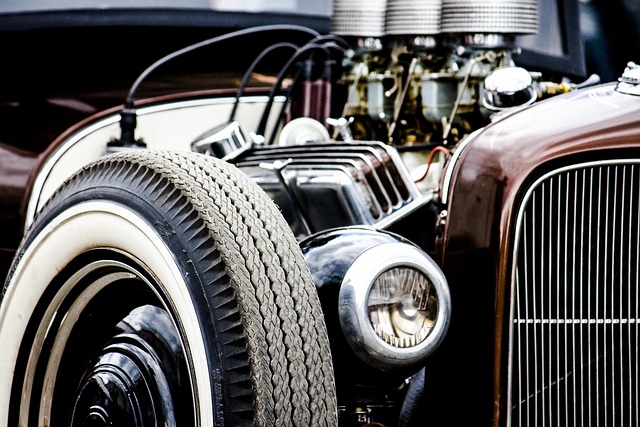

Each customer’s story is unique, reflecting their specific circumstances, challenges, and triumphs. For instance, some borrowers share how a cash advance using their vehicle collateral helped them during an unexpected financial crisis, while others rave about the convenience and speed of the loan approval process. These testimonials not only highlight the accessibility of title loans but also demonstrate how they can serve as a viable solution for various short-term financial needs, fostering transparency in the loan requirements and terms.

Building Trust: How Testimonials Shape Loan Perceptions

When it comes to financial services, building trust is paramount. Title loan customer testimonials serve as a powerful tool in this regard, shaping perceptions and fostering credibility among prospective borrowers. In the competitive world of Dallas Title Loans and emergency funding options, these real-life experiences can make or break a business. Each testimonial tells a story, offering insights into the loan process, interest rates, repayment terms, and customer service from lenders like Dallas Title Loans.

By reading about others’ positive encounters with refinancing options, potential borrowers gain a sense of security and transparency. These testimonials provide concrete examples of how efficient, ethical, and supportive lending practices can make a significant difference in times of financial need. As a result, customers are more inclined to trust the lender, leading to increased business and a loyal customer base.

Title loan customer testimonials serve as powerful tools for fostering transparency and building trust. By sharing authentic experiences, borrowers provide insights into the loan process, highlighting both positive aspects and potential challenges. This collective knowledge empowers prospective clients to make informed decisions, ensuring a more transparent lending environment. Through these testimonials, individuals can navigate the complexities of title loans with greater confidence, ultimately fostering a healthier financial ecosystem.