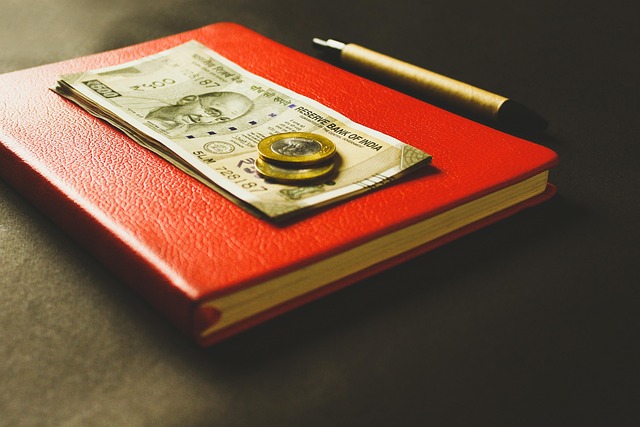

Title loan teacher discounts provide financial support to educators with urgent cash flow needs, offering same-day funding through streamlined title transfer processes. These discounts include reduced interest rates, faster approval, and access to funds for current loans, helping teachers manage unexpected costs and maintain financial stability while focusing on teaching.

“Teachers, the backbone of our society, often face unique financial challenges. Enter ‘Title Loan Teacher Discounts’—a game-changer in educator financial wellness. This article explores how these tailored discounts provide much-needed relief. We break down eligibility criteria and highlight the significant impact on teachers’ lives. Discover how this initiative supports their journey towards financial stability and overall well-being. Unlock the secrets to navigating this powerful tool for teachers seeking assistance.”

- Understanding Teacher Loan Discounts: Unlocking Financial Relief

- Eligibility Criteria: Who Qualifies for Title Loan Benefits?

- The Impact: Improved Wellness Through Financial Support

Understanding Teacher Loan Discounts: Unlocking Financial Relief

Understanding Title Loan Teacher Discounts: Unlocking Financial Relief for Educators

Teacher loan discounts are designed to offer much-needed financial relief to educators who often face unique challenges when it comes to managing their finances. These discounts, specific to title loans, provide a safety net for teachers seeking quick approval on short-term lending options. In the fast-paced world of education, where commitment and dedication demand constant attention, these discounts cater to urgent cash flow needs without compromising long-term financial stability.

With same-day funding made possible through streamlined title transfer processes, educators can access immediate financial support during unexpected expenses or economic downturns. This swift accessibility ensures teachers have the resources they need to focus on their primary role: imparting knowledge and shaping young minds. By leveraging these teacher loan discounts, educators can navigate financial hurdles with greater ease, allowing them to prioritize teaching and personal well-being.

Eligibility Criteria: Who Qualifies for Title Loan Benefits?

The eligibility criteria for teacher title loan discounts are designed to support educators in their financial journey. These benefits are typically open to full-time teachers and faculty members who work in public or private schools, colleges, or universities. To qualify, individuals must provide proof of employment, such as a valid contract or salary slip, demonstrating their status as educators. Additionally, lenders often require minimal credit history or a lower credit score, ensuring that even those with less-than-perfect financial records can access these discounts.

Teachers interested in availing of these perks should also be current on their loan repayments and maintain a good standing with their financial institutions. The process involves applying for a title loan, which includes assessing the value of the educator’s vehicle and determining the loan amount. Upon approval, teachers can enjoy discounted interest rates or reduced fees, making loan refinancing more viable. Loan approval is usually faster for qualified educators, providing them with access to much-needed funds in no time.

The Impact: Improved Wellness Through Financial Support

For educators, managing financial wellness is a constant challenge, often exacerbated by unexpected expenses and limited resources. Traditional loan options may come with stringent requirements and high-interest rates, making it difficult for teachers to access much-needed funds swiftly. However, with teacher title loan discounts specifically tailored for their needs, this landscape changes dramatically. These discounts provide an innovative solution, offering financial support with more accessible terms, allowing educators to better manage unexpected costs and create a buffer against financial strain.

By providing emergency funds through the Title Loan Process, teachers can alleviate immediate financial burdens and improve their overall wellness. This financial security enables them to focus on what truly matters—enabling educators to serve students more effectively. Moreover, loan eligibility based on professional qualifications ensures that these discounts are both inclusive and supportive of the teaching community.

Teacher title loan discounts play a crucial role in enhancing financial wellness for educators. By understanding eligibility criteria and the significant impact of these discounts, it’s clear that they’re a valuable resource for supporting teachers’ financial well-being. Embracing these opportunities can help alleviate financial stress, enabling educators to focus on what matters most—enriquing their students’ lives.