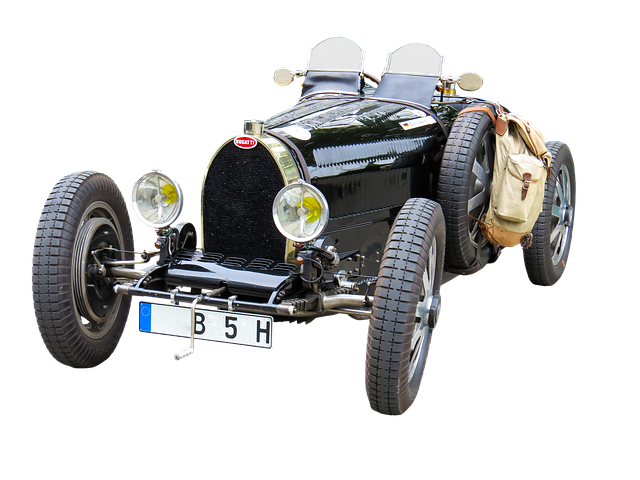

When considering Texas motorcycle title loans, compare lenders for transparent fees and rates. Negotiate terms and review all costs, including hidden fees and early repayment penalties, to make an informed decision and avoid financial surprises.

In the vibrant landscape of Texas motorcycle enthusiasts, accessing funds through title loans can be a game-changer. However, understanding hidden fees is crucial to avoid financial surprises. This article guides you through navigating the intricacies of Texas motorcycle title loans, equipping you with strategies to recognize and avoid unnecessary charges. By learning how to negotiate better terms and rates, you can ensure a smoother loan experience, making your ride more enjoyable without the financial burden of hidden costs.

- Understanding Hidden Fees in Texas Motorcycle Title Loans

- How to Avoid Unnecessary Charges on Your Loan

- Strategies for Negotiating Better Terms and Rates

Understanding Hidden Fees in Texas Motorcycle Title Loans

When considering Texas motorcycle title loans, it’s crucial to be aware of potential hidden fees that can significantly impact your financial decision. These fees often go unnoticed by borrowers who are eager to access fast cash for emergency funds or other urgent needs. Lenders may charge various expenses such as processing fees, documentation costs, and even early repayment penalties. Each of these fees contributes to the overall cost of borrowing, which is essential to understand before signing any loan agreements.

Hidden fees in Texas motorcycle title loans can vary widely among lenders. Some may offer seemingly attractive low-interest rates but add on numerous additional charges. Others might provide transparent terms with reasonable fees. Borrowers should carefully review all loan documents and ask questions to ensure they fully comprehend the financial obligations ahead. Understanding these costs upfront allows for informed borrowing, helping you avoid surprises later and facilitating a smoother process when seeking fast cash through alternative means like semi truck loans if needed.

How to Avoid Unnecessary Charges on Your Loan

When considering a Texas motorcycle title loan, it’s crucial to be vigilant about potential hidden fees that could significantly impact your financial burden. To avoid unnecessary charges, start by thoroughly reading and understanding the terms and conditions of any loan agreement before signing. Loan providers in Texas are legally required to disclose all associated costs upfront, including interest rates, processing fees, and any other applicable charges.

One effective strategy to minimize extra expenses is to shop around for the best rates and terms. Don’t be shy to ask questions or compare offers from different lenders. Additionally, opting for a loan with vehicle collateral can sometimes result in better deals, as it allows lenders to mitigate risk, potentially leading to lower interest rates and quicker same-day funding. Remember, transparency is key; avoid providers that offer vague or unclear fee structures, and opt for those who provide a clear picture of what you’ll be paying throughout the loan period.

Strategies for Negotiating Better Terms and Rates

When considering a Texas motorcycle title loan, negotiating better loan terms and rates can save you significant amounts in the long run. Start by shopping around to compare offers from different lenders. This gives you leverage and helps identify competitive rates within the market for Dallas title loans. Don’t be afraid to ask for lower interest rates or extended repayment periods, especially if you have a strong credit history or a reliable co-signer. Lenders may be open to negotiation as they strive to secure your business.

Additionally, clarify any hidden fees and charges associated with the loan. Carefully review the vehicle ownership terms and conditions to understand potential penalties for early repayment, late fees, or title transfer costs. Understanding these factors allows you to make informed decisions and avoid unexpected financial surprises later on.

When exploring Texas motorcycle title loans, being aware of hidden fees is crucial to ensuring a smooth borrowing experience. By understanding these charges and implementing strategies to negotiate better terms, riders can avoid unnecessary costs and secure more favorable loan conditions. Remember that knowledgeable borrowing decisions lead to financial stability, especially when navigating the world of Texas motorcycle title loans.