In Texas, the state's title loan verification process is crucial for lenders and borrowers with limited credit history. It involves rigorous checks on vehicle condition, ownership, and liens, including safety inspections to prevent fraud. Borrowers need to provide ID, residency proof, and vehicle registration to streamline verification, gaining access to funds without extensive background checks. Vehicle inspection is vital, ensuring collateral meets standards, reducing loan defaults, and simplifying online applications. Best practices leverage technology for accurate data analysis and faster decision-making, providing borrowers with timely financial support.

In the state of Texas, vehicle inspection plays a pivotal role in the intricate process of title loan verification. This crucial step ensures the legitimacy and value of collateral, directly impacting loan approval rates. This article delves into the intricacies of Texas title loan verification requirements, exploring how vehicle inspections act as a gatekeeper for lenders while streamlining the overall borrowing experience. By examining best practices, we uncover efficient methods to navigate this essential process.

- Understanding Texas Title Loan Verification Requirements

- The Impact of Vehicle Inspection on Loan Approval

- Streamlining the Process: Benefits and Best Practices

Understanding Texas Title Loan Verification Requirements

In Texas, understanding the state’s title loan verification process is crucial for both lenders and borrowers seeking a financial solution. The state has specific requirements that must be followed to ensure the legitimacy and security of these loans, which often serve as a no-credit-check option for those in need of immediate financial assistance. This verification process includes comprehensive checks on the vehicle’s condition, ownership history, and outstanding liens or encumbrances.

Lenders are required to conduct thorough inspections, ensuring the vehicle meets safety standards and has no hidden damage that could compromise its value. Additionally, verifying the title’s authenticity is a critical step to safeguard against fraud. Borrowers should be prepared to provide necessary documentation, including identification, proof of residency, and the vehicle’s registration, to streamline the process and gain access to much-needed financial assistance without extensive background checks or credit assessments.

The Impact of Vehicle Inspection on Loan Approval

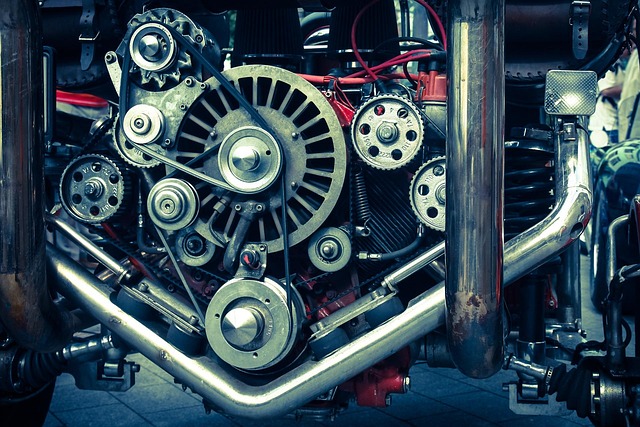

Vehicle inspection plays a pivotal role in the Texas title loan verification process. By thoroughly examining a vehicle’s condition and authenticity, lenders can significantly impact the loan approval rate. This critical step ensures that the collateral for the loan—the vehicle—meets specific safety standards and is not encumbered or stolen. An expert inspection includes verifying the vehicle’s identity, checking its history for any accidents or damage, and assessing its overall market value.

This process is crucial, especially in a state like Texas where title loans are a common financial option. A comprehensive inspection helps lenders make informed decisions, minimizing risks associated with loan defaults. It also streamlines the online application process by providing concrete data on the vehicle’s condition, thereby reducing the need for extensive credit check procedures. For instance, in the case of boat title loans, where vehicles may have unique characteristics, a detailed inspection ensures lenders offer competitive rates and terms while safeguarding their interests.

Streamlining the Process: Benefits and Best Practices

Vehicle inspection plays a pivotal role in streamlining the Texas title loan verification process, offering numerous benefits that enhance both efficiency and accuracy. By thoroughly examining a vehicle’s condition, history, and documentation, lenders can make informed decisions about extending loans, ensuring the security of both parties. This process not only protects lenders from potential fraud but also provides borrowers with a fair assessment of their asset’s value.

Best practices in vehicle inspection include leveraging technology for comprehensive data analysis, maintaining consistent evaluation criteria, and promoting transparency throughout the verification process. San Antonio Loans, renowned for their quick funding options, often employ digital tools to cross-reference information from various sources, ensuring that every detail about the vehicle is accurately captured. This streamlined approach facilitates faster decision-making, providing borrowers with emergency funds when they need them most.

Vehicle inspection plays a pivotal role in the Texas title loan verification process, ensuring both the legitimacy of vehicles used as collateral and fostering trust between lenders and borrowers. By thoroughly assessing vehicle condition, ownership, and documentation, inspections streamline the loan approval process, reducing risk for lenders while providing borrowers with fair access to much-needed funds. Embracing best practices, such as digital record-keeping and efficient scheduling, further enhances this crucial step, contributing to a more transparent and accessible Texas title loan verification system.