Brookshire auto title loans offer swift financial support secured by a vehicle's title, with faster approval times and access to funds for emergencies or unexpected expenses. Eligibility is based on vehicle value, making it available to diverse car owners, including those with less-than-perfect credit. Local regulations are vital in maintaining a balanced lending market, setting interest rates, loan durations, and collection methods, ensuring transparency and fairness for borrowers. These rules also facilitate flexible repayment options and protect against usurious practices, particularly crucial for boat title loans, enabling residents to access these services responsibly while benefiting local communities.

Brookshire Auto Title Loans have emerged as a financial option for residents seeking quick cash. However, understanding this process and navigating local regulations is crucial. This article delves into the intricacies of Brookshire auto title loans, exploring how local lending laws shape car title financing. We guide borrowers through legal requirements, ensuring they make informed decisions in an ever-evolving financial landscape. By understanding these regulations, individuals can access much-needed funds securely and responsibly.

- Understanding Brookshire Auto Title Loans

- Local Regulations Shaping Car Title Lending

- Navigating Legal Requirements for Borrowers

Understanding Brookshire Auto Title Loans

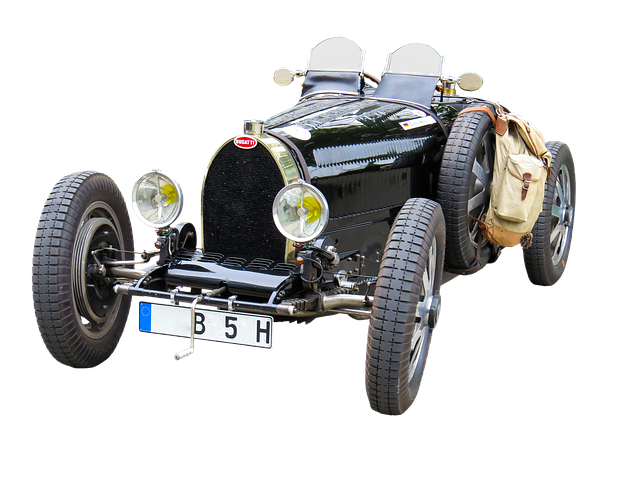

Brookshire Auto Title Loans offer a unique financial solution for individuals seeking quick and accessible credit. This type of loan is secured by the borrower’s vehicle title, allowing for a faster approval process compared to traditional bank loans. Once approved, borrowers can gain immediate access to funds, providing much-needed financial assistance during emergencies or unexpected expenses. The beauty of these loans lies in their flexibility; they cater to various needs, from paying off debts to funding essential repairs or even boater’s dreams, such as Boat Title Loans.

Eligiblity criteria for Brookshire Auto Title Loans is typically based on the value and condition of the borrower’s vehicle. Lenders assess the overall condition, making it accessible for a wide range of vehicle owners. This alternative lending option proves especially beneficial for those with less-than-perfect credit or limited loan options, offering an opportunity to rebuild financial stability while accessing much-needed capital.

Local Regulations Shaping Car Title Lending

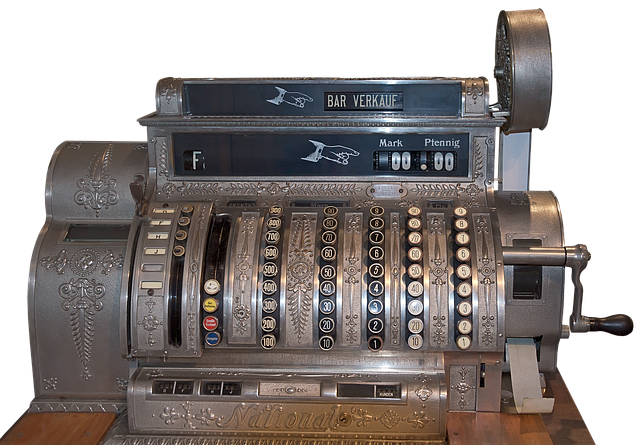

Local regulations play a pivotal role in shaping the landscape of car title lending, including Brookshire auto title loans. These rules are designed to protect consumers from predatory lending practices while ensuring access to fast cash for those in need. In many areas, lenders must adhere to strict guidelines regarding interest rates, loan terms, and collection procedures, making sure that borrowers receive a fair and transparent financial solution.

The regulatory framework also promotes flexible payments, allowing borrowers to manage their debt more effectively. By striking a balance between consumer protection and access to capital, these local regulations contribute to a healthier lending environment, offering individuals a reliable financial solution for emergency situations or unexpected expenses without burdening them with excessive constraints.

Navigating Legal Requirements for Borrowers

When it comes to Brookshire auto title loans, borrowers must first understand and navigate through a web of local lending regulations. These rules are in place to protect both lenders and consumers, ensuring fair practices and quick funding for those in need. One significant aspect is understanding what assets can be used as collateral, with vehicle titles often being a popular choice due to their readily available value.

The process involves a thorough credit check, which is a standard procedure for any loan. However, it’s not just about assessing creditworthiness; local regulations also dictate the interest rates, repayment terms, and fees allowed. For instance, some areas might have limits on the maximum interest rate, ensuring borrowers don’t get trapped in cycles of high-interest debt. This regulatory framework is designed to provide a safety net for local communities, especially when it comes to quick funding options like boat title loans, ensuring that residents can access these services responsibly.

Brookshire auto title loans, while offering a quick solution for cash needs, are subject to local lending regulations that protect borrowers. Understanding these regulations is crucial for navigating the process safely and securely. By familiarizing themselves with legal requirements, borrowers can make informed decisions when considering Brookshire auto title loans, ensuring a positive experience without falling into potential debt traps. Local regulations play a vital role in shaping car title lending, fostering a fair and transparent environment for all involved parties.