Car title loan debt consolidation offers faster approval but high interest rates and collateral risk. Alternative options like traditional refinancing or personal loans may provide better terms. Responsible lenders offer competitive rates, and accurate vehicle valuation is crucial for loan amounts. Before choosing, understand that it restructures debt with strict requirements and potential high costs.

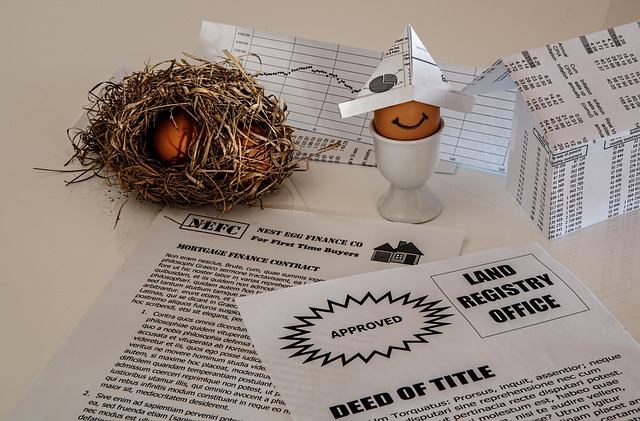

“Confused about car title loan debt consolidation? This comprehensive guide debunks common myths surrounding this financial strategy. Explore the reality of car title loans and learn how debt consolidation can provide much-needed relief. We dissect misconceptions, revealing the truth behind this powerful tool for managing debt. By understanding the facts, you’ll make informed decisions about your financial future, ensuring a clearer path to financial freedom.”

- Car Title Loans: Unlocking Fact vs. Fiction

- Debt Consolidation Myths Busted: A Comprehensive Look

- Understanding Car Loan Debt Relief Reality

Car Title Loans: Unlocking Fact vs. Fiction

Car title loans have gained a reputation for being a quick fix for financial emergencies, but there’s more to understand beyond the myths. Often marketed as a convenient source of car title loan debt consolidation and financial assistance, these loans come with unique features and considerations. While they can provide same-day funding when traditional banking options seem out of reach, borrowers should be aware of the high-interest rates and potential risks associated with such transactions.

The reality is that car title loans are secured by the vehicle’s title, allowing lenders to offer faster approval processes compared to conventional loans. However, this convenience comes at a cost. Borrowers typically face higher interest rates due to the short-term nature of these loans and the collateral involved. It’s essential for individuals considering car title loan debt consolidation to weigh these factors carefully and explore alternative options, such as traditional refinancing or personal loans, which might offer more favorable terms.

Debt Consolidation Myths Busted: A Comprehensive Look

Many individuals considering car title loan debt consolidation are met with a barrage of misconceptions and false information. This often stems from a lack of understanding or deliberate attempts to mislead borrowers. To ensure clarity, let’s debunk some common myths surrounding this financial strategy. One prevalent notion is that car title loan debt consolidation is inherently risky, implying high-interest rates and unfavorable terms. While it’s true that such loans are secured by your vehicle, responsible lenders offer competitive rates and transparent terms tailored to individual needs. Many borrowers find relief from multiple high-interest debts consolidated into a single, lower-interest payment with a Houston Title Loan.

Another myth perpetuates the idea that credit checks are inevitable and stringent during the consolidation process. In reality, many lenders, including those offering Houston Title Loans, employ alternative credit assessment methods. These non-traditional checks focus on your vehicle’s value and its current condition rather than solely relying on credit scores. Furthermore, understanding the importance of accurate vehicle valuation cannot be overstated. Lenders use this to determine loan amounts, so ensuring an unbiased and fair appraisal is crucial when consolidating car title loans.

Understanding Car Loan Debt Relief Reality

Many individuals seeking financial relief often turn to car title loan debt consolidation as a solution for their monetary troubles. However, understanding the reality behind this option is crucial before making any hasty decisions. Car title loan debt consolidation has gained popularity due to its promise of simplifying and reducing the burden of multiple high-interest loans. But the truth is far from the glamorous portrayal often associated with it.

In reality, car title loan debt consolidation does not eliminate debts; instead, it merely restructures them. Lenders who offer these services typically require borrowers to put their vehicles up as collateral. This means that if you fail to make payments as agreed, you risk losing your vehicle. Moreover, the Loan Requirements for car title loans are often stringent, and interest rates can be significantly higher than traditional loan options. Unlike a mythical fix, it’s important to recognize that car title pawn services in cities like Houston Title Loans are financial instruments that demand careful consideration and responsible borrowing practices.

In navigating the complex landscape of car title loan debt consolidation, it’s essential to separate fact from fiction. By debunking common myths and understanding the true potential for relief, borrowers can make informed decisions about their financial future. Car title loan debt consolidation offers a strategic path to overcoming debt burdens, providing a clearer, more sustainable financial outlook for those who qualify.