Title loans for cars offer quick cash but carry significant risks, including high interest rates and repossession due to default. Thorough inspection of vehicles determines loan value, impacting approval and costs. Borrowing should be a last resort, with careful consideration of terms and comparisons between lenders to protect financial well-being.

Title loans for cars can provide quick cash, but they come with significant risks. Understanding the potential financial hazards is crucial before agreeing to such agreements. This article delves into the complexities of title loans for cars, exploring both the dangers and strategies to mitigate them. By the end, readers will have a comprehensive grasp of the risks involved and how to protect themselves in this challenging financial landscape.

- Understanding the Risks of Title Loans for Cars

- Potential Financial Hazards: A Closer Look

- Mitigating Dangers: Strategies and Protections

Understanding the Risks of Title Loans for Cars

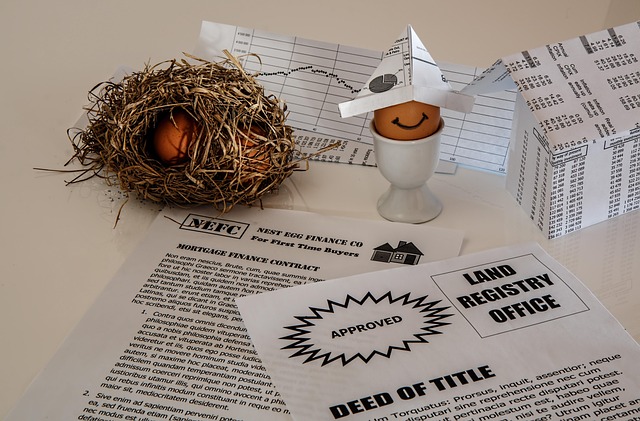

When considering a Title loan for your car, it’s crucial to understand that this type of loan comes with unique risks. Unlike traditional loans where your credit score plays a significant role in eligibility, title loans primarily rely on the value and condition of your vehicle. This means if you’re dealing with a less-than-perfect credit history or no credit at all, you might find it easier to secure a loan—but at a higher cost. These short-term agreements often come with steep interest rates and fees, making them potentially harmful if not managed responsibly.

Additionally, the process involves a comprehensive vehicle inspection to determine its worth. In Fort Worth Loans, for instance, lenders will assess your car’s make, model, age, and overall condition to set the loan amount. While this can be advantageous for those with bad credit loans, it also means any damage or outstanding issues with your vehicle could result in lower-than-expected loan proceeds. It’s essential to be aware of these risks before agreeing to such an agreement to ensure you’re making a well-informed decision.

Potential Financial Hazards: A Closer Look

When considering a title loan for cars, it’s crucial to be aware of the potential financial hazards that come with this type of agreement. These loans, while offering quick access to cash, often have hidden risks that can lead to a cycle of debt. The title loan process typically involves using your vehicle’s title as collateral, which means if you fail to repay the loan on time, you could lose ownership of your car.

One significant risk is the high-interest rates associated with these loans. Lenders often charge substantial fees and premiums, making it difficult for borrowers to pay off the debt promptly. Additionally, credit check isn’t always a determining factor in approval, which can be beneficial for those with poor credit but also leads to higher risks for lenders and, consequently, borrowers. Loan extensions might seem like a solution, but they typically come with even more fees, increasing your financial burden over time.

Mitigating Dangers: Strategies and Protections

When considering a title loan for cars, it’s crucial to acknowledge the potential risks associated with such agreements. The primary danger lies in the high-interest rates and the possibility of default, which can lead to repossession of your vehicle. However, there are strategies to mitigate these dangers.

One effective approach is to thoroughly understand the loan requirements before signing any documents. Reputable lenders often provide clear terms and conditions, outlining interest rates, repayment schedules, and potential penalties for late payments. Additionally, an online application process can help borrowers save time and ensure they are dealing with a legitimate lender. By staying informed and comparing multiple offers, individuals can secure the best possible deal, ensuring their financial safety and peace of mind when facing unexpected expenses, even if it’s for emergency funding.

Title loans for cars can provide quick funding, but it’s crucial to understand the risks involved. By grasping the potential financial hazards and employing strategies to mitigate dangers, borrowers can make informed decisions and avoid the pitfalls commonly associated with these agreements. Prioritizing responsible borrowing practices ensures that title loans for cars serve as a viable option rather than a source of long-term financial strain.