Lenders assess vehicle equity, employment history, and financial health for title loan cash income acceptance, requiring clear vehicle titles and proof of income. While strict, this process offers simplicity, speed, and potentially favorable rates, ideal for quick funds but requires careful repayment consideration to avoid repossession. Compare rates and terms from multiple lenders to secure the best deal.

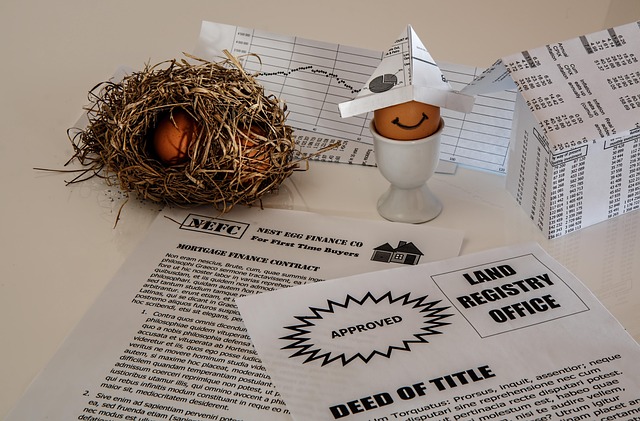

“Uncover the potential of leveraging your vehicle’s equity with title loan cash income acceptance. This innovative financing option allows you to access immediate funds by using your car title as collateral. In this comprehensive guide, we’ll explore how this alternative lending solution works and who it benefits. From understanding the acceptance process to delving into eligibility criteria and the advantages and considerations, this article will equip you with insights to make informed decisions regarding title loan cash income acceptance.”

- Understanding Title Loan Cash Income Acceptance

- Eligibility Criteria for Title Loan Cash

- Benefits and Considerations of Using Title Loan Cash Income

Understanding Title Loan Cash Income Acceptance

When considering a loan, understanding how your income is evaluated is crucial. In the case of title loan cash income acceptance, lenders assess your ability to repay by examining your vehicle equity and current financial situation. This process involves verifying your earnings, employment history, and outstanding debts to determine if you qualify for a loan based on your vehicle’s value.

The title loan process starts with an application where lenders request relevant information. They evaluate your creditworthiness, including your credit score and payment history, while also considering the market value of your vehicle. Interest rates vary depending on several factors, such as the lender’s policies, your credit standing, and the loan amount. Transparency is key, so be sure to inquire about any fees and charges associated with the title loan cash income acceptance process.

Eligibility Criteria for Title Loan Cash

When considering a title loan cash income acceptance, understanding the eligibility criteria is crucial. Lenders will assess your financial health and vehicle condition to determine if you qualify for a loan. The primary requirement revolves around having a clear vehicle title, typically for a car or truck, in your name. This serves as collateral for the loan. Additionally, lenders often mandate proof of income, ensuring borrowers have the means to repay the loan. Employment verification and bank statements may be requested to gauge your financial stability.

The process prioritises responsible lending practices, aiming for quick approval while adhering to strict loan requirements. Even if you have poor credit or no credit history, certain lenders specialise in truck title loans and offer flexible terms. It’s essential to compare rates, repayment options, and hidden fees from multiple lenders to secure the best deal for your title loan cash income acceptance.

Benefits and Considerations of Using Title Loan Cash Income

Using Title Loan Cash Income Acceptance can offer several benefits for those seeking fast cash. One of the key advantages is the simplicity and speed of the process. Unlike traditional loans that require extensive documentation and a lengthy application procedure, securing a loan using your vehicle’s title allows for a quicker turnaround time. This is particularly appealing to individuals who need immediate financial support. The entire process involves a quick assessment of your vehicle, a simple application, and within hours, you could have access to the funds you need, providing much-needed relief during unexpected financial emergencies.

Another consideration is that this type of loan is secured by your vehicle’s title, which means it is a form of secured loans. This security ensures lenders take on less risk, potentially leading to more favorable interest rates and repayment terms compared to unsecured loans like fast cash options. However, if you’re unable to repay the loan, the lender has the right to repossess your vehicle. Therefore, while it provides quick access to funds, it’s crucial to carefully consider your financial situation and ensure you can meet the repayment obligations without compromising your asset.

In conclusion, understanding Title loan cash income acceptance can open doors to financial support for those in need. By meeting the eligibility criteria and considering the benefits, individuals can leverage their vehicle’s equity to gain access to much-needed funds. However, it’s essential to weigh the considerations carefully to ensure a favorable outcome that aligns with your financial goals.