Kyle auto title loans offer quick financial relief, but thorough understanding of terms, including interest rates and repayment conditions, is vital to avoid penalties and loss of your vehicle. Avoid assuming these are only for good credit or underestimating costs. Explore flexible plans, meet basic eligibility criteria, review loan details carefully, and use secure direct deposit options for a seamless, protected loan process.

“In the world of Kyle auto title loans, understanding the intricacies of these agreements is paramount. This guide aims to equip folks with knowledge to navigate the process smoothly. We’ll delve into ‘Understanding Kyle Auto Title Loan Agreements,’ uncover common pitfalls to avoid, and provide best practices for securing your loan. By following these tips, you can ensure a straightforward and successful transaction.”

- Understanding Kyle Auto Title Loan Agreements

- Common Mistakes to Avoid During Process

- Securing Your Loan: Best Practices & Tips

Understanding Kyle Auto Title Loan Agreements

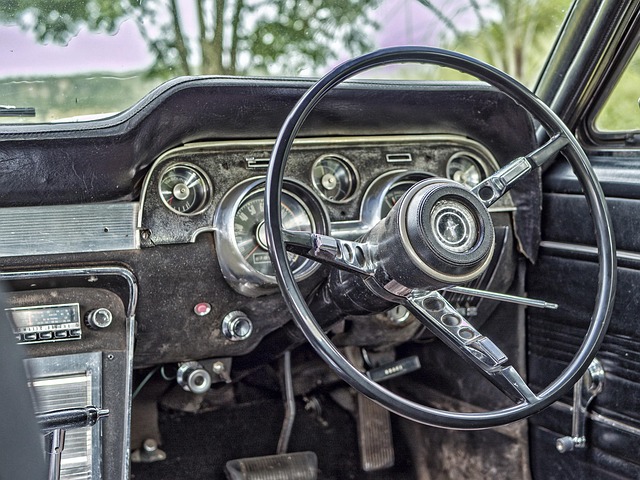

Kyle auto title loans can provide a quick solution for those needing financial assistance. However, understanding the agreement is crucial before committing. These loans are secured by your vehicle’s title, which means if you fail to repay the loan according to the terms, the lender has the right to take possession of your vehicle.

Before signing, carefully review the conditions, including interest rates, repayment schedules, and any penalties for early repayment. Ensure that all details match your understanding and that you’re comfortable with the terms. Direct deposit of funds is often a convenient feature offered by many lenders, streamlining the process. Remember, while vehicle collateral can be a helpful source of financial assistance, it’s important to prioritize timely repayments to avoid potential loss of your asset.

Common Mistakes to Avoid During Process

When considering a Kyle auto title loan, it’s easy to make mistakes that could lead to financial strain later on. A common pitfall is assuming that these loans are only for those with excellent credit. This isn’t true—Kyle auto title loans are often accessible to individuals with bad credit, offering a chance to improve their financial standing through responsible borrowing and timely repayments. However, this alternative financing option comes with its own set of challenges. Borrowers sometimes underestimate the cost of these loans due to their quick approval process.

Another mistake is not exploring repayment options thoroughly. It’s crucial to understand the terms and conditions, including interest rates, loan periods, and penalties for early or late payments. Given the secured nature of these loans, failing to keep up with repayments can result in repossession of your vehicle. Therefore, it’s essential to choose a lender that provides flexible repayment plans tailored to different budgets, ensuring you can comfortably manage your debt without the fear of losing your asset.

Securing Your Loan: Best Practices & Tips

When securing a Kyle auto title loan, following best practices ensures a smooth process and protects your interests. Firstly, ensure you meet the basic loan eligibility criteria set by lenders. This typically involves having a valid driver’s license, a clear vehicle ownership history, and a steady source of income. Lenders will assess your creditworthiness based on these factors, so maintaining good financial health is paramount.

Before signing any agreements, thoroughly review the terms and conditions. Understand the interest rates, repayment schedules, and any associated fees. It’s crucial to comprehend how much you’ll be borrowing and the total cost of the loan. Additionally, confirm that the lender offers direct deposit options for fund transfers, ensuring a secure and convenient transaction.

When considering a Kyle auto title loan, understanding the process and avoiding common pitfalls is key to securing a fair and beneficial agreement. By familiarizing yourself with the terms, staying alert for potential red flags, and following best practices outlined in this article, you can make informed decisions and navigate the process smoothly. Remember, Kyle auto title loans offer quick access to funds, but proper diligence ensures a positive experience that serves your financial needs without added stress.