Texas 24 hour title loans offer swift financial aid secured by vehicles but carry high interest rates, hidden fees, and stringent eligibility criteria. Borrowers should research reputable lenders with transparent terms to avoid repossession and financial strain, prioritizing safety and responsible management.

In the competitive landscape of Texas, understanding 24-hour title loans is crucial for consumers navigating financial tight spots. These short-term, high-interest loans offer quick cash but come with significant risks, including sky-high interest rates and potential security implications. This article delves into the basics and risks of Texas 24-hour title loans, highlights common pitfalls to avoid, and provides safe practices for responsibly navigating these loan options.

- Understanding Texas 24 Hour Title Loans: Basics and Risks

- Common Pitfalls: What to Watch Out for in Texas

- Safe Practices: Navigating 24-Hour Loan Options Responsibly

Understanding Texas 24 Hour Title Loans: Basics and Risks

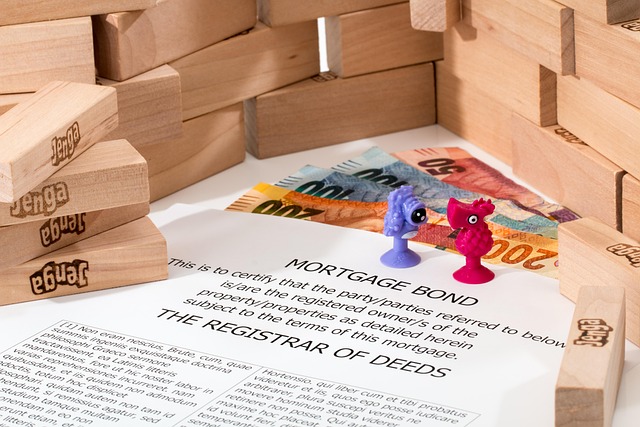

Texas 24 hour title loans offer a short-term financial solution for borrowers facing immediate cash needs. These loans are secured against a vehicle, allowing lenders to provide quick approvals and access to funds within hours. However, it’s crucial to understand the basics and risks associated with such loans before making any decisions.

One of the main advantages is their speed, as the name suggests—a 24-hour turnaround time for approval and funding. This can be a lifesaver during emergencies or unexpected financial crises. But, this quick approval comes at a cost; high-interest rates are a common feature, often making these loans more expensive in the long run. Additionally, loan eligibility criteria can be stringent, leaving some individuals ineligible despite desperate needs. Lenders typically require clear vehicle ownership and proof of income to mitigate risks, but borrowers must carefully consider if they can afford the potential consequences, including the risk of defaulting on the loan, which could lead to repossession of their vehicle.

Common Pitfalls: What to Watch Out for in Texas

In the competitive world of Texas 24 hour title loans, borrowers often find themselves navigating a maze of financial options. It’s crucial to be aware of potential pitfalls to make informed decisions. One common trap is dealing with lenders who offer incredibly high-interest rates and hidden fees, making repayment an uphill battle. Additionally, some disreputable lenders may pressure borrowers into accepting terms without fully explaining the implications, including short repayment periods that could strain financial resources.

Another aspect to watch out for is the lack of transparency regarding the vehicle collateral process. Reputable lenders should provide clear details about what constitutes acceptable vehicle value and how it influences loan amounts. Moreover, while convenience is a draw for Texas 24 hour title loans, borrowers should beware of lenders that skip essential credit check procedures, as this could lead to unfair lending practices and higher risks for both parties.

Safe Practices: Navigating 24-Hour Loan Options Responsibly

When considering a Texas 24-hour title loan, it’s crucial to adopt safe practices and approach these short-term financial solutions responsibly. These loans can provide a quick fix for unexpected expenses, but they come with risks if not managed properly. One of the key aspects is understanding that these loans are secured by your vehicle, so defaulting could result in losing your car or motorcycle.

Therefore, it’s essential to thoroughly research and compare lenders offering 24-hour title loans in Texas. Look for reputable companies that prioritize customer satisfaction and offer transparent terms and conditions. Keep your vehicle as a priority; ensure the lender’s processes allow you to retain possession of your asset while providing the necessary financial support. Opting for a reliable lender and maintaining open communication can help avoid pitfalls often associated with such loans, making it a more manageable financial decision.

When considering Texas 24 hour title loans, it’s crucial to be aware of both the benefits and significant risks involved. By understanding common pitfalls and adopting safe practices, borrowers can navigate these short-term options more responsibly. Always remember that while quick cash is appealing, the potential consequences of high-interest rates and strict repayment terms should not be taken lightly. Informed decisions are key to avoiding financial strain in the long run.