Texas small business owners increasingly turn to Texas title loans for quick funding, leveraging vehicle titles as collateral. With simplified eligibility and same-day access, these loans offer growth capital for expansions and purchases but carry risks of high interest rates, potential vehicle loss, and increased financial vulnerability due to lack of credit check. Despite these hazards, Texas title loans provide an attractive alternative financing option compared to traditional unsecured loans, fostering local business success across the state.

In today’s competitive landscape, Texas small business owners are always on the lookout for capital. One alternative financing option gaining traction is business title loans. This article delves into the intricacies of Texas title loans designed for small businesses, exploring both their potential risks and substantial rewards. By understanding these factors, savvy owners can make informed decisions to unlock business growth and success.

- Understanding Texas Title Loans for Small Businesses

- Potential Risks: What Every Owner Should Know

- Unlocking Business Growth: Rewards of Title Loans in Texas

Understanding Texas Title Loans for Small Businesses

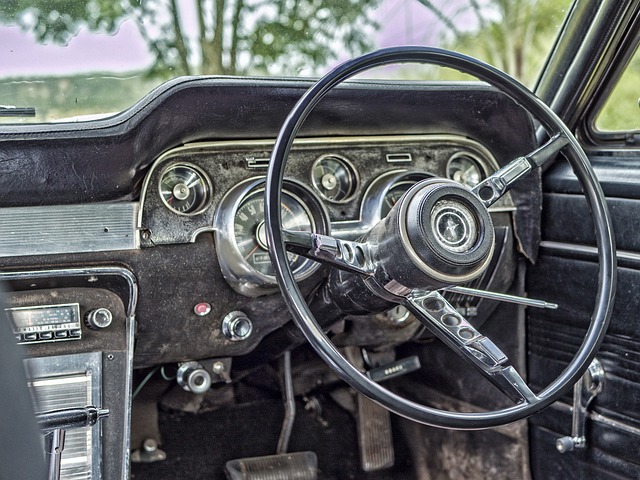

In Texas, small business owners often explore various funding options to support their ventures, and one unique approach gaining traction is the use of Texas title loans. This alternative financing method allows business owners to leverage their company’s assets, specifically their vehicle titles, as collateral for a loan. It provides a quick and accessible source of financial assistance for those in need of capital for expansion, equipment purchases, or unexpected expenses. The process involves applying for a loan with a lender who assesses the value of the business’s asset, typically offering same-day funding if approved.

Unlike traditional bank loans that require extensive documentation and credit checks, Dallas title loans often have simpler eligibility criteria. Lenders consider factors such as the overall value of the vehicle and its condition rather than relying solely on an individual’s credit score. This makes it a viable option for entrepreneurs who may have limited credit history or lower credit ratings but possess valuable assets. While convenient and fast, small business owners should be mindful of the potential risks, including interest rates and the possibility of losing the collateralized asset if they fail to repay the loan as agreed.

Potential Risks: What Every Owner Should Know

Small business owners in Texas often look for quick financial solutions to bridge gaps or seize opportunities. One such option gaining popularity is a Texas title loan for small business owners. While this alternative financing method can be enticing due to its quick approval and same day funding, it’s crucial for owners to understand the potential risks involved before committing.

Among the key risks associated with these loans are high-interest rates, which can quickly compound into substantial debt. Additionally, lenders often require the business’s title as collateral, posing a significant risk of losing the owner’s asset if they fail to repay. Furthermore, no credit check policies might suggest ease of access but also indicate a potential lack of scrutiny into the borrower’s financial health and ability to repay, increasing both personal and business financial vulnerability.

Unlocking Business Growth: Rewards of Title Loans in Texas

For Texas small business owners seeking a boost, business title loans offer a unique opportunity to unlock growth potential. These secured loans, backed by the owner’s commercial property, provide quick access to capital, a significant advantage in today’s fast-paced business environment. The process is straightforward; lenders assess the value of the property and offer a loan amount based on that assessment, making it an attractive option for those needing immediate financial support.

One of the key rewards lies in the flexibility these loans provide. Texas title loan terms are often tailored to individual needs, allowing business owners to choose repayment periods that align with their cash flow patterns. Furthermore, compared to traditional unsecured loans, these secured options typically feature lower interest rates, making them a cost-effective choice for funding expansions, equipment purchases, or working capital needs, thereby fostering the growth and success of local businesses across the state.

Business title loans in Texas offer a unique opportunity for small business owners seeking capital, but it’s crucial to weigh both the risks and rewards. By understanding the intricacies of these loans, owners can make informed decisions that drive growth while minimizing potential pitfalls. As with any financial strategy, thorough research and consultation are key to ensuring a Texas title loan serves as a catalyst for success rather than a source of strain.