Austin car title loans have gained popularity due to unique financial challenges faced by locals in Austin, Texas, offering swift approval and immediate funding. However, these loans carry high interest rates and strict collateral demands, trapping borrowers in a cycle of debt. Residents advocate for Title Loan Reform to promote flexible repayment options and responsible lending practices, empowering informed financial decisions and long-term stability.

In Austin, as in many cities, car title loans have emerged as a fast-cash option for residents facing financial emergencies. However, the high interest rates associated with these loans can trap borrowers in a cycle of debt. This article explores why advocates in Austin are pushing for reform of Austin car title loans. By examining the local perspective on these loans, their impact on borrowers, and the importance of fair lending practices and consumer protection, we aim to shed light on this pressing issue.

- Understanding Austin Car Title Loans: A Local Perspective

- The Impact of High Interest Rates on Borrowers

- Promoting Fair Lending Practices and Consumer Protection

Understanding Austin Car Title Loans: A Local Perspective

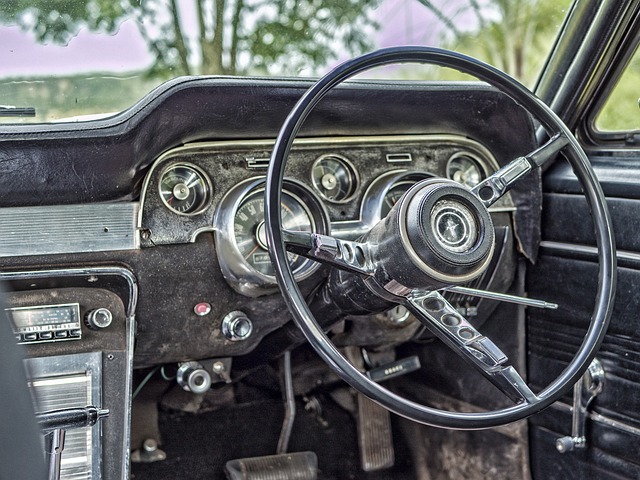

In the vibrant city of Austin, Texas, the local community has navigated unique financial challenges, often turning to alternative lending solutions for quick funding. Among these options, Austin car title loans have emerged as a prominent and, for some, indispensable source of cash advances. These loans are secured by an individual’s vehicle, providing a streamlined title loan process that offers benefits such as faster approval times compared to traditional bank loans. This local perspective highlights the appeal of Austin car title loans, particularly among residents facing urgent financial needs.

The allure of these short-term lending options lies in their accessibility and convenience. With a quick funding mechanism, Austin car title loans allow borrowers to tap into the equity of their vehicles, providing immediate relief during unexpected financial crises. However, it’s essential to approach this option with caution, as the potential consequences of defaulting on such loans can be significant, impacting not just an individual’s credit score but also their ownership of the secured vehicle.

The Impact of High Interest Rates on Borrowers

Austin car title loans can put a significant strain on borrowers due to their high interest rates. These loans, secured by a borrower’s vehicle, often come with annual percentage rates (APRs) that far exceed those of traditional bank loans. Borrowers find themselves in a cycle of high-interest payments, making it difficult to pay off the loan and leading to a constant need for refinancing. This not only prolongs debt but can also result in substantial financial strain on individuals already facing economic challenges.

High interest rates make it challenging for borrowers to manage their finances effectively. They often struggle with making ends meet, as a large portion of their income is directed towards loan repayments. In some cases, individuals resort to taking out additional loans or engaging in debt consolidation to alleviate the financial burden. This can create a vicious cycle where borrowers are perpetually trapped in debt, hindering their ability to achieve financial stability and security.

Promoting Fair Lending Practices and Consumer Protection

Austin advocates push for Title Loan Reform to ensure fair lending practices and consumer protection. The city’s residents understand that while Austin car title loans can offer a quick approval process, it’s crucial to safeguard against predatory lending. By advocating for reform, they aim to provide borrowers with transparent repayment options and flexible payment structures, ensuring these short-term loans do not trap individuals in cycles of debt.

These efforts are driven by the desire to protect vulnerable Austinites from the potential pitfalls of high-interest rates and strict collateral requirements often associated with title loans. By promoting responsible lending, advocates seek to empower borrowers to make informed decisions, encouraging them to explore alternative financing options that align with their long-term financial stability and growth.

Austin advocates push for Title Loan Reform to address the high interest rates and unfair lending practices associated with Austin car title loans. By promoting fair lending, they aim to protect consumers from predatory loans, ensuring a more secure financial future for all residents. Through reform, Austin can create a balanced ecosystem where individuals have access to credit while maintaining their financial stability.