Car title loan consumer advocacy protects borrowers' rights by educating them about legal protections, simplifying agreements, and encouraging transparent industry practices. It empowers individuals to make informed decisions, negotiate better terms, and avoid predatory lending behaviors. Key aspects include clear fee disclosures, quick approvals, and regulated interest rates, ensuring lenders maintain ethical standards while borrowers understand the true cost of borrowing.

Car title loans, despite offering quick cash, can be a financial burden. That’s where car title loan consumer advocacy steps in. This guide breaks down what advocates do and why they’re crucial. We’ll explore borrowers’ rights and protections, helping you navigate these loans fairly. Learn how to identify and avoid predatory practices, ensuring peace of mind. By understanding your advocate options, you can make informed decisions about this popular short-term financing option.

- Understanding Car Title Loan Consumer Advocacy

- Rights & Protections for Borrowers

- How to Navigate and Ensure Fair Practices

Understanding Car Title Loan Consumer Advocacy

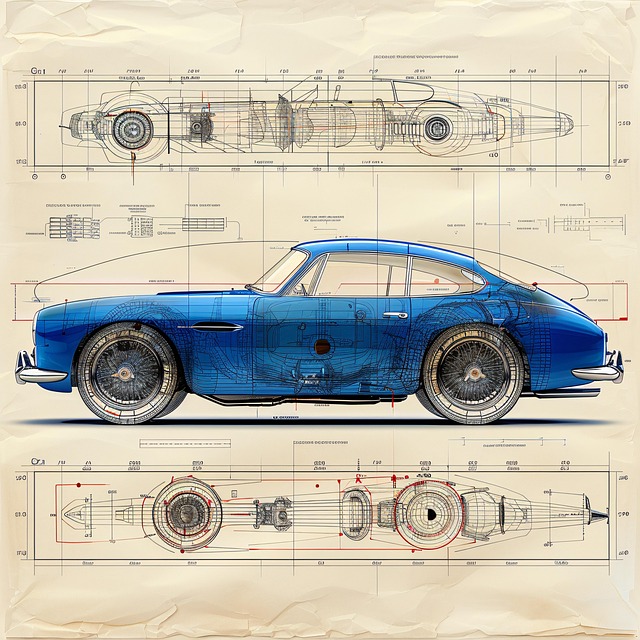

Car title loan consumer advocacy is a vital aspect designed to protect borrowers’ rights and ensure they receive fair treatment when taking out a car title loan. This type of advocacy focuses on educating consumers about their legal protections, helping them understand the intricacies of loan agreements, and promoting transparent practices in the lending industry. By advocating for consumers, organizations aim to prevent predatory lending behaviors and empower individuals to make informed decisions regarding their vehicles as collateral.

Understanding consumer advocacy is crucial for borrowers seeking a car title loan. It involves learning about various aspects, including loan approval processes, flexible payment options, and potential risks associated with such loans. Armed with this knowledge, consumers can negotiate better terms, comprehend the full scope of their obligations, and safeguard against unfair or misleading practices, ensuring a more secure borrowing experience.

Rights & Protections for Borrowers

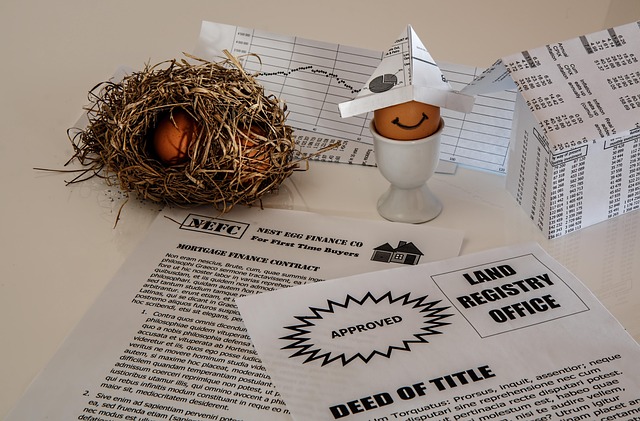

When it comes to Car Title Loan Consumer Advocacy, borrowers have a range of rights and protections designed to ensure fair lending practices. This advocacy ensures that lenders adhere to transparent and ethical standards throughout the entire loan process. One of the key aspects is the disclosure of interest rates and fees, providing borrowers with clear information about their financial obligations.

Lenders must offer quick approval processes, but this should not come at the cost of thorough evaluation and responsible lending. Car title loans, due to their secured nature, often come with high-interest rate concerns. Advocacy groups push for regulated interest rates, ensuring consumers understand the true cost of borrowing. This consumer advocacy plays a crucial role in protecting individuals from predatory lending practices, empowering them to make informed decisions regarding their financial future.

How to Navigate and Ensure Fair Practices

Navigating the world of car title loans requires a keen eye for detail and an understanding of consumer advocacy. The first step is to educate yourself about the process, terms, and conditions attached to such loans. Many reputable lenders offer transparent practices, ensuring that borrowers are well-informed about interest rates, repayment schedules, and any potential fees. It’s essential to ask questions and compare different loan offers before making a decision.

Consumer advocacy in car title lending involves protecting your rights as a borrower. This means being aware of unfair or predatory lending practices such as excessive interest charges, hidden fees, or deceptive marketing. Look out for terms like “fast cash” (a common SEO keyword) or “title pawn,” which might signal risky lending habits. A responsible lender will always prioritize your financial well-being and offer a fair cash advance option, ensuring you have a clear understanding of the loan’s impact on your financial health.

Car title loan consumer advocacy is vital in ensuring borrowers understand their rights and are protected against unfair practices. By navigating the market with awareness and knowing your protections, you can make informed decisions regarding car title loans. Remember, responsible borrowing and staying vigilant are key to a positive experience in this alternative financing landscape.