Borrowers leverage creative car title loan strategies for title loan success stories, offering quick approval and flexible terms using vehicle equity. These solutions bridge paychecks, cover unexpected expenses, consolidate debt, and invest in growth, demonstrating positive impacts on financial stability and future prospects.

Discover inspiring title loan success stories where borrowers transformed their financial futures. Explore unique strategies they employed to unlock funds, escape debt, and achieve financial freedom. From unconventional approaches to creative problem-solving, this article highlights real-life triumphs navigating title loans. Learn how these success stories can guide others seeking alternative financing solutions. Uncover the power of innovative thinking in overcoming financial challenges and achieving positive outcomes.

- Unlocking Funds: Unique Title Loan Strategies Proven Successful

- From Debt to Freedom: Borrowers Share Triumphs

- Creative Solutions: Navigating Title Loans with Success Stories

Unlocking Funds: Unique Title Loan Strategies Proven Successful

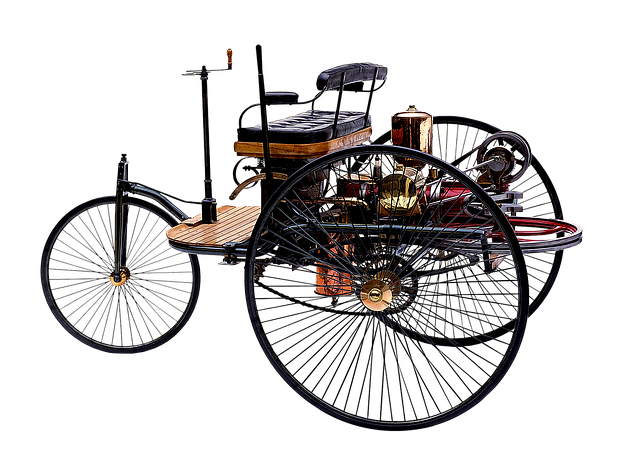

Many borrowers have discovered that creative strategies with car title loans can lead to successful title loan success stories. Unlocking funds through these unique methods has proven to be a game-changer for individuals seeking quick financial relief. One of the key advantages is the quick approval process, which allows borrowers to access their needed capital in a fraction of the time traditional loans require. This speed is particularly beneficial when urgent expenses arise.

Instead of relying solely on credit checks, which can be a barrier for those with less-than-perfect credit, car title loans offer an alternative approach. Borrowers can use the equity in their vehicles as collateral, providing lenders with assurance and enabling them to offer more flexible terms. This strategy has helped numerous individuals achieve financial stability, making it a popular choice for those looking for title loan success.

From Debt to Freedom: Borrowers Share Triumphs

Many borrowers have shared inspiring stories of transforming their financial situations through the responsible use of title loans. What started as a means to bridge a gap between paychecks or cover unexpected expenses often ended as a pathway to freedom from debt. These success stories highlight how access to quick funding, in the form of title loans, can provide a lifeline when traditional borrowing options are limited or unattainable.

The allure lies not only in the direct deposit of funds into borrowers’ accounts, but also in the flexibility offered by some lenders, allowing for loan extensions when unexpected challenges arise. This support has enabled individuals to regain control over their finances, pay off high-interest debt, and even invest in opportunities that foster growth and stability, ultimately paving the way for a more prosperous future.

Creative Solutions: Navigating Title Loans with Success Stories

Many borrowers have found title loan success stories by thinking outside the box and leveraging creative solutions. When faced with financial challenges, they turned to vehicle collateral loans as an innovative way to access quick funding. This approach allows individuals to use their vehicles’ equity as security, providing a fast and convenient solution for debt consolidation and other financial needs.

By tapping into this unique financing option, borrowers have been able to overcome immediate cash flow obstacles. The process offers several advantages, including minimal paperwork, no credit checks, and the ability to maintain full control over their vehicles. As these title loan success stories demonstrate, utilizing vehicle collateral can be a game-changer for those seeking financial respite in a pinch, providing them with the necessary funds for opportunities or emergencies without the usual delays.

In exploring various creative strategies for navigating title loans, it’s clear that borrowers have found unique paths to financial freedom. By leveraging their assets and adopting innovative solutions, these individuals have turned challenges into opportunities. From unlocking much-needed funds to emerging debt-free, the success stories highlighted here demonstrate the potential of title loans as a flexible financing option. When approached thoughtfully and strategically, title loans can play a pivotal role in helping borrowers achieve their financial goals.