Title loan customer testimonials reveal borrowers' positive experiences with flexible and accessible funding solutions. These stories highlight swift approval processes, high loan amounts, and minimal requirements, offering relief from traditional lenders' restrictions. Testimonials showcase successful cases of securing semi truck loans and emergency funding during crises, emphasizing Title loans as a lifeline during financial emergencies.

Discover how real customers are navigating their financial journeys with title loan customer testimonials highlighting loan flexibility. In a world where individual needs vary, title loans have emerged as a adaptable solution. This article delves into “Title Loans: Adapting to Individual Financial Needs” and shares “Flexibility in Lending: Customer Stories Unveiled,” providing insights into how these loans cater to diverse circumstances. Read on for real-life experiences that demonstrate the power of flexible lending.

- Real Customers Share Their Flexible Loan Experiences

- Title Loans: Adapting to Individual Financial Needs

- Flexibility in Lending: Customer Stories Unveiled

Real Customers Share Their Flexible Loan Experiences

Real customers share their flexible loan experiences through Title loan customer testimonials, painting a clear picture of how these loans can adapt to unique financial needs. Many praise the loan approval process, highlighting its speed and accessibility, especially for those turned away by traditional lenders. Stories often mention securing semi truck loans or emergency funding during unexpected events, lauding the flexibility to use their vehicle titles as collateral. These testimonials not only affirm the convenience but also the life-saving nature of these lending options, especially in times of crisis.

Title Loans: Adapting to Individual Financial Needs

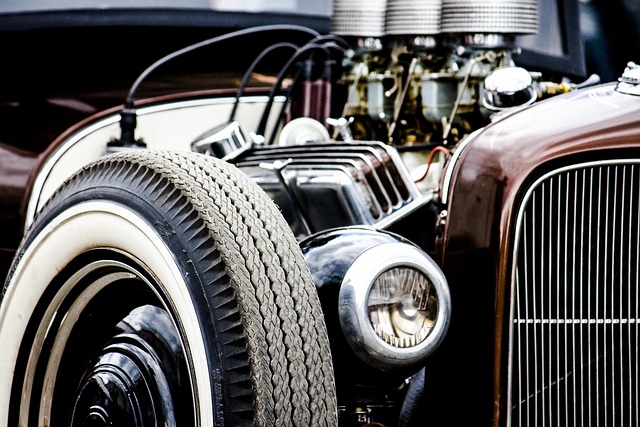

Title loans have evolved to become a flexible financial solution, adapting to the diverse needs of individuals. As evidenced by numerous Title loan customer testimonials, this lending option provides a unique advantage in times of urgency or unexpected expenses. The process is designed to be straightforward and swift, allowing borrowers to access funds using their vehicle equity as collateral. This flexibility ensures that those with vehicles in good standing can tap into their asset’s value without the stringent requirements often associated with traditional loans.

The Title Loan Process offers several benefits, including shorter application times and less paperwork compared to bank loans. Borrowers only need to provide proof of vehicle ownership and a valid driver’s license, making it accessible to many. Moreover, the use of vehicle equity as collateral means loan amounts can be higher than typical personal loans, catering to those with substantial financial needs. This tailored approach, highlighted in various Title loan customer testimonials, has made title loans an attractive option for individuals seeking quick and adaptable funding solutions.

Flexibility in Lending: Customer Stories Unveiled

Flexibility in Lending: Customer Stories Unveiled

Many customers who have availed of title loan services appreciate the remarkable flexibility offered by these financial solutions, especially when traditional banking options fall short. In the vibrant and bustling world of personal finance, where every individual’s situation is unique, car title loans have emerged as a game-changer for those facing unexpected expenses or urgent cash needs. Customers from diverse backgrounds share their experiences, highlighting how this alternative lending method caters to their specific requirements.

For instance, some Houston title loan customers with less-than-perfect credit histories found solace in the approval process that goes beyond traditional credit checks. This flexibility has been a boon for those seeking Bad Credit Loans, allowing them to access much-needed funds when other lenders might deny their requests. These customer testimonials paint a vivid picture of how adaptable lending practices can positively impact lives, offering a helping hand when it matters most.

In conclusion, title loan customer testimonials highlight the significant role these flexible financing options play in catering to diverse financial needs. By sharing their real-life experiences, borrowers underscore the adaptability of title loans, which have proven invaluable for many. These stories serve as a testament to how such lending solutions can provide much-needed flexibility when navigating unforeseen circumstances or seizing opportunities. When considering a title loan, it’s essential to explore these customer testimonials, as they offer insights into what makes this option a game-changer for countless individuals.