Unexpected funeral costs require immediate financial assistance. Title loans for funeral expenses use vehicle titles as collateral, offering faster approval and access to cash compared to traditional bank loans. In Houston and Dallas, companies like Houston Title Loans and Dallas title loans provide straightforward processes with flexible terms, catering to individuals with poor credit or no credit history.

“In times of profound loss, immediate financial relief becomes a pressing need. A Title Loan for Funeral Expenses offers a swift solution, allowing individuals to access funds swiftly without traditional credit checks. This article guides you through understanding this unique loan option, its eligibility criteria, and the application process.

We’ll explore the benefits it provides during challenging periods, ensuring peace of mind during an otherwise difficult time. Whether you’re facing unexpected costs or need urgent financial support, this resource aims to equip you with knowledge about Title Loans for Funeral Expenses.”

- Understanding Title Loans for Funeral Expenses

- Eligibility and Application Process

- The Benefits of Using Title Loans During Difficult Times

Understanding Title Loans for Funeral Expenses

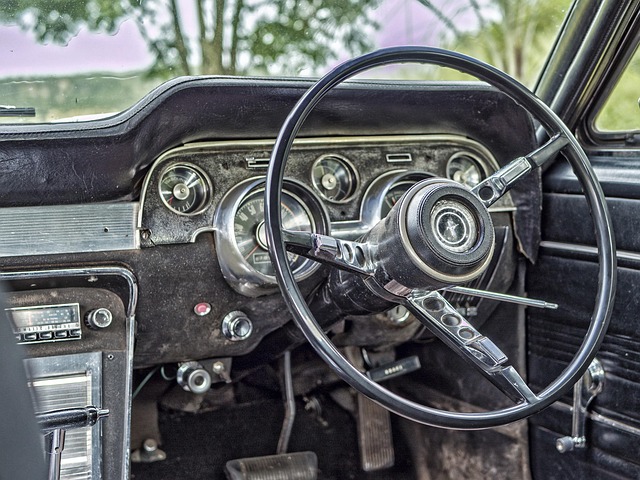

When faced with unexpected funeral expenses, many individuals seek immediate financial relief to honor their loved ones’ legacies. This is where understanding title loans for funeral expenses becomes crucial. These loans provide a quick solution by utilizing an asset—typically a vehicle, including cars, trucks, or even boats—as collateral. Unlike traditional bank loans, title loans offer accessible and often faster approval processes, catering to those in urgent need.

Semi Truck Loans, Boat Title Loans, and similar asset-based financing options have gained prominence as alternative sources of funding for various purposes, including funeral arrangements. Loan refinancing is another strategy where individuals can utilize existing vehicle titles to secure fresh loans with potentially better terms, helping them manage immediate financial burdens related to end-of-life expenses.

Eligibility and Application Process

When faced with unexpected funeral expenses, a title loan for funeral expenses can offer immediate relief. Eligibility is typically based on owning a vehicle with clear title and having a valid government-issued ID. Lenders assess the value of your vehicle to determine the loan amount available. The application process is straightforward and often involves providing personal information, verifying identity, and inspecting your vehicle.

In Houston, Houston Title Loans offers quick funding for those in need. The entire process can be completed promptly, ensuring you receive the necessary financial support without delay. Unlike traditional loans that may take days or weeks to approve, a title pawn provides faster access to cash, making it a viable option during urgent situations like funeral planning.

The Benefits of Using Title Loans During Difficult Times

During difficult financial times, like when facing funeral expenses, a title loan for funeral expenses can provide much-needed immediate relief. Unlike traditional loans that require extensive paperwork and good credit, these secured loans use your vehicle’s title as collateral, making them accessible to a broader range of individuals. This means that even if you have bad credit or no credit history, you can still secure financial assistance quickly.

Dallas title loans, for instance, offer several benefits during challenging periods. They provide a loan payoff solution with faster processing times compared to bank loans. The process is straightforward, often requiring only your vehicle’s title and a few basic documents. Additionally, these loans offer flexible repayment terms tailored to help you manage the financial burden without adding unnecessary stress during an emotional time.

When facing the unexpected loss of a loved one, dealing with funeral expenses can be a significant burden. A title loan for funeral expenses offers a swift solution, providing immediate relief during an emotional and challenging time. By understanding the application process and benefits, you can access much-needed funds quickly, allowing you to focus on honoring your loved one’s life without the added stress of financial worry.