When facing unexpected funeral costs, a title loan for funeral expenses offers fast cash with minimal requirements. These short-term loans, secured by your vehicle's equity, provide same-day approval and access to funds, easing financial stress during difficult times. However, before applying, explore alternatives like reaching out to loved ones, traditional personal loans with lower interest, or seeking assistance from funeral homes for more flexibility and informed decision-making.

In times of bereavement, arranging a funeral can be a financial burden. A title loan for funeral expenses offers a swift solution with same-day funds. This article explores how these loans work and their role in providing immediate financial support during difficult periods. We’ll delve into the process, considerations, and alternatives to help you make informed decisions when facing unexpected funeral costs. Understanding your options is crucial when navigating this emotional and financial labyrinth.

- Understanding Title Loans for Funeral Expenses

- How Same-Day Funds Work in These Situations

- Considerations and Alternatives to Explore

Understanding Title Loans for Funeral Expenses

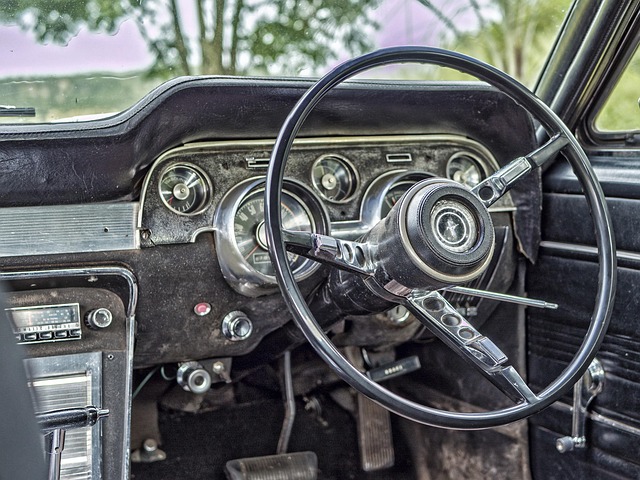

When facing the unfortunate loss of a loved one, arranging funeral services can bring significant financial strain. This is where understanding title loans for funeral expenses can be a lifeline. These short-term, fast cash solutions are designed to help individuals cover immediate and essential burial costs without delay. Unlike traditional secured loans, which require extensive paperwork and a credit check, title loans use your vehicle’s equity as collateral, making the approval process quicker and more accessible.

The application is straightforward; you simply need to present identification, provide details of your vehicle, and demonstrate proof of insurance. Once approved, you can access same-day funds, allowing you to focus on grieving while professionals handle the financial burden. This option offers peace of mind, ensuring that funeral arrangements can proceed without the added stress of financial worry.

How Same-Day Funds Work in These Situations

When facing unexpected funeral expenses, a title loan for funeral expenses with same-day funds can provide much-needed relief. These loans are secured by your vehicle’s title, allowing lenders to offer quick approval and immediate access to cash. The process is designed to be efficient and straightforward, especially in emergencies.

In situations like these, same-day funds refer to the swift disbursement of the loan amount. Borrowers can apply online or visit a local lender, providing necessary documents and details about their vehicle. After verification, the funds can be transferred directly into the borrower’s account within hours, ensuring quick access to capital. This is particularly beneficial when time is of the essence, as is often the case with funeral arrangements. Whether you opt for a Dallas Title Loan or explore other vehicle collateral loan options, understanding the loan eligibility criteria and ensuring you meet the requirements can expedite the entire process.

Considerations and Alternatives to Explore

When facing unexpected funeral expenses, it’s understandable to seek immediate financial support. While a title loan for funeral expenses can provide quick approval and access to funds, it’s crucial to explore alternatives first. Not everyone owns a vehicle suitable for this type of loan, and the process involves a thorough vehicle inspection and valuation, which takes time.

Consider other options like reaching out to close friends or family members for financial aid, applying for a traditional personal loan with a lower interest rate, or contacting local funeral homes and cemeteries for assistance or payment plans. These alternatives may not offer the same level of convenience as a title loan, but they provide more choices and allow you to make informed decisions without rushing into high-interest debt.

A title loan for funeral expenses can provide much-needed financial support during an emotional time. Same-day funding options offer swift access to capital, ensuring immediate relief. However, it’s crucial to weigh the benefits and consider alternatives like reaching out to family and friends, exploring community resources, or seeking financial aid from non-profit organizations. Before deciding on a title loan, understanding the terms, fees, and potential impact on your financial future is essential to make an informed choice.