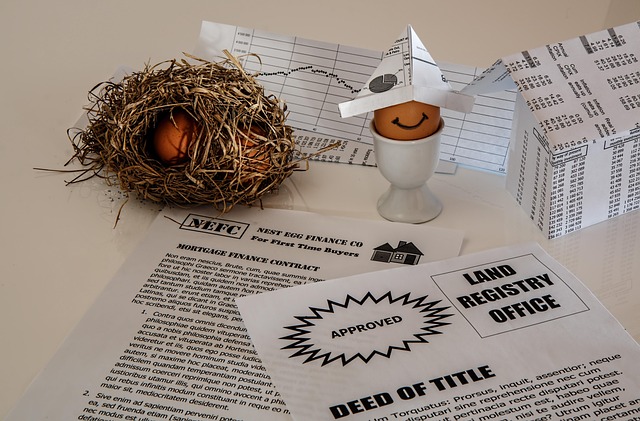

Borrowers in Texas with financial emergencies can access short-term Texas title loans with liens as emergency funding, secured by their vehicle titles. Existing liens, such as tax or security interests, can impact loan amounts and terms. Lenders require detailed information about these encumbrances, and proactive management is crucial for favorable loan conditions. Strategic repayment planning and specialized financing like semi-truck or bad credit loans assist in navigating complex Texas title loan with liens scenarios, offering flexible terms and immediate funding to manage existing debts effectively.

In Texas, understanding the intricacies of a title loan process with existing liens is paramount. This guide provides essential tips for navigating this complex scenario. We delve into Texas’ regulatory framework surrounding title loans and how liens can impact your options. Before securing a loan, evaluating current liens is crucial. Additionally, we offer strategies for repayment to help Texans manage their financial situations effectively while dealing with pre-existing liens.

- Understanding Texas Title Loan Regulations and Liens

- Evaluating Existing Liens Before Taking Out a Loan

- Strategies for Repaying Loans with Current Liens in Texas

Understanding Texas Title Loan Regulations and Liens

In Texas, understanding the regulations around title loans is crucial for borrowers facing financial emergencies and needing quick approval. These short-term loans, often used as a form of emergency funding, are secured by the borrower’s vehicle title. This means lenders have a legal claim on the vehicle until the loan is repaid. However, when considering a Texas title loan with existing liens, such as outstanding tax liens or other security interests, borrowers must be aware of potential complexities. Liens can impact both the loan amount and terms, as lenders prioritize repayment of their claims before releasing the lien on the vehicle.

When taking out a San Antonio loan with pre-existing liens, it’s important to know that lenders may require additional documentation and may offer different interest rates or repayment plans based on the number and type of liens involved. Some lenders might even decline to lend if they believe the existing liens pose too much risk. Therefore, borrowers should be transparent about their financial situation and explore options for resolving any outstanding issues before applying for a Texas title loan with liens to secure the best possible terms for their emergency funding needs.

Evaluating Existing Liens Before Taking Out a Loan

Before applying for a Texas title loan with existing liens, it’s crucial to thoroughly evaluate those liens. This involves understanding the type and amount of existing debt or claims against your asset, such as a vehicle, real estate, or equipment. Your lender will require a complete picture of your financial obligations to assess your eligibility and determine the terms of the loan.

Evaluating your existing liens also includes considering their impact on the value of your collateral. For instance, if you’re looking for San Antonio loans or even Semi Truck Loans, the lender will appraise your vehicle using current market values. Any outstanding liens against it can affect this valuation and, consequently, the maximum loan amount available to you. Therefore, understanding and managing these liens pre-application is a key step in securing the best possible terms for your Texas title loan.

Strategies for Repaying Loans with Current Liens in Texas

When navigating a Texas title loan with existing liens, managing repayment can seem daunting. However, there are several strategies to make this process smoother. One effective approach is to prioritize and strategize your repayments. Focus on settling debts with higher interest rates first while making minimum payments on others to maintain a good credit score. Additionally, consider consolidating multiple loans into one with a lower interest rate, which can simplify repayment and potentially save money in the long run.

Another viable option for Texas residents is to explore specialized financing options tailored to their needs. For instance, those in the trucking industry might benefit from semi-truck loans that cater to their unique circumstances. Similarly, individuals with less-than-perfect credit can look into bad credit loans that offer flexible terms and same-day funding, providing immediate relief and a chance to get back on track. These alternatives can help alleviate the stress of existing liens while ensuring access to much-needed funds.

When considering a Texas title loan with existing liens, it’s crucial to navigate these regulations carefully. By understanding the state’s rules and thoroughly evaluating your current liens, you can employ effective repayment strategies. This enables you to access much-needed funds while managing your financial obligations efficiently, ensuring a smoother process for both borrowers and lenders alike.