Title loans for luxury vehicles offer rapid cash access to affluent car owners, leveraging their high-end vehicles as collateral. This short-term solution involves a simple process but demands careful consideration of terms, including repossession risks upon default. State regulations protect both lenders and borrowers by setting guidelines on application requirements, interest rates, and repayment terms. Consumers are protected by transparent loan terms, fair practices, and clear fee breakdowns, with early repayment options and a straightforward title transfer process.

Title loans for luxury vehicles have gained popularity, offering a unique financing option for car enthusiasts. However, understanding the state laws that govern these loans is crucial. This article navigates the intricate world of title loans, exploring key aspects such as state regulations, compliance requirements, and consumer rights. By delving into these topics, we aim to provide clarity on this alternative lending method, specifically tailored to high-end vehicles, empowering consumers with informed decisions.

- Understanding Title Loans for Luxury Vehicles

- State Regulations and Compliance Requirements

- Consumer Rights and Loan Repayment Options

Understanding Title Loans for Luxury Vehicles

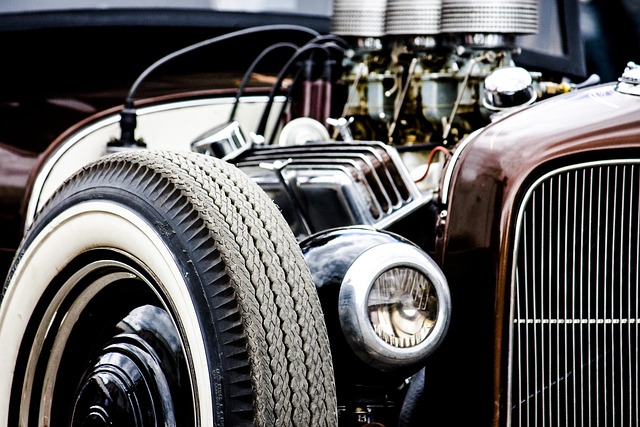

Title loans for luxury vehicles have gained popularity as a financing option for high-end car owners who need quick access to cash. These loans allow individuals to use their luxury vehicle’s title as collateral, providing them with a short-term funding solution. The process involves several steps, including applying for the loan, providing necessary documentation, and agreeing to specific terms set by the lender. Upon approval, borrowers receive a lump sum, which can be used for various purposes, such as debt consolidation or unexpected expenses.

Unlike traditional loans, title loans offer easier access and faster approval times, making them an attractive option for those in need of immediate financial assistance. However, it’s important to understand the terms and conditions thoroughly before applying. The loan process involves assessing the vehicle’s value, verifying the owner’s identity, and ensuring the ability to repay according to the agreed-upon schedule. Additionally, borrowers should be aware that failure to repay can result in the repossession of their luxury vehicle, similar to the implications of defaulting on a motorcycle title loan or other secured loans.

State Regulations and Compliance Requirements

State regulations around title loans for luxury vehicles are designed to protect both lenders and borrowers. These laws govern various aspects of the loan process, from application requirements to interest rates and repayment terms. Compliance with these regulations is crucial for lenders offering Dallas title loans or similar services. Lenders must verify the authenticity of the vehicle’s title, assess its market value, and ensure that the borrower understands the terms and conditions before finalizing the loan agreement.

In addition to these general guidelines, specific requirements may vary from state to state. For instance, some states mandate a cooling-off period during which borrowers can cancel the loan without penalties. Others enforce strict limitations on interest rates and fees, aiming to prevent excessive borrowing costs. Understanding and adhering to these state laws are essential for lenders looking to offer cash advance or loan refinancing services while maintaining ethical practices.

Consumer Rights and Loan Repayment Options

When taking out a title loan for a luxury vehicle, consumers have rights and options that are designed to protect them. These include transparent loan terms, fair interest rates, and the right to understand all fees associated with the loan. Lenders must provide detailed information about the loan payoff process, including how to make payments and the consequences of default. It’s crucial for borrowers to review their loan documents carefully and ask questions to ensure they fully comprehend their obligations.

One key aspect is the ability to pay off the loan early without penalties. This flexibility allows consumers to save on interest costs and potentially free up funds for other expenses. Additionally, understanding the title transfer process is essential, as it involves transferring ownership of the luxury vehicle from the borrower to the lender until the loan is fully repaid. Similar to boat title loans or any other secured loans, this ensures the lender’s interest in the asset, but borrowers can retain possession and use of their vehicle throughout the repayment period.

Title loans for luxury vehicles have specific state laws governing their provision, ensuring consumer protection and fair practices. Understanding these regulations, compliance requirements, and consumer rights is crucial when considering such loans. By navigating the current landscape, borrowers can make informed decisions about repaying their loans, fostering a more transparent and accessible credit market.