Title loan late payments can incur significant fees and interest rate hikes, potentially leading to asset forfeiture. However, refinancing options exist for borrowers facing such issues. Lenders may offer new loans with improved terms like lower rates or extended repayment periods after evaluating financial situations and outstanding balances. Factors like lender policies, credit history, and asset value influence refinancing opportunities. Maintaining open communication, setting up automatic payments, and regular balance checks are crucial to avoiding late fees and preserving credit scores. Using online applications for secured loans streamlines the refinancing process, minimizing delays.

“Curious about refinancing after a title loan late payment? Understanding the consequences is crucial. This article delves into the challenges and options available, guiding you through the complexities of title loan delays. We explore the refinancing process, offering insights into what to expect post-late payment. Additionally, we provide strategies to prevent such setbacks, ensuring better access to future refinancing opportunities. Learn how to navigate these situations wisely.”

- Understanding Title Loan Late Payments: Consequences and Options

- The Refinancing Process: What to Expect After a Late Payment

- Strategies to Avoid Delays and Their Impact on Refinancing Opportunities

Understanding Title Loan Late Payments: Consequences and Options

Understanding Title Loan Late Payments: Consequences and Options

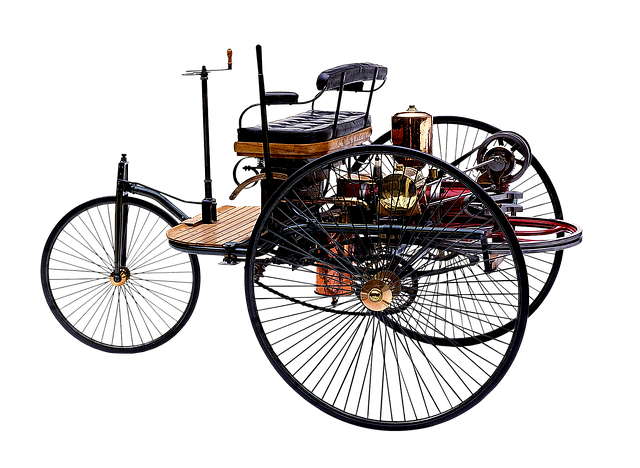

When it comes to title loans, late payments can have significant consequences. These short-term, high-interest loans are secured against an asset, typically a vehicle like a car or motorcycle (including Motorcycle Title Loans) or even a boat (Boat Title Loans). Failure to make timely payments can result in additional fees, higher interest rates, and even repossession of the secured asset. For borrowers facing financial difficulties, it’s crucial to know that options exist beyond defaulting on these loans.

One possible solution is refinancing. Some lenders offer refinancing opportunities that allow borrowers to secure a new loan with potentially lower interest rates or extended terms, making repayment more manageable. This could involve replacing the original title loan with a different type of loan, such as a personal loan with better terms, or even using a Direct Deposit from an employment source to cover the outstanding balance. However, the availability and terms of refinancing depend on various factors, including the lender’s policies, your credit history, and the value of the secured asset.

The Refinancing Process: What to Expect After a Late Payment

After a title loan late payment, many borrowers wonder if refinancing is still an option. The good news is that it often is, but what follows after such a delay is crucial to understand before proceeding. The refinancing process typically begins with an online application, offering convenience and quick approval for those who qualify. Lenders will review your financial situation, assess the outstanding balance on your current title loan, and evaluate your ability to repay.

If approved, you can discuss new loan terms, including interest rates, repayment periods, and potential savings compared to your original agreement. The lender will then disburse the refinanced funds, allowing you to catch up on any missed payments and potentially lower your monthly obligations. Remember, open communication with lenders is key, as they may offer solutions or alternatives to help borrowers overcome delays and maintain a positive financial standing.

Strategies to Avoid Delays and Their Impact on Refinancing Opportunities

Avoiding delays when it comes to title loan payments is crucial for maintaining good credit and future refinancing opportunities. One effective strategy is to set up automatic payments, ensuring your loan repayments are never missed. This simple step can save you from potential late fees and negatively impact your credit score. Additionally, staying proactive by regularly checking your account balance and keeping track of payment due dates will help prevent any unexpected delays.

Another approach is to communicate openly with your lender. If you anticipate any issues making a payment, reach out to discuss options. Lenders may offer flexible repayment plans or work with you during challenging times. Moreover, understanding the process of securing a new loan, such as preparing accurate financial documents and ensuring your vehicle’s valuation aligns with current market prices, can streamline the refinancing experience if a title loan late payment occurs. Utilizing online applications for secured loans allows for quick assessments and faster turnaround times, providing a buffer against potential delays.

While a title loan late payment can temporarily impact your refinancing options, it doesn’t necessarily close the door. By understanding the consequences and taking proactive measures to avoid future delays, you can still explore refinancing opportunities. Remember, timely payments and a solid repayment history are key to maintaining financial flexibility.