Self-employed individuals in Sherman, Texas, can access competitive car title loans secured by their vehicle's title, offering flexible terms and quick funding to cover business expenses or opportunities without strict credit requirements. With transparent rates and a straightforward application process, these loans provide an alternative financial safety net for those with irregular incomes or limited credit history.

In today’s economic landscape, self-employed drivers in Sherman, TX, often face unique financial challenges. Enter car title loans as a potential solution. This article explores how these secured loans can provide much-needed capital to qualifying self-employed individuals. We break down the process, from understanding local regulations on car title loans Sherman TX offers, to the eligibility criteria specifically tailored for freelancers, and the transparent repayment process.

- Understanding Car Title Loans in Sherman TX

- Eligibility Criteria for Self-Employed Drivers

- Benefits and Repayment Process Explained

Understanding Car Title Loans in Sherman TX

In Sherman TX, car title loans have emerged as a popular option for self-employed individuals seeking financial assistance. This type of loan uses your vehicle’s title as collateral, allowing lenders to offer competitive rates and flexible repayment options tailored to meet the unique needs of self-employed drivers. Unlike traditional loans that often require stringent credit checks, car title loans Sherman TX rely more on the equity in your vehicle than your personal credit score.

This alternative financing method is particularly appealing for self-employed folks who may experience irregular income or lack the extensive credit history typically required for conventional loans. By leveraging their vehicle’s value, borrowers can access much-needed funds quickly and, upon successful repayment, regain full ownership of their car. Moreover, with various repayment options available, self-employed drivers in Sherman TX can choose a plan that aligns best with their cash flow patterns, ensuring they get back on track financially without further straining their operations or personal lives.

Eligibility Criteria for Self-Employed Drivers

In order to qualify for Car Title Loans Sherman TX, self-employed drivers must meet specific criteria. Lenders typically require a steady income stream from self-employment, substantiated by tax returns or financial statements. This ensures that borrowers can make consistent loan repayments. Additionally, a clear vehicle title in the borrower’s name is essential, as it serves as collateral for the loan.

The application process for Car Title Loans Sherman TX is designed to be straightforward and fast, with Quick Approval being a notable benefit. Despite focusing on swift approvals, lenders still conduct responsible lending practices, which may include checking credit history. This doesn’t mean that those with Bad Credit Loans are automatically disqualified; it simply involves providing additional financial documentation to demonstrate the borrower’s ability to repay.

Benefits and Repayment Process Explained

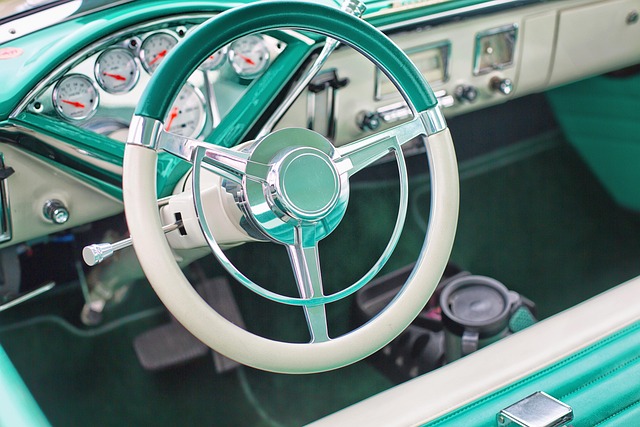

Car title loans Sherman TX offer a unique opportunity for self-employed drivers to access much-needed funding. One of the key advantages is that these loans provide a reliable alternative to traditional banking options, especially for those with limited credit history or no credit at all. Since car title loans are secured by the vehicle’s title, lenders offer competitive interest rates and flexible repayment terms. This ensures self-employed individuals can keep their vehicles while accessing capital to cover business expenses, manage cash flow gaps, or invest in new opportunities.

The repayment process for these loans is straightforward. Borrowers agree on a loan amount and term, typically ranging from 30 days to a year. Once approved, the lender installs a lien on the vehicle’s title, meaning the car remains with the borrower during the loan period. Repayment usually involves regular monthly installments, and once the final payment is made, the lien is removed, and full ownership of the vehicle is restored. The transparency and simplicity of this process make car title loans Sherman TX an attractive option for those seeking quick and accessible funding without the usual stringent requirements of banks or credit unions.

Car title loans Sherman TX can be a viable option for self-employed drivers seeking quick financial support. By understanding the eligibility criteria, benefits, and repayment process, you can make an informed decision. These loans offer a flexible and accessible way to access capital, allowing you to keep driving while managing your finances. So, if you’re in need, consider car title loans as a potential solution for your short-term financial needs.