Title loans for cars provide swift financial aid, leveraging vehicle collateral for urgent cash needs. With minimal paperwork and fast approval, eligibility requires clear title, stable income, and ability to make regular payments. The process involves five steps: apply, assess/offer, sign agreement, receive funds, and repayment. These loans offer lower interest rates than traditional bank loans but carry the risk of vehicle repossession if not repaid on time; understanding terms is crucial for informed decision-making.

Looking for a fast financial fix? Title loans for cars offer a quick cash solution with minimal hassle. In this article, we’ll demystify these short-term loans secured by your vehicle’s title. From understanding the process to weighing benefits and considerations, we guide you through unlocking immediate assistance. By the end, you’ll know if a title loan is the right choice for your urgent financial needs.

- Understanding Title Loans for Cars: Unlocking Fast Financial Assistance

- How Do Title Loans Work? A Step-by-Step Guide

- Benefits and Considerations: Are Title Loans the Right Choice?

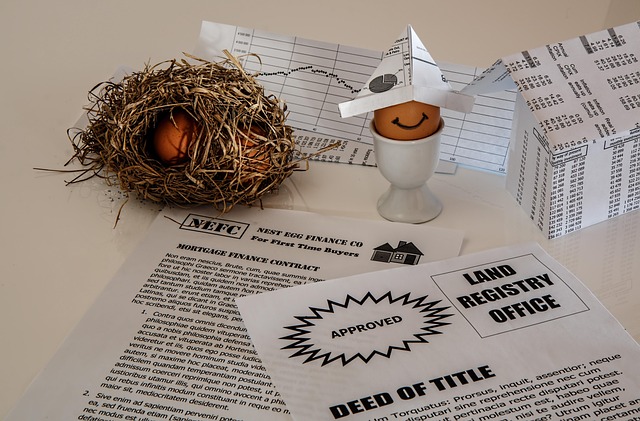

Understanding Title Loans for Cars: Unlocking Fast Financial Assistance

Title loans for cars offer a quick and convenient solution for those seeking immediate financial assistance. This type of loan allows individuals to use their vehicle’s title as collateral, providing access to funds in a short amount of time. The process is designed to be straightforward, with minimal paperwork and fast approval, making it an attractive option for borrowers who need cash swiftly.

Understanding loan eligibility and requirements is key when considering a title loan for cars. Lenders will assess the value of your vehicle, evaluate your creditworthiness, and determine if you meet the necessary criteria. Having a clear title, stable income, and the ability to make regular payments are typically essential factors in securing this type of loan. Using vehicle collateral ensures lenders have security, often resulting in lower interest rates and more flexible terms for borrowers.

How Do Title Loans Work? A Step-by-Step Guide

Title loans for cars offer a quick cash solution for individuals who own a vehicle and need immediate financial aid. Here’s how they work in a simple step-by-step guide:

1. Apply: The first step is to apply for a title loan by providing your personal information, such as your name, address, and income details. You’ll also need to present your vehicle’s registration and proof of ownership. No credit check is required, making it accessible to many.

2. Assess and Offer: After reviewing the submitted documents, the lender will assess the value of your vehicle. If approved, they’ll offer you a loan amount based on your vehicle’s condition and current market value. This step ensures that both parties are comfortable with the terms.

3. Sign Agreement: Once you agree to the offered terms, including the interest rate and repayment schedule, you’ll sign an agreement. This legal document outlines the conditions of the loan, including the due date and consequences of default. It’s crucial to read and understand all terms before signing.

4. Receive Funds: After finalizing the agreement, the lender will disburse the funds. You can receive the cash in hand or have it transferred directly into your bank account, depending on the lender’s policies.

5. Repayment: Repaying a title loan typically involves making regular monthly payments, including interest, until the balance is cleared. Keep in mind that if you miss a payment or fail to meet the terms, your vehicle could be repossessed. To avoid this, plan your repayment accordingly and consider a loan extension if needed, but stay informed about any additional fees.

Remember, while title loans can provide quick cash, they come with risks, including potential loss of vehicle ownership if not repaid on time. Always ensure you understand the terms and conditions before taking out such a loan.

Benefits and Considerations: Are Title Loans the Right Choice?

Title loans for cars can offer a quick financial solution for individuals needing immediate access to cash. One of the key benefits is the use of vehicle collateral, which allows borrowers to secure a loan against their car’s value. This means even if you have poor credit or no credit history, you may still qualify for a title loan. The process is often simpler and faster compared to traditional bank loans, making it an attractive option for those in urgent need of funds.

However, there are considerations to keep in mind. While flexible payments can make these loans appealing, the interest rates tend to be higher than with other types of lending. Additionally, if you’re unable to repay the loan as agreed, lenders may repossess your vehicle. It’s crucial to thoroughly understand the terms and conditions before taking out a title loan for cars to ensure it’s truly the right financial solution for your situation.

Title loans for cars can provide a quick solution for those in need of immediate financial assistance. By understanding the process and considering the benefits, individuals can make informed decisions about using their vehicle’s title as collateral. While these loans offer speed and convenience, it’s essential to weigh the potential risks and explore alternative options to ensure the best financial outcome.