Title loans for cars provide a rapid financial solution for those with limited banking access or poor credit, using vehicle titles as collateral. While offering quick cash within 30 minutes and flexible repayment options, these loans come with higher interest rates and shorter terms compared to traditional banking. Online applications simplify the process, but borrowers must carefully understand terms to avoid financial strain.

Title loans for cars can offer a financial lifeline for individuals with poor credit, providing an alternative to traditional lending. This article delves into the world of title loans, explaining how they work and why they’re attractive for those facing credit challenges. We explore the eligibility criteria, benefits that set them apart, and crucial risks to consider before securing this type of loan against your vehicle.

- Understanding Title Loans for Cars

- Eligibility Criteria for Poor Credit Applicants

- Benefits and Risks of This Loan Option

Understanding Title Loans for Cars

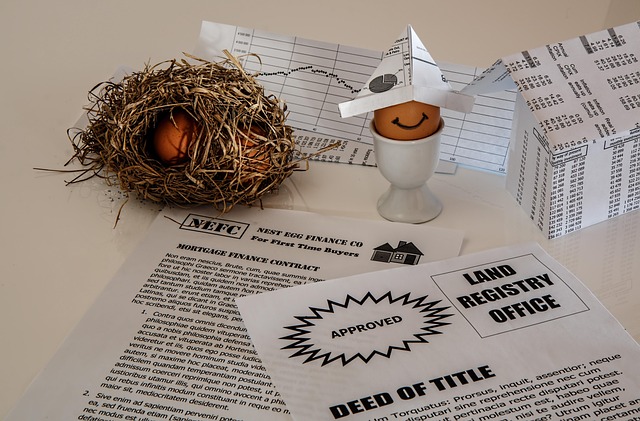

Title loans for cars have gained popularity as a quick solution for individuals seeking emergency funding. This alternative lending method allows borrowers to use their vehicle’s title as collateral, providing access to cash in as little as 30 minutes. It’s an attractive option for those with poor credit or limited banking options who might not qualify for traditional loans.

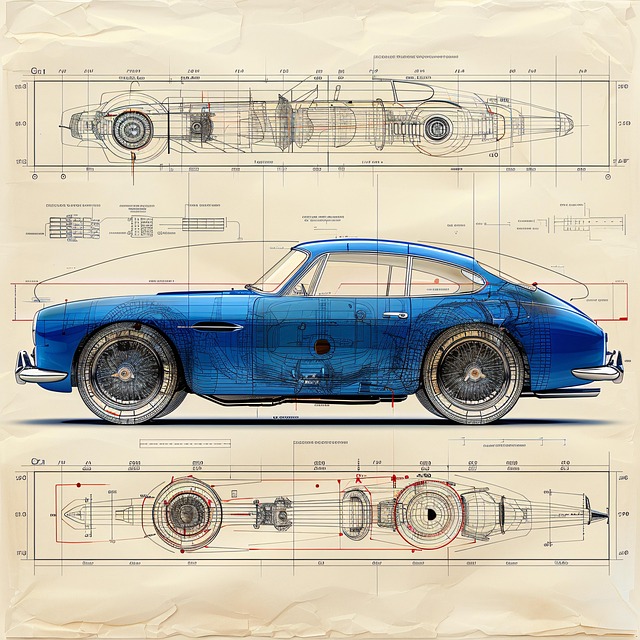

Unlike a Title Pawn, where the lender takes temporary possession of the vehicle, a title loan involves signing over the car’s title while retaining its use. Borrowers can also consider loan refinancing if they’ve already taken out a title loan and need more flexibility or lower monthly payments. This option provides breathing room for borrowers to regroup financially without giving up their vehicle’s ownership.

Eligibility Criteria for Poor Credit Applicants

When considering a title loan for your car, individuals with poor credit might feel daunted, but several lenders now offer flexible options to cater to diverse needs. Despite their reputation as a last resort, title loans can be accessible to those with low or no credit, provided they meet certain eligibility criteria.

Lenders often require applicants to own a vehicle of substantial value, which serves as collateral for the loan. This security mitigates risk for the lender. An online application process, typically involving a digital assessment and verification of your vehicle’s details and personal information, streamlines the initial steps. However, it’s crucial to understand that while these loans are more inclusive than traditional banking options, they come with higher interest rates and shorter repayment periods. For instance, a title pawn (a specific type of title loan) for a semi-truck could be an option if you meet the requirements, but always ensure you can repay within the specified timeframe to avoid potential financial strain.

Benefits and Risks of This Loan Option

Title loans for cars can be a viable option for individuals with poor credit looking to access immediate funds. One significant advantage is the ease and speed of the approval process, often involving less stringent credit checks compared to traditional bank loans. This makes Fort Worth Loans an attractive choice for those in need of quick cash. The collateralized nature of these loans, secured against the vehicle’s title, allows lenders to offer competitive interest rates and flexible repayment terms, providing a potential lifeline for borrowers.

However, it’s crucial to be aware of the risks associated with such loans. While quick approval is an allure, the high-interest rates can result in substantial financial burden if not managed carefully. Furthermore, loan refinancing options might encourage borrowers to extend their debt, leading to a cycle of increasing financial strain. Individuals should thoroughly understand the terms and conditions before agreeing to a title loan for cars to ensure they are making an informed decision that aligns with their long-term financial health.

Title loans for cars can offer a unique solution for individuals with poor credit seeking immediate financial support. By leveraging their vehicle’s equity, applicants can gain access to funds without the strict credit requirements often associated with traditional loans. However, it’s crucial to approach this option with caution due to potential risks, such as high-interest rates and the possibility of repossession if payments are missed. Understanding both the benefits and drawbacks will empower borrowers to make informed decisions regarding their financial needs.