Georgetown title loans offer quick cash for immediate needs using your car title as collateral, ideal for unexpected expenses but with risks of vehicle loss and debt if repayments miss. Process involves assessing vehicle value, providing docs, verification, legal agreement, and direct funding within hours; evaluate financial situation, consider alternatives, choose a reputable lender for informed decision-making.

In times of urgent financial need, Georgetown title loans offer a potential solution. This article explores how these short-term lending options can provide immediate cash access, ideal for unexpected expenses. We’ll break down the process with a step-by-step guide, highlighting both benefits and risks. Understanding Georgetown title loans is crucial when considering this alternative financing method, so let’s weigh your options informedly.

- Understanding Georgetown Title Loans: Unlocking Immediate Cash

- How Do Title Loans Work in Practice? A Step-by-Step Guide

- Benefits and Risks: Weighing Your Options for Emergency Funds

Understanding Georgetown Title Loans: Unlocking Immediate Cash

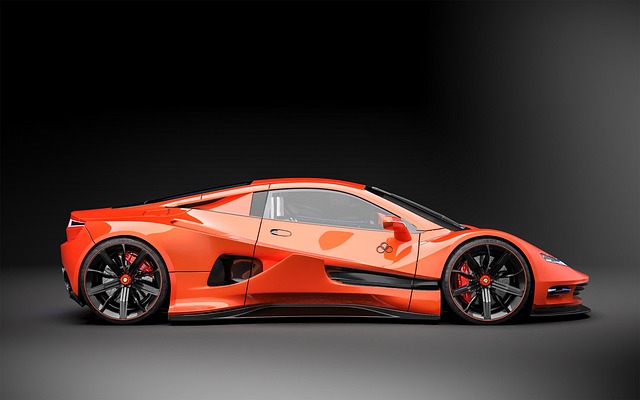

Georgetown title loans offer a unique financial solution for individuals facing urgent cash needs. This type of loan utilizes the value of an individual’s car title as collateral, allowing them to unlock immediate access to funds. It’s a convenient and quick approval process, especially beneficial for those with bad credit or limited banking options. By leveraging their vehicle’s equity, borrowers can obtain a loan payoff amount they need without extensive waiting periods or stringent requirements.

This alternative financing method is designed to provide fast cash in as little time as possible, ensuring that borrowers can address their financial emergencies promptly. Whether it’s an unexpected medical bill, home repair, or a sudden expense, Georgetown title loans offer a viable short-term solution. With a simple application process and direct funding, individuals can take control of their financial situation and manage their cash flow effectively during challenging times.

How Do Title Loans Work in Practice? A Step-by-Step Guide

When considering Georgetown title loans, understanding the process is key to making an informed decision for your urgent financial needs. Here’s a step-by-step guide on how these loans work in practice:

1. Vehicle Valuation: The first step involves assessing the value of your vehicle. Lenders will evaluate factors like make, model, year, condition, and overall market value to determine the maximum loan amount you might qualify for. This ensures a fair and secure transaction.

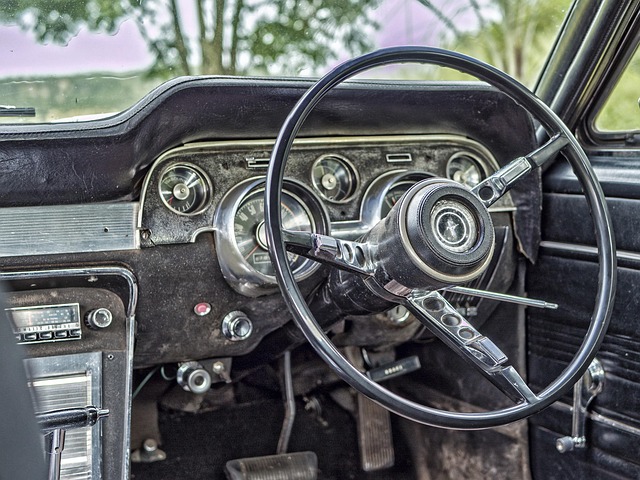

2. Title Loan Process: Once your vehicle’s value is established, the title loan process begins. You’ll need to provide essential documents, such as your vehicle’s registration, identification, and proof of income. The lender will then verify these details and create a legal agreement outlining the terms of the loan, including interest rates and repayment schedules. After quick approval, you’ll receive the funds, typically in a matter of hours. The title acts as collateral for the loan, giving lenders security and ensuring prompt approval times.

Benefits and Risks: Weighing Your Options for Emergency Funds

When considering Georgetown title loans as a solution for urgent financial needs, it’s crucial to weigh both the benefits and risks. A title pawn can offer quick access to cash, making it an attractive option for those facing immediate financial crises. However, this type of loan comes with significant drawbacks. The primary advantage is the simplicity and speed of approval, often within minutes, without strict credit checks. This can be especially beneficial for individuals with poor credit or no credit history who might otherwise struggle to obtain a traditional loan.

Additionally, keeping your vehicle as collateral ensures that you retain possession of it during the loan period, unlike pawn shops where items are sold upon default. Yet, the risk lies in potential loss of the title and the possibility of spiraling into a cycle of debt if unable to repay on time. Loan requirements typically include a clear vehicle title in your name, a valid driver’s license, and proof of insurance. It’s essential to understand these risks, carefully consider all options for emergency funds, and choose a reputable lender to make informed decisions regarding Georgetown title loans.

Georgetown title loans can provide a quick solution for urgent financial needs, but it’s crucial to understand both the benefits and risks involved. By weighing your options carefully, you can make an informed decision that best suits your emergency funding requirements. Remember, while title loans offer immediate cash, they come with potential drawbacks, so proceed with caution and explore all available alternatives before securing a loan.