Texas residents can access low-interest title loans using their vehicle ownership as collateral, offering a flexible financing option for those with poor credit or lacking other assets. However, it's crucial to understand terms, fees, and potential risks like high-interest accrual and repossession before pledging your vehicle title. Bad Credit Loans in Houston require careful consideration to avoid predatory lending practices. These loans provide fast cash access, lower rates, and easier approval for emergency expenses or desired purchases.

In the financial landscape of Texas, low-interest Texas title loans have emerged as a unique option for borrowers. This article delves into the intricate world of these loans, offering a comprehensive guide on both their risks and rewards. We’ll explore how understanding this type of lending can equip individuals with the knowledge to make informed decisions. From recognizing potential pitfalls like high fees and repayment challenges to uncovering the advantages, such as flexible terms and quick access to funds, this piece promises insights into the fine print of low-interest Texas title loans.

- Understanding Low-Interest Texas Title Loans

- Potential Risks: What to Look Out For

- Unlocking Rewards: Benefits of Low-Interest Loans

Understanding Low-Interest Texas Title Loans

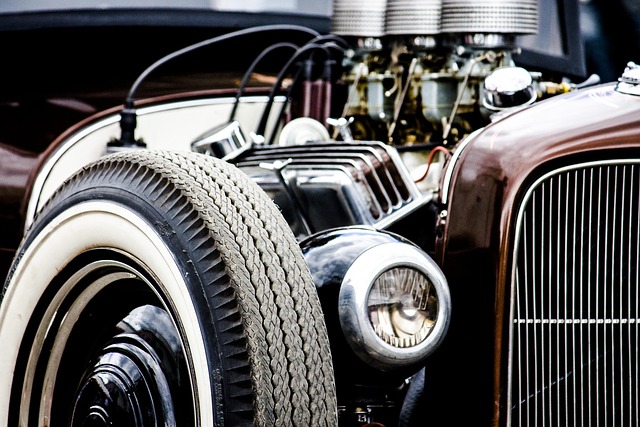

Low-interest Texas title loans are a unique financing option tailored to residents of Texas. This type of loan utilizes a person’s vehicle ownership as collateral, allowing them to borrow funds while keeping their vehicle. Unlike traditional loans, the interest rates for these titles loans are significantly lower, making them appealing to borrowers who might have limited options due to poor credit or lack of collateral. The process involves pledging your vehicle title to a lender, who will then provide you with a loan amount based on your vehicle’s value. This arrangement offers a chance for individuals seeking quick cash, especially those with bad credit, as it provides access to emergency funds without stringent requirements.

Texas title pawns can be a game-changer when managed responsibly. The low-interest rates and flexible repayment terms make them a viable alternative to traditional personal loans or credit cards. However, it’s crucial to understand the terms and conditions thoroughly before pledging your vehicle title. Lenders may charge fees and have specific requirements for loan eligibility. Individuals with bad credit might find this option particularly attractive, as it does not typically involve a credit check, focusing instead on the value of the collateral—your vehicle ownership.

Potential Risks: What to Look Out For

When considering a Texas title loan with low interest rates, it’s crucial to be aware of potential risks. One significant concern is the high-interest rate that can accumulate if the loan isn’t repaid promptly. Since these loans are secured by your vehicle’s equity, failure to meet repayment terms could result in repossession, leaving you without transportation and potentially causing financial strain. Additionally, if you’re considering a Bad Credit Loan in Houston, be wary of predatory lending practices. Lenders may exploit your desperate situation by offering seemingly attractive rates but charging excessive fees or having hidden clauses that can make the loan unaffordable.

Another risk to look out for is the potential loss of your vehicle. If you fall behind on payments, the lender has the right to repossess your car. This can be particularly challenging if your vehicle is your primary mode of transportation, impacting your daily life and work commitments. It’s essential to understand the terms and conditions thoroughly before agreeing to any Houston title loans or vehicle equity loans, ensuring you’re aware of all associated fees and potential outcomes to make an informed decision.

Unlocking Rewards: Benefits of Low-Interest Loans

Low-interest Texas title loans offer a unique opportunity for borrowers to access capital with minimal financial strain. One of the primary advantages is the potential for significant cost savings. Unlike traditional bank loans, which often come with steep interest rates, title loans in Texas allow you to borrow money using your vehicle’s title as collateral. This means you can secure a loan at a lower rate since the risk for lenders is reduced by the security of the asset. As a result, borrowers can enjoy more affordable monthly payments and save on overall borrowing costs.

Additionally, these loans are typically easy to obtain, even for individuals with less-than-perfect credit or no credit history. Lenders often conduct a quick credit check as part of the application process but may still approve loans based on the value of the collateral rather than strict creditworthiness criteria. This feature makes low-interest title loans in Dallas an attractive option for those seeking fast access to cash, whether it’s for emergency expenses or a desired purchase. A seamless title transfer process further streamlines the borrowing experience, providing borrowers with a convenient and potentially life-changing financial solution.

Texas title loans with low interest rates offer a unique financial solution, balancing risks and rewards. By understanding both the potential pitfalls, such as high fees and extended repayment periods, and the advantages like improved cash flow and better credit scores, borrowers can make informed decisions. These loans can be a game-changer for those in need of quick funds, but it’s crucial to navigate them carefully. Remember that, while low-interest Texas title loans provide access to capital, responsible borrowing is key to avoiding negative impacts on your financial health.